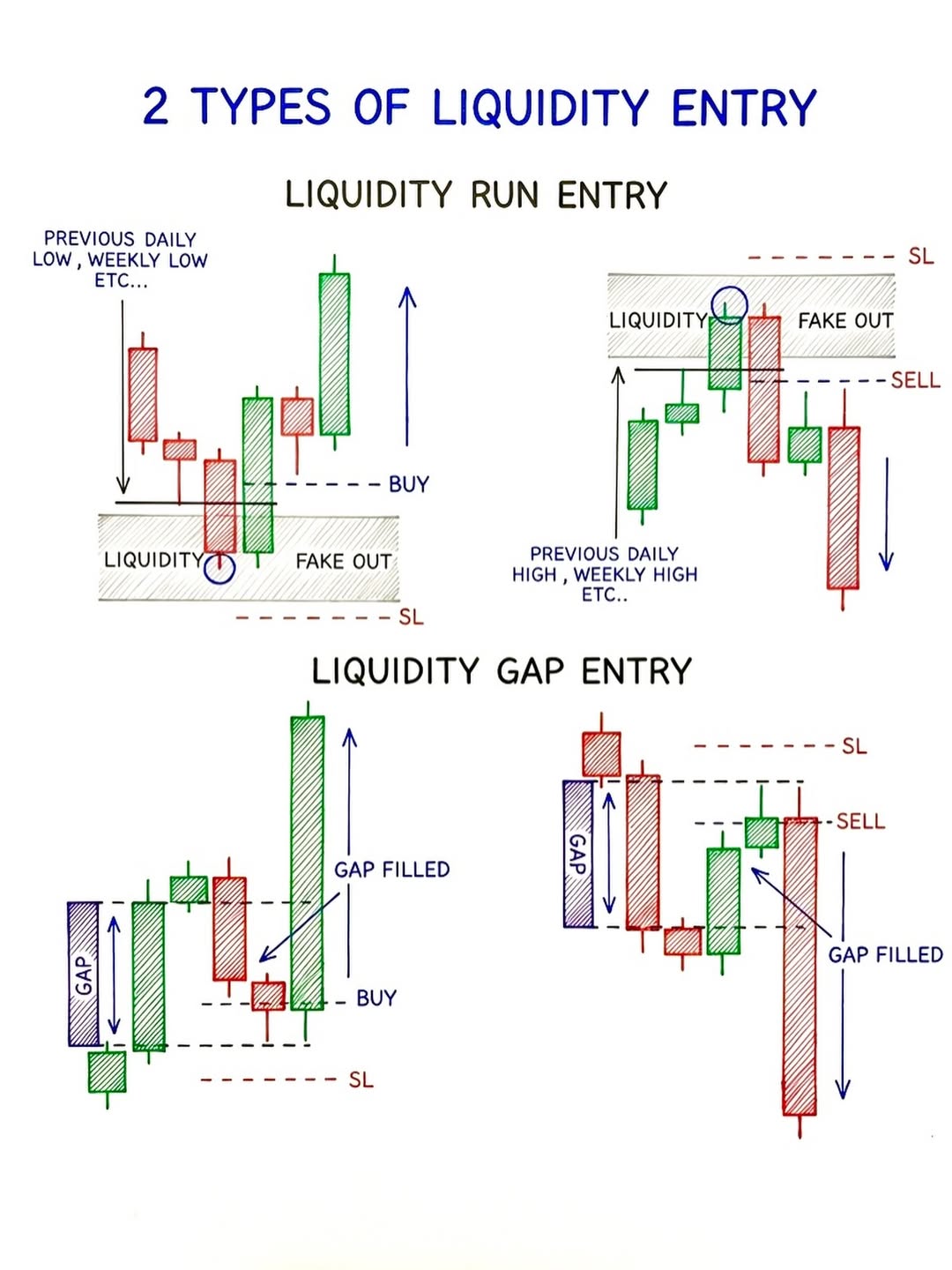

2 Types of Liquidity Entry – Beginner Breakdown

1. Liquidity Run Entry

Bullish (Buy) Version — Left

Price sweeps below a key level like a previous daily low or weekly low — this is the liquidity grab. All the stop-losses sitting below that level get triggered (smart money collects them). This sweep is a fake out — price doesn't actually continue lower. Instead, it quickly reverses back above. You enter a buy on the reversal, with your stop-loss below the fake out wick.

Bearish (Sell) Version — Right

The mirror image. Price spikes above a key level like a previous daily high or weekly high, grabbing liquidity (stop-losses from sellers). That breakout is a fake out — price reverses back down. You enter a sell after the rejection, with your stop-loss above the fake out wick.

In simple terms: The market hunts stops at obvious levels, fakes everyone out, then goes the opposite direction. You trade with the reversal after the hunt.

2. Liquidity Gap Entry

Bullish (Buy) Version — Left

A strong move up leaves behind a gap (Fair Value Gap) — a space where price moved so fast that there's an imbalance. Price then pulls back down to fill the gap. Once it touches/fills the gap, you enter a buy, expecting the original bullish trend to continue. Stop-loss goes below the gap.

Bearish (Sell) Version — Right

A strong move down leaves a gap above. Price retraces up to fill that gap, and once filled, you enter a sell, expecting the bearish move to continue. Stop-loss goes above the gap.

In simple terms: Big moves leave "unfinished business" (gaps). Price comes back to fill them, and that retracement is your entry point in the direction of the original move.

Key difference: Liquidity Run entries trade the fake out reversal at key levels. Liquidity Gap entries trade the pullback into an imbalance before continuation. Both rely on understanding where liquidity sits and how smart money exploits it.