From yesterday's chart (September 13, 2024): The importance of breaking down from higher timeframes to lower timeframes and the signal of mBDSR (RCI two-filter)

Indicator to "capture the bottom/top and reversal" in combination with RCI【mBDSR】

Methods and Case Study (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of those PDFs’ titles, please see the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

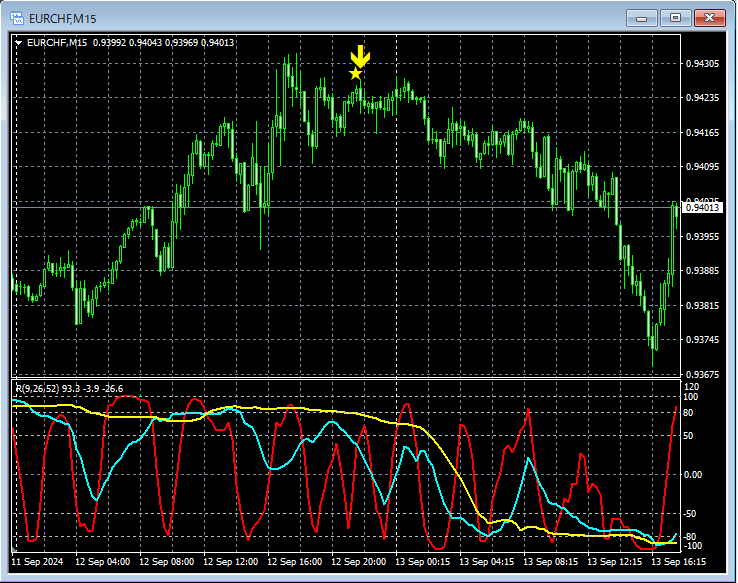

EUR/CHF 15-minute chart

Details about higher timeframe conditions are omitted. Also, the explanation of drilling down from higher to lower timeframes using RCI is provided in the attached PDF, so it is omitted here as well.

In actual trading, when formulating a plan,understanding the higher-timeframe conditionsanddrilling down from higher to lower timeframes using RCIare extremely important.

On the 15-minute chart above (the lower timeframe in this example),mBDSR (RCI two-filter) mean-reversion selling signalis lit up at an opportune moment.

Indicator that shines in combination with RCI: 【BODSOR・mBDSR】

Methods and Case Study (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files include 301 items (over 1,000 pages, over 350,000 characters in total).

Among them,they are compiled as examples that logically link the higher and lower timeframes using three RCI lines to sequentially examine multiple lower-timeframe conditions, ultimately waiting for a pullback buy or pullback sell timing (i.e., the mBDSR signal) on the lower timeframe.

Also,many of them focus on identifying points where multiple entry reasons overlap.

In the explanations,more than 1,000 chartsare used.

Methods and Case Study (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of those PDFs’ titles, please see the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

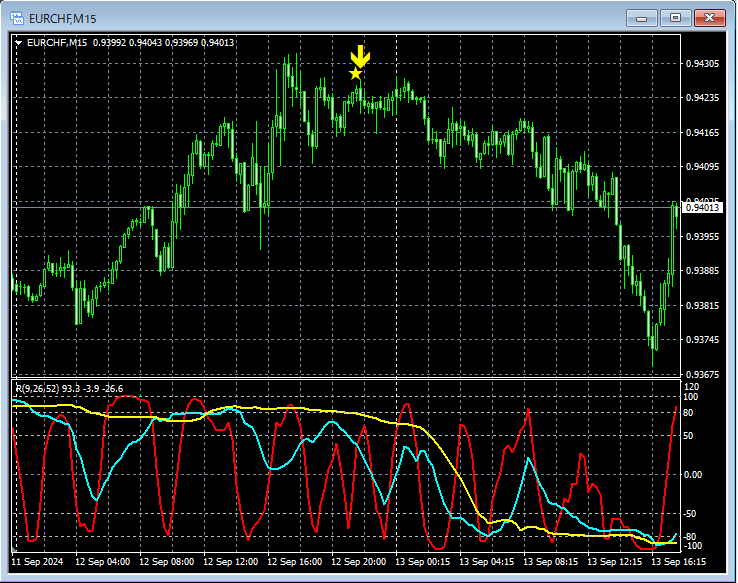

EUR/CHF 15-minute chart

Details about higher timeframe conditions are omitted. Also, the explanation of drilling down from higher to lower timeframes using RCI is provided in the attached PDF, so it is omitted here as well.

In actual trading, when formulating a plan,understanding the higher-timeframe conditionsanddrilling down from higher to lower timeframes using RCIare extremely important.

On the 15-minute chart above (the lower timeframe in this example),mBDSR (RCI two-filter) mean-reversion selling signalis lit up at an opportune moment.

Indicator that shines in combination with RCI: 【BODSOR・mBDSR】

Methods and Case Study (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files include 301 items (over 1,000 pages, over 350,000 characters in total).

Among them,they are compiled as examples that logically link the higher and lower timeframes using three RCI lines to sequentially examine multiple lower-timeframe conditions, ultimately waiting for a pullback buy or pullback sell timing (i.e., the mBDSR signal) on the lower timeframe.

Also,many of them focus on identifying points where multiple entry reasons overlap.

In the explanations,more than 1,000 chartsare used.

× ![]()