Validate the effectiveness of the mBDSR (RCI2 low-pass filter) by creating an EA

Indicator that shines when combined with RCI: BODSOR・mBDSR

https://www.gogojungle.co.jp/tools/indicators/11836

※mBDSR is an indicator developed to improve the entry precision when using the three-line RCI for buy-the-dip and sell-on-rebound entries.

In the case of an EA, backtesting and forward testing are methods to show its effectiveness with concrete numbers, buthow should the effectiveness of an indicator be demonstrated?

mBDSR itself was developed to narrow entry points for buy-the-dip and sell-on-rebound using theRCI 3-line combination, but here, taking a certain time frame of USD/JPY as an example,“mBDSR (RCI 2-line filter)”is evaluated with concrete numbers by determining the entry conditions using only“mBDSR (RCI 2-line filter)” and then setting TP and SL to create an EA that yields a favorable risk-reward, followed by a backtest.

(The results below are only one example, though...)

EA Overview

Currency pair: USD/JPY

Time frame: confidential

Entry conditions: determined only by mBDSR (RCI 2-line filter) (details are confidential)

Lot size: 0.1 lots (fixed)

TP: 105 pips (fixed)

SL: 15 pips (fixed)

Other (settlement-related): no break-even or trailing stop settings

Spread: 1 pip (fixed)

Trade direction: Sell only

Number of positions: no limit

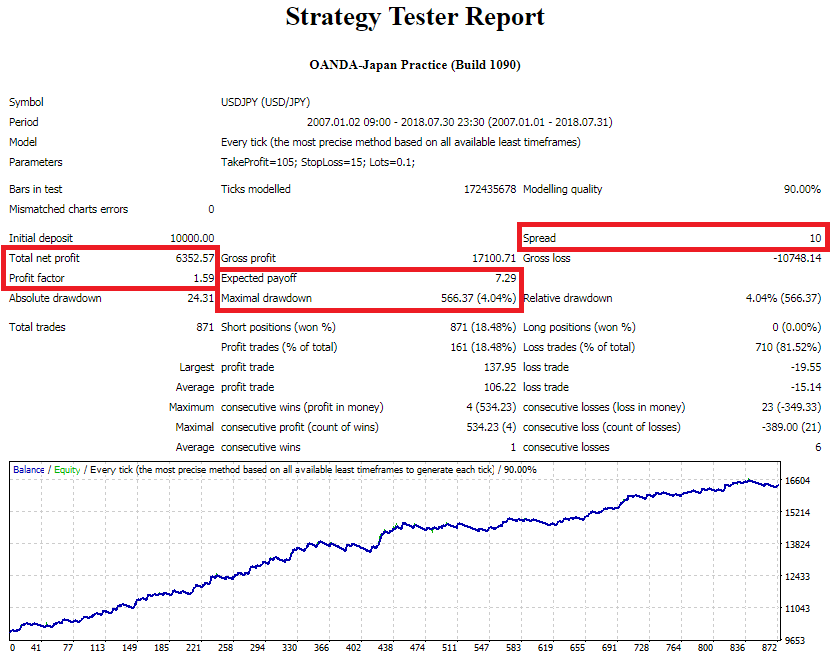

Backtest results (Period: 2007-01-01 to 2018-07-31)

Period: 2007-01-01 to 2018-07-31

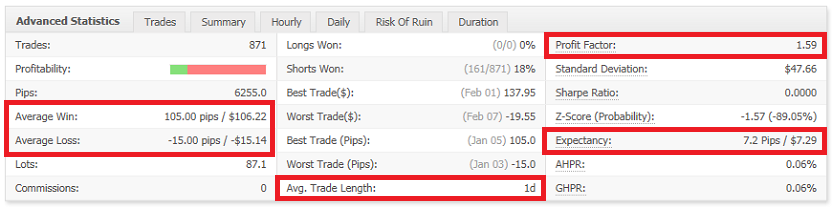

Total trades: 871

Profit factor: 1.59

Net profit: 6,352.57 USD

Maximum drawdown: 566.37 USD

Net profit / max drawdown: 11.21

Expected profit: 7.29 USD (7.2 pips)

Average trade duration: 1 day

Entry conditions are determined from RCI and mBDSR only, yet the profit factor value is 1.59 and yields good results. Given that no other indicators are used at all, this example suggests that“mBDSR (RCI 2-line filter)” is extremely effective.

The above results show a high risk-reward ratio, with TP (105 pips) being 7 times SL (15 pips), which helps explain the good results. This suggests that“mBDSR (RCI 2-line filter)” is very effective at capturing times when price moves strongly in one direction, as inferred from the backtest results.

Also, the above example indicates an average trade duration of 1 day, showing this is not a so-called scalping strategy.

Additionally, the expected profit is 7.2 pips, meaning the results are under conditions less affected by spreads.

Indicator that shines when combined with RCI: BODSOR・mBDSR

https://www.gogojungle.co.jp/tools/indicators/11836

※An indicator developed to improve entry accuracy when using the three-line RCI for buy-the-dip and sell-on-rebound entries