[MBDSR Sign] Mastering the Use of RCI Filter and Moving Average Filter from Yesterday's Chart (August 30, 2024)

Indicator that captures “tops/bottoms and reversals” in combination with RCI【mBDSR】

Methods・Case Studies (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs (methods, case studies, etc.). For a list of the PDF titles, please refer to the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

mBDSR (RCI filter)andmBDSR (Moving Average filter)have different roles. The usage distinctions are also mentioned in the above PDFs.

Below, on higher timeframesmBDSR (Moving Average filter)and on lower timeframesmBDSR (RCI filter)are used to describe the corresponding patterns.

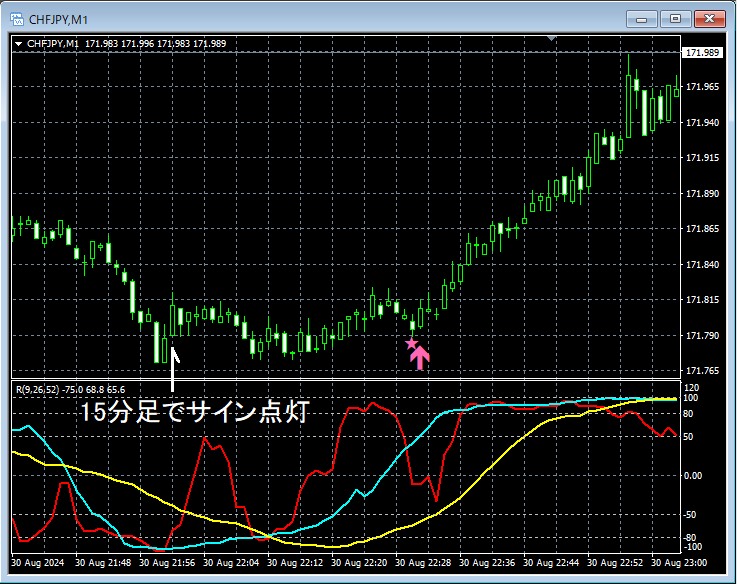

CHF/JPY – Swiss Franc against Japanese Yen 15-minute chart

Sign of mBDSR (two Moving Averages filter)andGMMA

On the 15-minute chart,the buy-on-dip signal of the moving-average filter mBDSRis lit. Here, after the signal lights on the 15-minute chart, check on the lower timeframe for a dip-buying opportunity.

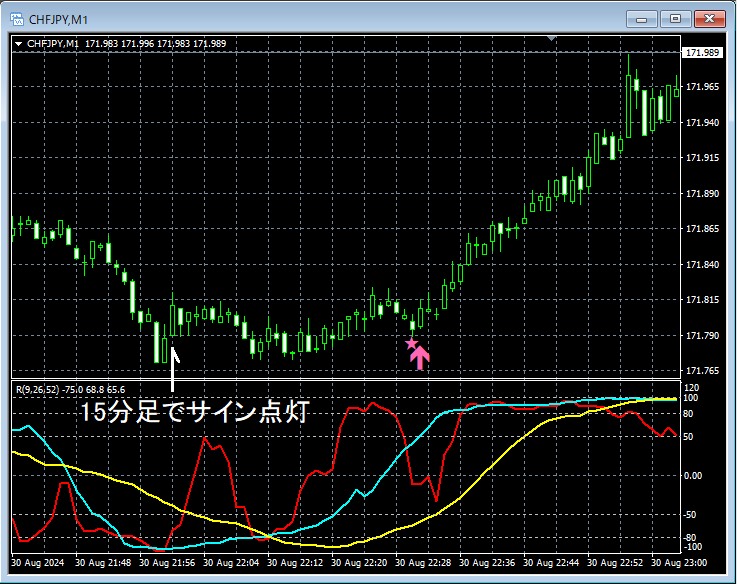

CHF/JPY – Swiss Franc against Japanese Yen 1-minute chart

Sign of mBDSR (two Moving Averages filter)andGMMA

After the 15-minute chart lights thedip-buy signal of the moving-average filterwe observe the chart movement; on the 1-minute chart above,the dip-buy signal of the two-RCI filterlights up and the price clearly rises.

Additionally, in this example, placing the stop-loss slightly below the most recent lowallows a high risk-reward tradeto be possible. (This high risk-reward trade is made possible by addressing on the lower timeframe.)

Indicator that shines in combination with RCI【BODSOR・mBDSR】

Methods・Case Studies (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

PDF files total 301 (over 1,000 pages, over 350,000 characters in total).

Many of them are examples that lay out a sequence from logically linking the higher and lower timeframes using three RCI lines, and ultimately waiting for dip-buying or pullback selling timing (the signal of mBDSR) on the lower timeframe.Additionally,

.

Explanation uses

Methods・Case Studies (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs (methods, case studies, etc.). For a list of the PDF titles, please refer to the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

mBDSR (RCI filter)andmBDSR (Moving Average filter)have different roles. The usage distinctions are also mentioned in the above PDFs.

Below, on higher timeframesmBDSR (Moving Average filter)and on lower timeframesmBDSR (RCI filter)are used to describe the corresponding patterns.

CHF/JPY – Swiss Franc against Japanese Yen 15-minute chart

Sign of mBDSR (two Moving Averages filter)andGMMA

On the 15-minute chart,the buy-on-dip signal of the moving-average filter mBDSRis lit. Here, after the signal lights on the 15-minute chart, check on the lower timeframe for a dip-buying opportunity.

CHF/JPY – Swiss Franc against Japanese Yen 1-minute chart

Sign of mBDSR (two Moving Averages filter)andGMMA

After the 15-minute chart lights thedip-buy signal of the moving-average filterwe observe the chart movement; on the 1-minute chart above,the dip-buy signal of the two-RCI filterlights up and the price clearly rises.

Additionally, in this example, placing the stop-loss slightly below the most recent lowallows a high risk-reward tradeto be possible. (This high risk-reward trade is made possible by addressing on the lower timeframe.)

Indicator that shines in combination with RCI【BODSOR・mBDSR】

Methods・Case Studies (PDF) ★GogoJungle AWARD2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

PDF files total 301 (over 1,000 pages, over 350,000 characters in total).

Many of them are examples that lay out a sequence from logically linking the higher and lower timeframes using three RCI lines, and ultimately waiting for dip-buying or pullback selling timing (the signal of mBDSR) on the lower timeframe.Additionally,

.

Explanation uses

× ![]()