Trend of Cross Yen: Sakata's Five Methods "Evening Star" and mBDSR's Return Sell Signal (2)

An indicator that demonstrates power in combination with RCI: 【BODSOR・mBDSR】

and methods・case studies (PDF) ★GogoJungle AWARD2020 Winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF file includes 275 items.Most of them are examples that lay out a form where you logically link higher-time frames and lower-time frames using three RCI lines, sequentially analyze the状況 of multiple lower-time frames, and finally wait for a timing to buy on dips or sell on rallies in the lower-time frame (=mBDSR signals).In the explanations,more than 1,000 chartsare used.

In recent Investment Navigator+ articles,we focus on examples that illustrate the high compatibility between various trading methods and mBDSR signals.We introduce primarily such examples.

AUDJPY 4-hour chart

Looking at the area circled in white on the 4-hour chart above, you can see the “Evening Star” from the Sakuya Five Methods. This candlestick pattern suggests a downward reversal, so it might be reasonable to consider selling on rallies in the lower time frame.

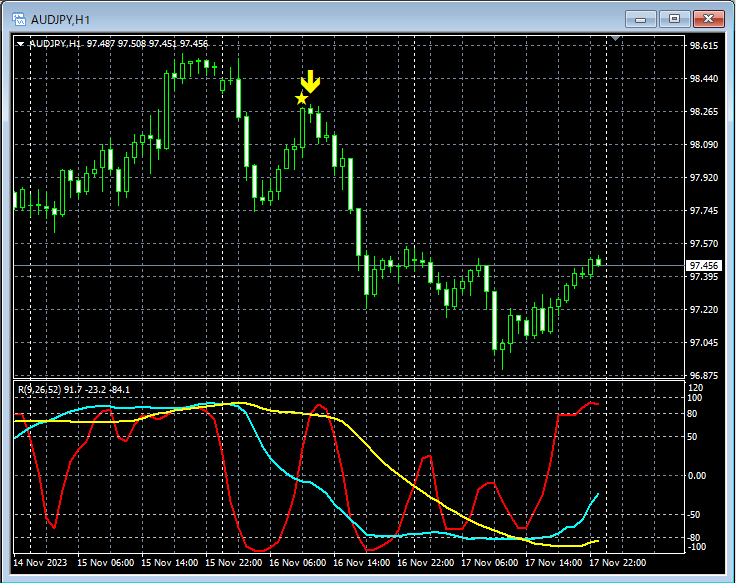

AUDJPY 1-hour chart

After the “Evening Star” from the 4-hour higher time frame appears, on the 1-hour higher time framethe mBDSR (filter: RCI26 and RCI52) sell-on-rally signallights up and the price declines smoothly.

From this example,a trading method focusing on the “Evening Star” in the Sakuya Five Methodsandthe signals of mBDSRshow a high degree of compatibility.

An indicator that demonstrates power in combination with RCI: 【BODSOR・mBDSR】

and methods・case studies (PDF) ★GogoJungle AWARD2020 Winner★

https://www.gogojungle.co.jp/tools/indicators/11836

The PDF file includes 275 items.Most of them are examples that lay out a form where you logically link higher-time frames and lower-time frames using three RCI lines, sequentially analyze the状況 of multiple lower-time frames, and finally wait for a timing to buy on dips or sell on rallies in the lower-time frame (=mBDSR signals).In the explanations,more than 1,000 chartsare used.

× ![]()