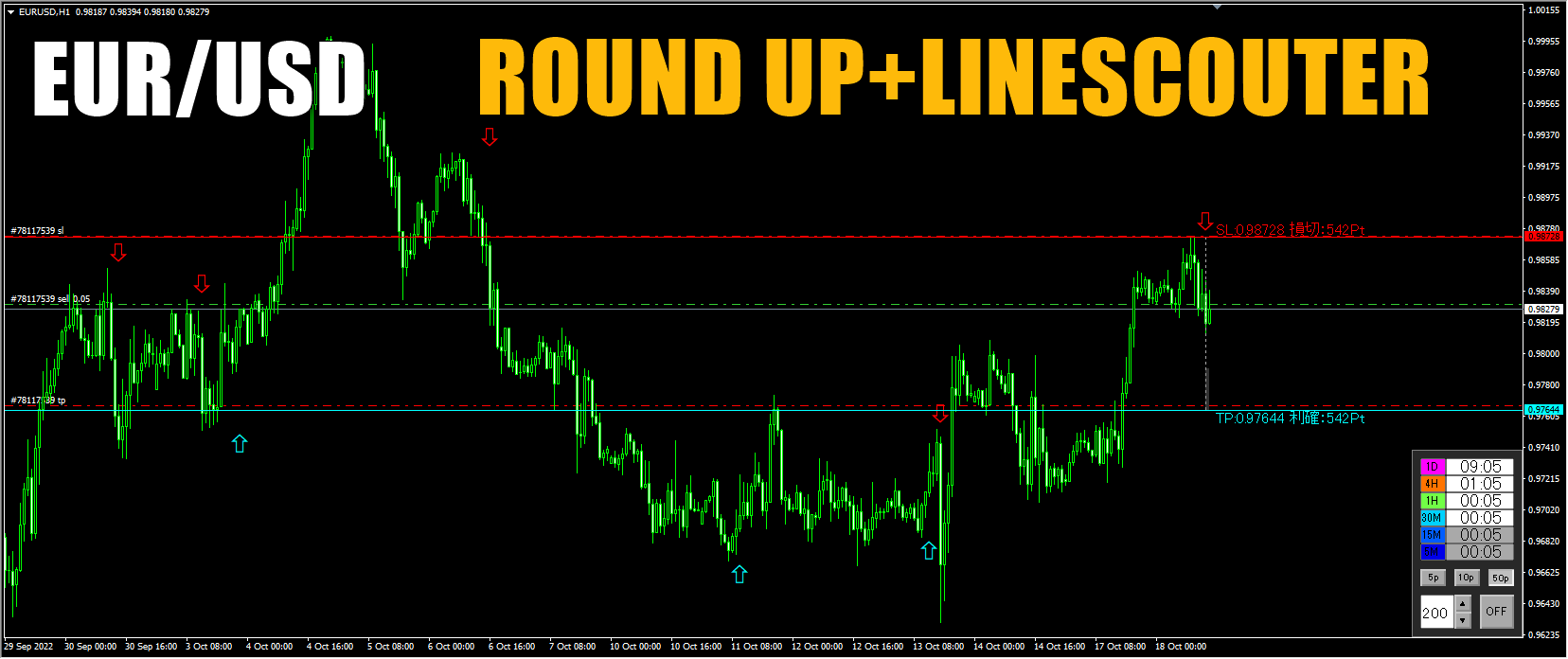

Today's Scenario EUR/USD (ROUNDUP sign) continuation

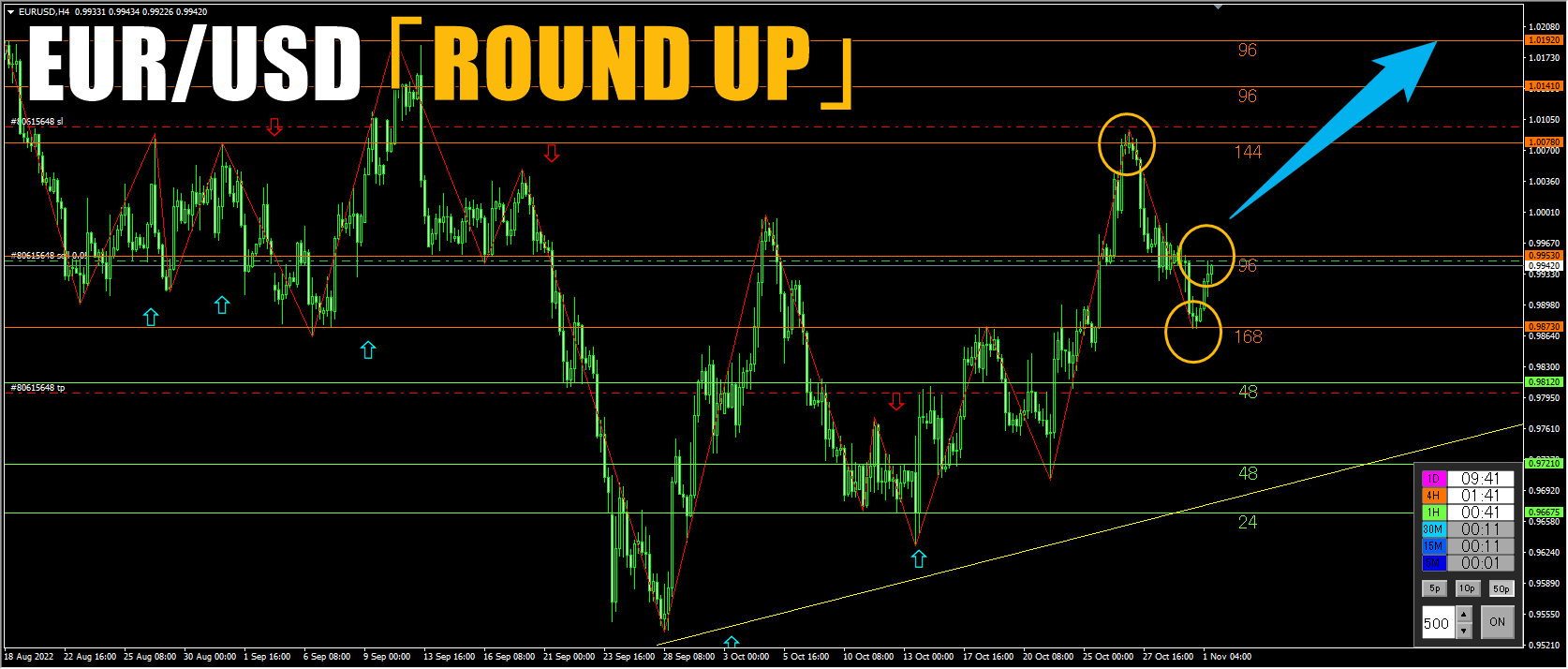

EUR/USD 4-hour chart

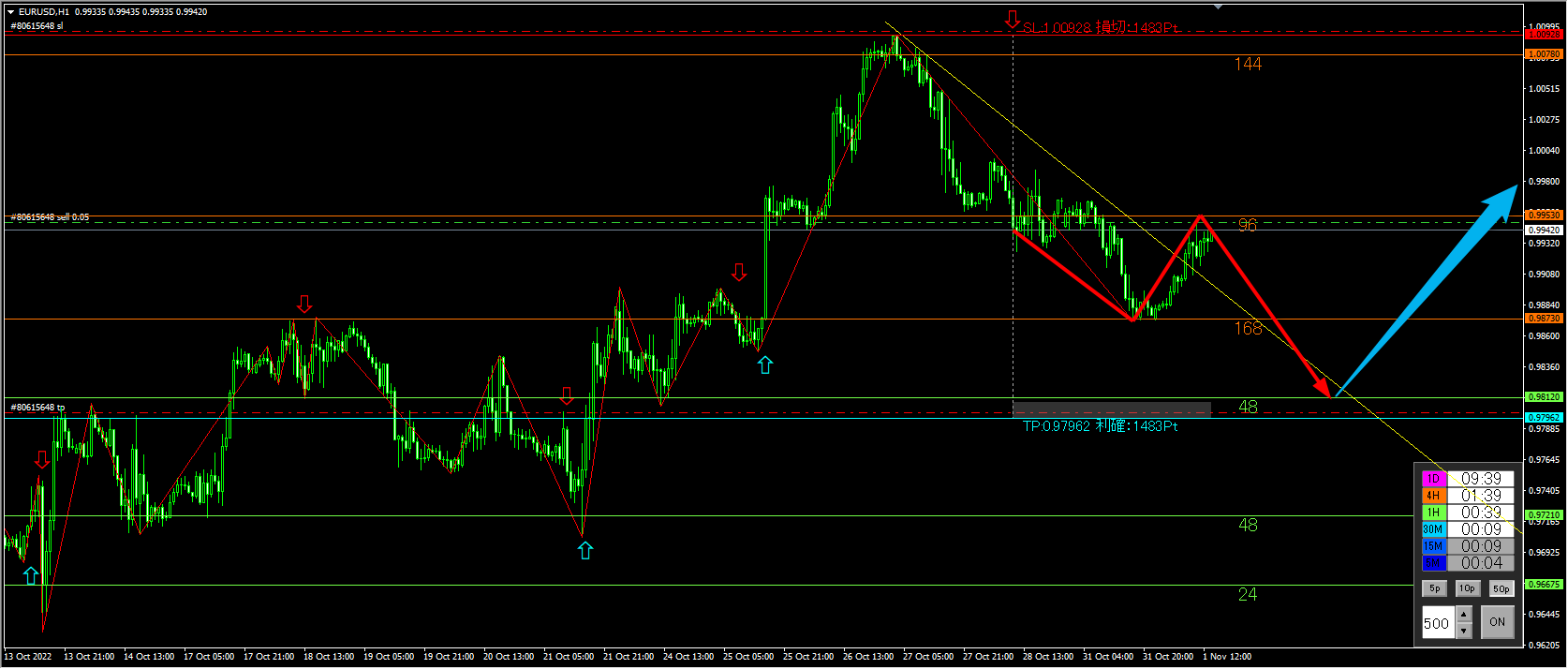

Continuation of the article from 10/28.

On the daily chart, the uptrend has taken a form of a reversal, but on the 1-hour chart, as it forms a head and shoulders with a pullback, a "ROUND UP" signal appeared.

Since a reversal at the orange support/resistance line at (144) that is watched on the 4-hour chart was also confirmed, I placed a stop-loss around the orange line (144) and entered in line with the signal.

Currently it has fallen temporarily, but it has come back to the point where I entered, reacting to the orange line (168) that is watched on the 4-hour chart.

With the FOMC policy announcement due on 11/2, I would like to close out to reduce risk within tomorrow.

If the downtrend resumes, take profits early around the support/resistance line.

If the 4-hour chart clearly breaks above the orange (96) near the entry with real body, cut losses early.

On the daily chart, there is a possibility of a pullback in the uptrend, and given the expected sharp price movement at the FOMC, it would be better to avoid holding positions beyond 11/2.