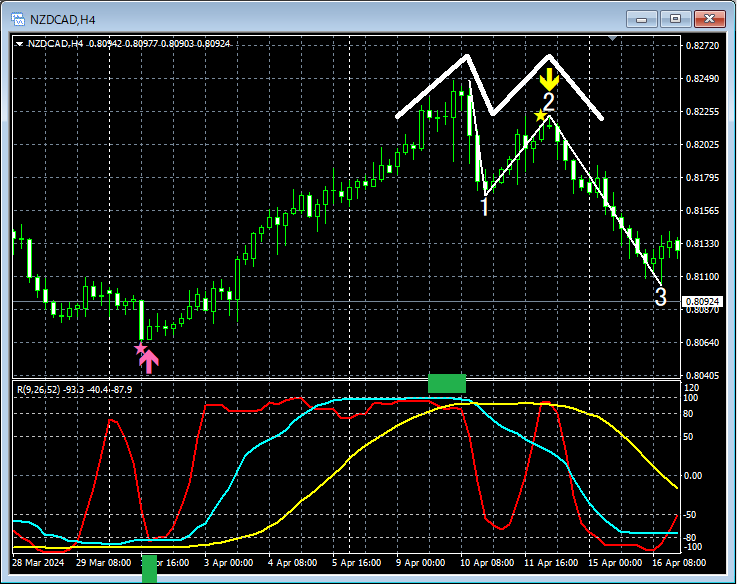

RCI3 main line, double top, and third wave, and mBDSR signal

NZDCAD 4-hour chart

In the 4-hour chart above, firstmBDSR (RCI two-filters) pullback buy signallights upRCI triple bottomfromRCI triple toprises tothe right peak of the double topandmBDSR (RCI two-filters) pullback sell signallights up and it declines.Wave 3 of the downtrendin its initial movemBDSR (RCI two-filters) pullback sell signallights up, which can be interpreted as a signal that the price is turning down.

From this example,a trading method focusing on the RCI 3 lines, double tops, and Wave 3andthe signals of mBDSRshow a strong compatibility.

Inter Indicator that shines in combination with RCI【BODSOR・mBDSR】

and Method/Case Studies (PDF) ★GogoJungle AWARD 2020 winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF file includes 286 items.

Many of them are summaries of examples where multiple lower-timeframe situations are examined logically by linking higher and lower timeframes using the three RCI lines, ultimately waiting for pullback buy timing or pullback sell timing (i.e., mBDSR signal) on the lower timeframe.They also emphasize capturing points where multiple entry reasons align.

In the explanations,more than 1,000 chartsare used.

× ![]()