Pin bar on higher time frame, counter-trend line, and mBDSR (RCI with 2 filters) dip-buy signal

An indicator that captures "tops/bottoms and reversals" in combination with RCI【mBDSR】

Methods, case studies (PDF) ★GogoJungle AWARD 2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of those PDFs’ titles and related details, please see the article below.

About the 301 PDF files accompanying 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

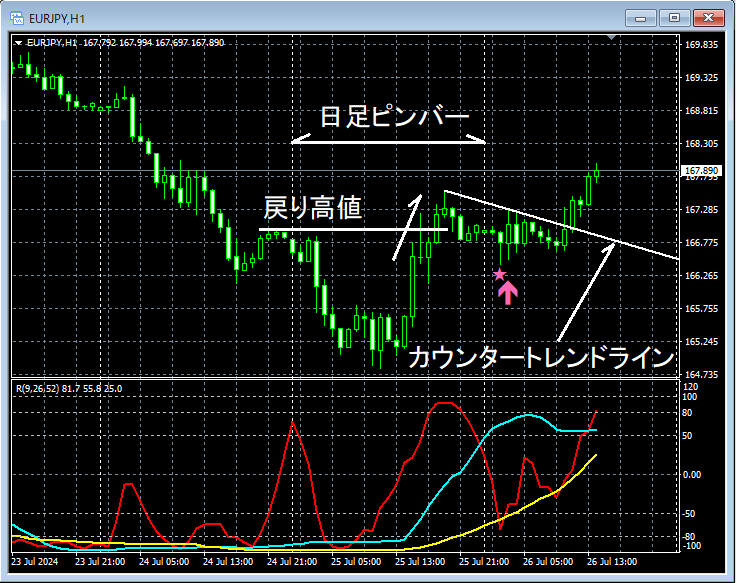

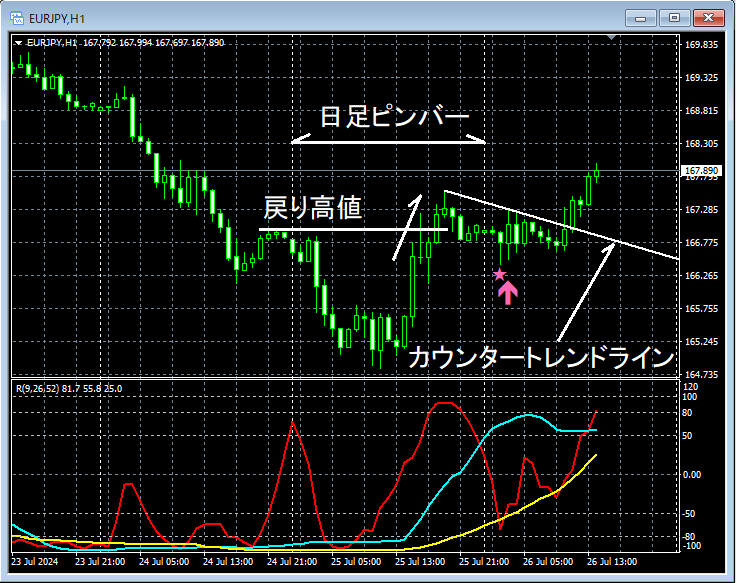

EUR/JPY 1-hour chart

Although higher-timeframe charts are omitted, the daily chart suggests an upward trendPin bar (long lower shadow)appears.Daily pin barhas appeared, anda break above the return highmay present a good buying opportunity on pullbacks.

As you monitor the chart progression,mBDSR (RCI two-line filter) buy-the-dip signallights up and the price continues to rise.

The 1-hour pullback buy signal activates and the price rises, but here,counter-trend linebreakout is expected to be entered after, so on the lower time frame (5-minute chart)counter-trend linemovement around the breakout will be examined in detail.

EUR/JPY 5-minute chart

On the 5-minute chart above,counter-trend linebreaking to the upside showsmBDSR (RCI two-line filter pullback buy signalhas lit up and the price is rising steadily.

From this example,a trading approach focusing on pin bars, swing highs (Dow Theory), and counter-trend linesandthe signals of mBDSRshow a strong synergy.

The indicator【BODSOR・mBDSR】that excels when combined with RCI

Methods, case studies (PDF) ★GogoJungle AWARD 2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files number 301 (over 1,000 pages in total, over 350,000 words).

Many of them aredocuments detailing a method that uses three RCI lines to logically link higher and lower timeframes, sequentially analyzing multiple lower-timeframe conditions, and ultimately waiting for pullback buying or pullback selling timings (i.e., mBDSR signals) on the lower timeframesin a compiled form.

Additionally,many emphasize identifying points where multiple entry reasons coincideas a focus.

Explanation includesover 1,000 chartsused.

Methods, case studies (PDF) ★GogoJungle AWARD 2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The above products include 301 PDFs. For a list of those PDFs’ titles and related details, please see the article below.

About the 301 PDF files accompanying 【BODSOR・mBDSR】

https://www.gogojungle.co.jp/finance/navi/articles/34271

EUR/JPY 1-hour chart

Although higher-timeframe charts are omitted, the daily chart suggests an upward trendPin bar (long lower shadow)appears.Daily pin barhas appeared, anda break above the return highmay present a good buying opportunity on pullbacks.

As you monitor the chart progression,mBDSR (RCI two-line filter) buy-the-dip signallights up and the price continues to rise.

The 1-hour pullback buy signal activates and the price rises, but here,counter-trend linebreakout is expected to be entered after, so on the lower time frame (5-minute chart)counter-trend linemovement around the breakout will be examined in detail.

EUR/JPY 5-minute chart

On the 5-minute chart above,counter-trend linebreaking to the upside showsmBDSR (RCI two-line filter pullback buy signalhas lit up and the price is rising steadily.

From this example,a trading approach focusing on pin bars, swing highs (Dow Theory), and counter-trend linesandthe signals of mBDSRshow a strong synergy.

The indicator【BODSOR・mBDSR】that excels when combined with RCI

Methods, case studies (PDF) ★GogoJungle AWARD 2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF files number 301 (over 1,000 pages in total, over 350,000 words).

Many of them aredocuments detailing a method that uses three RCI lines to logically link higher and lower timeframes, sequentially analyzing multiple lower-timeframe conditions, and ultimately waiting for pullback buying or pullback selling timings (i.e., mBDSR signals) on the lower timeframesin a compiled form.

Additionally,many emphasize identifying points where multiple entry reasons coincideas a focus.

Explanation includesover 1,000 chartsused.

× ![]()