ICT/SMC Trading Models – Beginner Breakdown - 4 Models any Trader must know!

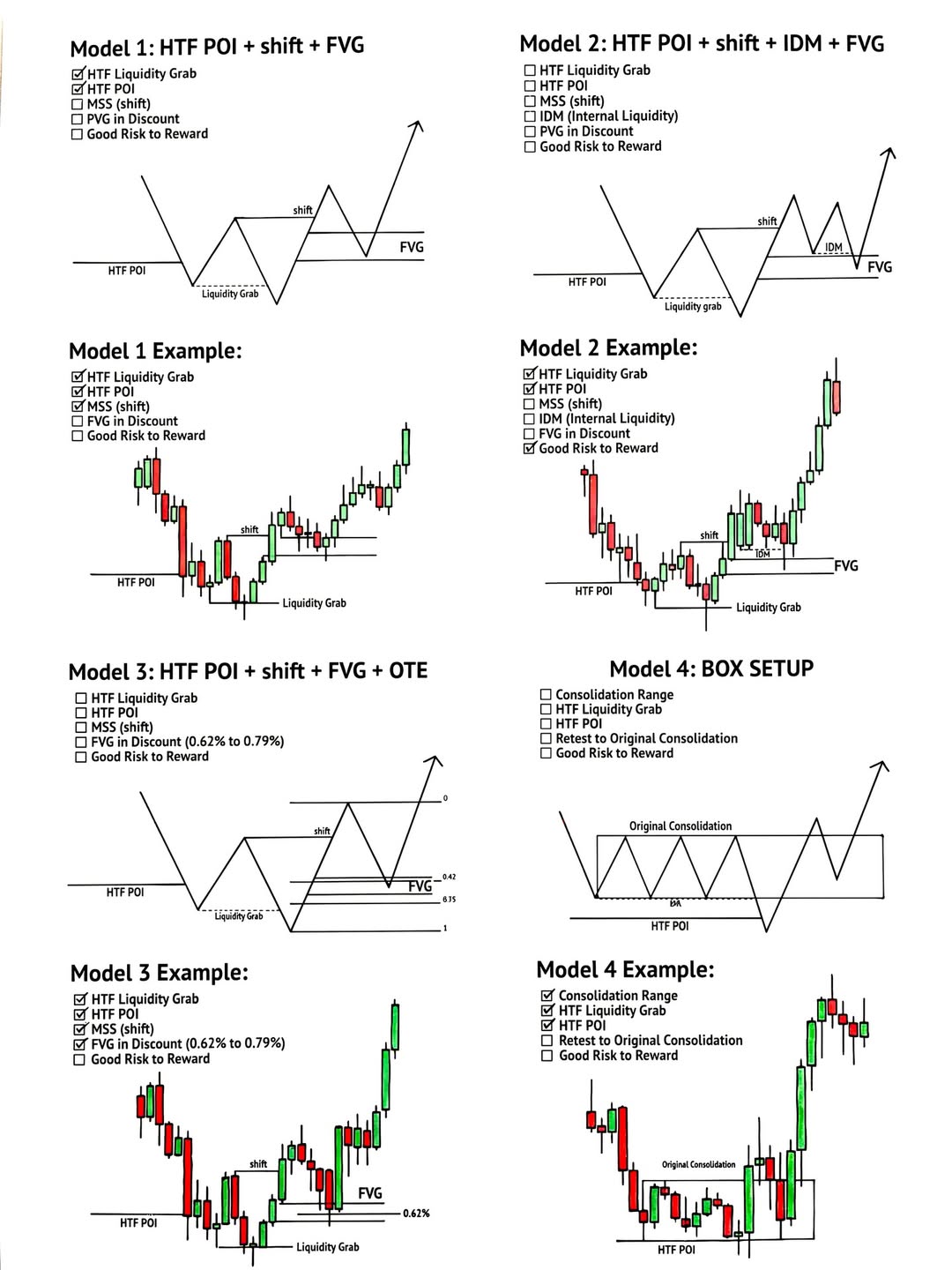

Model 1: HTF POI + Shift + FVG

Price drops into a higher timeframe point of interest (a key support zone), grabs liquidity below (stop-hunts lows), then shows a market structure shift (breaks a recent high). You enter on the Fair Value Gap (an imbalance/gap left behind in the move up). This is the simplest model — just POI, shift, and gap entry.

Model 2: HTF POI + Shift + IDM + FVG

Same as Model 1, but with an extra step: after the shift, price sweeps internal liquidity (IDM) — it takes out a minor high or low within the new move — before leaving a FVG to enter on. Think of it as a "deeper" confirmation because price fakes out one more time before going.

Model 3: HTF POI + Shift + FVG + OTE

Again similar, but now you're looking for the FVG to sit in the Optimal Trade Entry zone (the 62%–79% Fibonacci retracement of the move). This adds precision — you're not just entering any gap, but one that's in the "sweet spot" discount zone, giving you a tighter stop and better risk-to-reward.

Model 4: Box Setup

Price is stuck in a consolidation range (a box). It then drops out of the box, grabs liquidity, hits an HTF POI below, and reverses back up. The entry confirmation is a retest of the original consolidation zone from below. This model is great for range-bound markets that fake a breakdown before reversing.