From today's gold chart: After the mbDSR signal (RCI with 2 filters) lights up on the higher timeframe, consider entries on the lower timeframe. August 28, 2024

Indicator that captures the bottom/top reversal in combination with RCI: 【mBDSR】

Methods and Case Studies (PDF) ★GogoJungle AWARD2020 Winning★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of the titles of those PDFs, please refer to the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

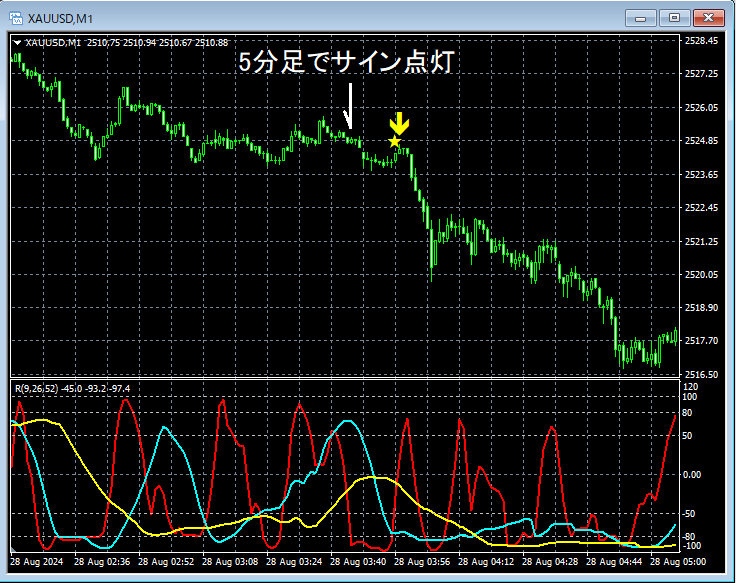

Gold XAUUSD 5-minute chart

Looking at the area circled by a white circle in the above 5-minute chart,the mBDSR (RCI two-filter) selling reversal signalis lit. Afterwards,the RCI three-line together move down,showing a very weak pattern. It might not be strange to consider selling on retracement on lower timeframes.

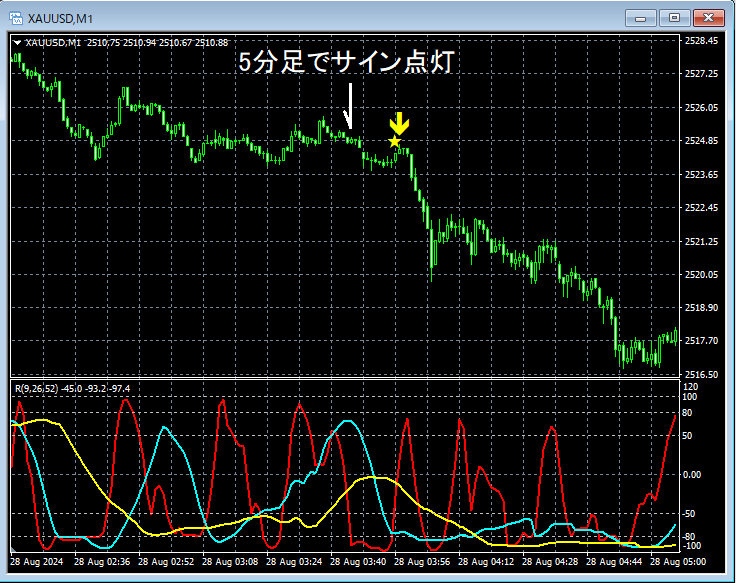

Gold XAUUSD 1-minute chart

In the above 1-minute chart, after the signal lights on the 5-minute chart and after confirming that the 5-minute RCI three-line is very weak,the mBDSR (RCI two-filter) selling reversal signallights up and the price drops sharply.

This is a very basic pattern of considering selling on retracement on the lower timeframe when the higher timeframe RCI is in a very weak state.

From this example,a trading method that focuses on the shape of the higher-timeframe RCI three-lineandthe signals of mBDSRare highly complementary.

Indicator that shines in combination with RCI: 【BODSOR・mBDSR】

Methods and Case Studies (PDF) ★GogoJungle AWARD2020 Winning★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files included number 301 (over 1,000 pages in total, over 350,000 characters)

Many of them arecollections that logically link the higher and lower timeframes using the RCI three-line, examining multiple lower-timeframe conditions sequentially, and ultimately describing a scenario where one waits for a buying on dips or selling on rallies on the lower timeframe (i.e., the mBDSR signal).

Also,there are many focuses on capturing points where multiple entry reasons overlap.

The explanation usesover 1,000 charts.

Methods and Case Studies (PDF) ★GogoJungle AWARD2020 Winning★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of the titles of those PDFs, please refer to the article below.

About the 301 PDF files included with 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

Gold XAUUSD 5-minute chart

Looking at the area circled by a white circle in the above 5-minute chart,the mBDSR (RCI two-filter) selling reversal signalis lit. Afterwards,the RCI three-line together move down,showing a very weak pattern. It might not be strange to consider selling on retracement on lower timeframes.

Gold XAUUSD 1-minute chart

In the above 1-minute chart, after the signal lights on the 5-minute chart and after confirming that the 5-minute RCI three-line is very weak,the mBDSR (RCI two-filter) selling reversal signallights up and the price drops sharply.

This is a very basic pattern of considering selling on retracement on the lower timeframe when the higher timeframe RCI is in a very weak state.

From this example,a trading method that focuses on the shape of the higher-timeframe RCI three-lineandthe signals of mBDSRare highly complementary.

Indicator that shines in combination with RCI: 【BODSOR・mBDSR】

Methods and Case Studies (PDF) ★GogoJungle AWARD2020 Winning★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files included number 301 (over 1,000 pages in total, over 350,000 characters)

Many of them arecollections that logically link the higher and lower timeframes using the RCI three-line, examining multiple lower-timeframe conditions sequentially, and ultimately describing a scenario where one waits for a buying on dips or selling on rallies on the lower timeframe (i.e., the mBDSR signal).

Also,there are many focuses on capturing points where multiple entry reasons overlap.

The explanation usesover 1,000 charts.

× ![]()