【EA Real Operation】HISUI【No-Trade Pattern】

1. Introduction

Thank you very much for visiting.

This is the developer of the Expert Advisor (EA) "HISUI" named "Imagawa Mochi-yo".

Here, from the developer's perspective, I will explain how HISUI, which is running on my real account, actually performs automatic trading, including the internal logic that can be disclosed.

I will describe it in a way that can be helpful to people like the following, so I would be grateful if you could read it.

- I am considering purchasing "HISUI" and want to see how it actually trades on a real account for reference materials, etc.

- I am not considering purchasing "HISUI," but I am interested in EAs and want to study and reference real trading to deepen my understanding of EAs.

- I have already purchased "HISUI" and am running it in real trading, but am worried whether it is operating correctly (e.g., trades are happening, but I am concerned whether the entry and exit positions are as specified).

The real-time operation of "HISUI" is divided into several patterns such as winning (profitable), losing (loss), and close to breakeven (near zero) rebalancing, and I am serializing them in multiple articles.

This time, I will introduce and explain the major patterns among the non-trading patterns (no-trade patterns) of "HISUI."

2. HISUI's No-Trade Pattern A

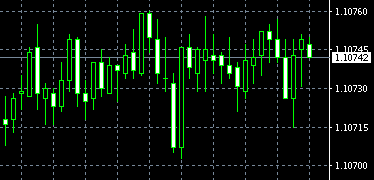

The figure below shows the period when no trading is done as of January 14, 2025.

When HISUI determines a range market, it adopts a strategy of going long near the lower bound of the range and closing near the upper bound, and going short near the upper bound and closing near the lower bound.

Therefore, as shown above, it does not trade in a clear downtrend.

Of course, not only in downtrends, it also does not trade in clear uptrends like the figure below.

3. HISUI's No-Trade Pattern B

So, it does not mean it will trade just because it is in a range; there are cases where the range is extremely narrow and, when considering the spread, even if it wins, it hardly makes a profit, so it does not trade in such cases.

4. HISUI's No-Trade Pattern C

In addition, there are cases where the spread widens due to indicators or around data releases, exceeding the "tolerable spread" parameter, and in such cases it does not trade.

5. Conclusion

This time, I introduced and explained the major no-trade patterns of HISUI.

There are other no-trade patterns besides those mentioned in this article, but listing many details would be endless, and since the detailed logic is not disclosed, I have limited it to the major ones.

In previous serialized articles, I have introduced and explained HISUI's winning patterns, losing patterns, breakeven patterns, and no-trade patterns.

This covers all the major patterns.

I plan to continue operating HISUI on my real account, so if I encounter rare patterns that have not been introduced yet during operation, I will consider adding articles.

The product page for HISUI introduced and explained in this article ishere.

× ![]()