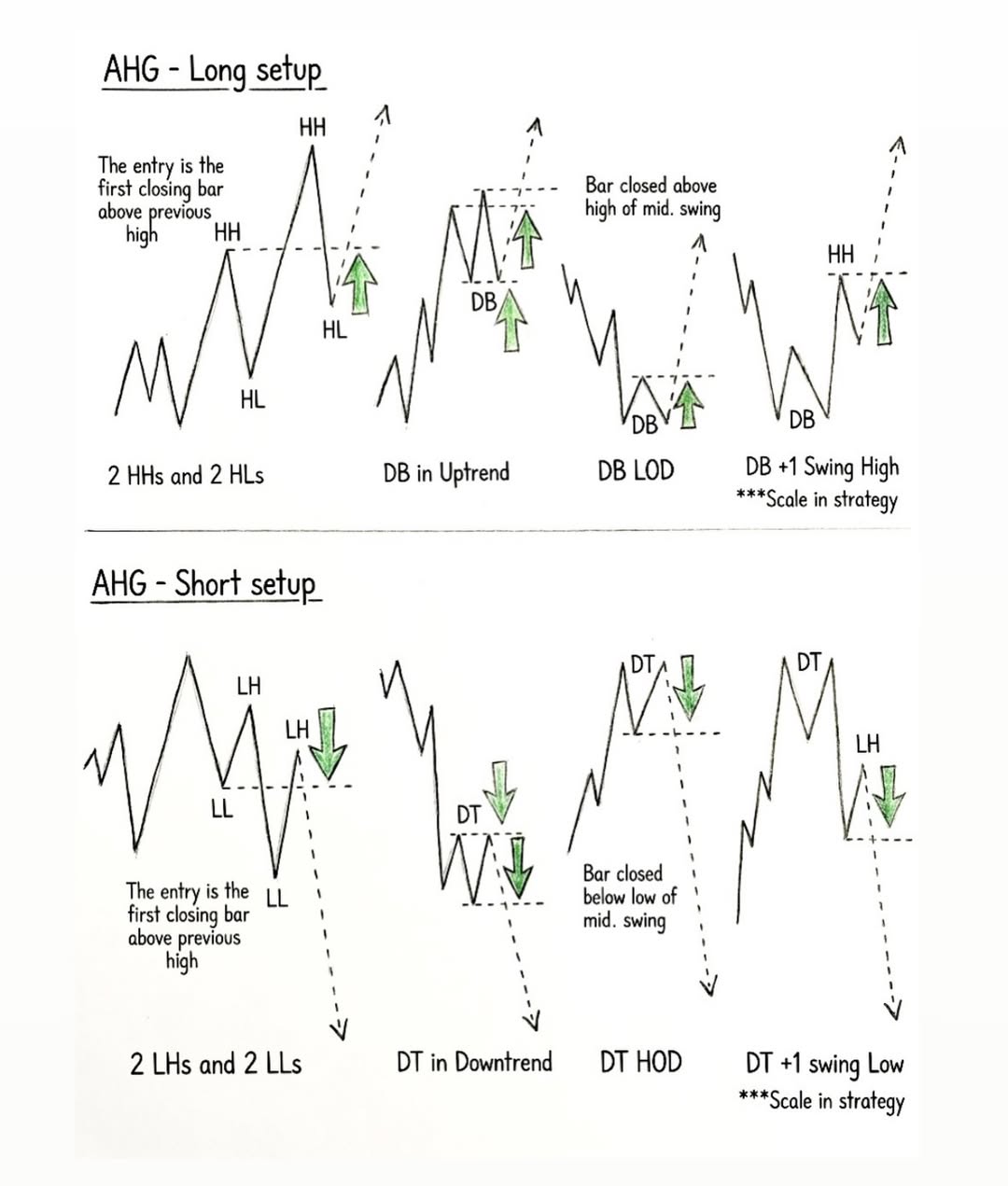

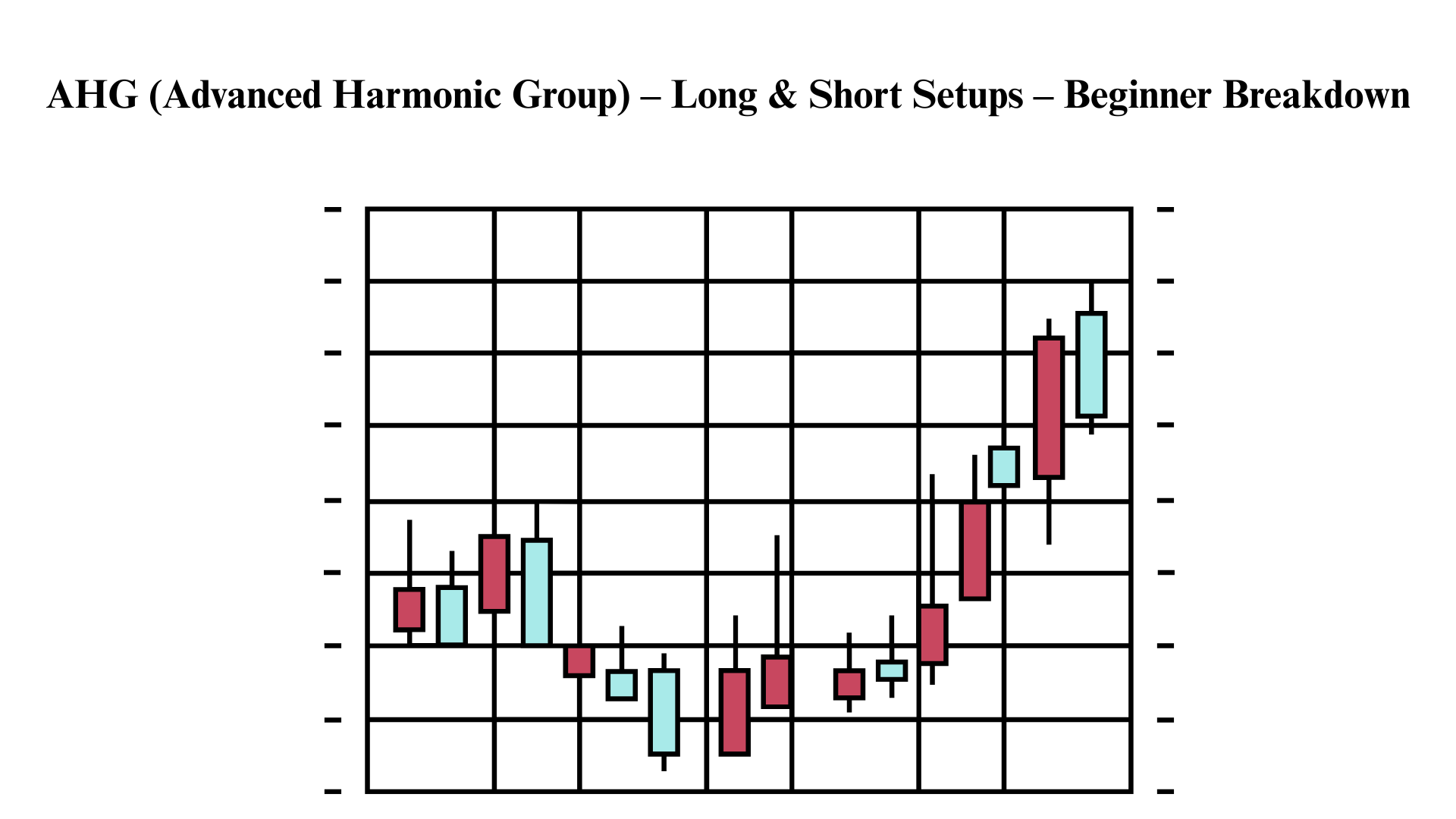

AHG (Advanced Harmonic Group) – Long & Short Setups – Beginner Breakdown

This chart shows 4 bullish (long) entries and 4 bearish (short) entries, all based on reading market structure and specific patterns.

AHG – Long Setups (Buy)

1. 2 HHs and 2 HLs

The classic uptrend confirmation. Price makes two Higher Highs (HH) and two Higher Lows (HL) — proving the trend is bullish. Your entry is the first candle that closes above the previous high. Simple trend-following: the structure is confirmed, you hop on.

2. DB in Uptrend (Double Bottom in Uptrend)

Within an existing uptrend, price pulls back and forms a double bottom (DB) — two equal lows. This is a pullback pattern, not a reversal. The double bottom holds as support, confirming buyers are still in control. Enter on the breakout above the neckline between the two bottoms.

3. DB LOD (Double Bottom at Low of Day)

A double bottom forms specifically at the low of the day — the absolute bottom of the session. A bar closes above the high of the middle swing between the two bottoms, confirming the reversal from the daily low. This is a powerful intraday reversal signal.

4. DB + 1 Swing High (Scale-In Strategy)

A double bottom forms, price breaks out and makes a new Higher High (HH), then pulls back. You enter (or add to your position) on the pullback after the first swing high confirms the reversal is legit. This is a scale-in strategy — you're adding size with more confirmation.

AHG – Short Setups (Sell)

1. 2 LHs and 2 LLs

The mirror of the long version — a confirmed downtrend. Price makes two Lower Highs (LH) and two Lower Lows (LL). Enter short on the first candle that closes below the previous low. Trend is confirmed bearish, you ride it down.

2. DT in Downtrend (Double Top in Downtrend)

Within an existing downtrend, price bounces and forms a double top (DT) — two equal highs that fail to break higher. This is a continuation pattern. Sell when price breaks below the neckline between the two tops.

3. DT HOD (Double Top at High of Day)

A double top forms at the high of the day — the session's peak. A bar closes below the low of the middle swing, confirming rejection from the daily high. Strong intraday reversal short entry.

4. DT + 1 Swing Low (Scale-In Strategy)

A double top forms, price breaks down and makes a new Lower High (LH), then pulls back up. You enter short (or add to your position) on this pullback after the first swing low confirms the move is real. Another scale-in strategy — more confirmation, more size.

Key rule across ALL setups: The entry trigger is always the same — wait for a closing bar that confirms the break of the previous swing point. Don't anticipate, wait for the close. The setups progress from simple (trend confirmation) to more advanced (double tops/bottoms + scale-ins), giving you options based on what the market presents.