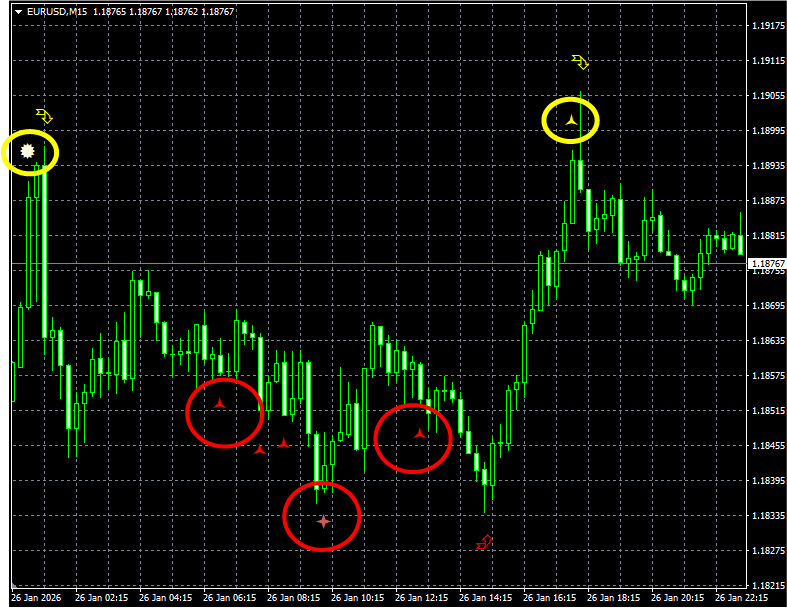

I translated the content while preserving the HTML format: "Look, I won by ○ pips"

How to Win

Reading time estimate: 3–5 minutes

Why “you can win only in certain situations” is dangerous

“I could take 〇 pips in this moment!”

That track record may be“not a lie”perhaps.

But,that alone does not guarantee you will keep winning.

Conclusion

What’s important is not the “position” itself

reproducibility, frequency, and expectancy

reproducibility, frequency, and expectancy

Danger signs

Only “snipped results”

appear

appear

鬼速AI

Rather than “guessing”

focus on resilienceto breakdown

focus on resilienceto breakdown

1

There are winning situations for everyone

Strong trends, clean rebounds...

If you isolate just that, anyone could say they “took it.”

I won’t deny that.

2

But “snipping” deceives people

Common pattern

・Remember only impressive wins

・Forget losses (or retrofit reasons)

・Feel like “I can do this”

The danger is thatyou expect outcomes based on mood, not logic.

3

Numbers to watch: these 3 plus 1

・Expected value

Average profit/loss per trade.

If positive, it accumulates

If positive, it accumulates

・Number of trials

10 trades include randomness.

Beyond 100 gives clarity

Beyond 100 gives clarity

・Drawdown

Before “being able to win,”

“being able to endure”is important

“being able to endure”is important

+Most important: frequency

In that situation,how many times per yeardoes it occur?

Too few “god patterns” have weak reproducibility

Too few “god patterns” have weak reproducibility

4

If you only have snipped results, listen to this

・How many times did it appear in the past 3 years?

・Of those, how many times did it enter under the same rules?

・What was the maximum drawdown?

・Are you biased toward currency pairs/timeframes that are easier to win?

・Of those, how many times did it enter under the same rules?

・What was the maximum drawdown?

・Are you biased toward currency pairs/timeframes that are easier to win?

If this is unclear,“only shows the moments that hit”is likely.

5

The structure that most signal tools fail under

・Fixed parameters

When markets change,

premises tend to shift

premises tend to shift

・Optimized for past partial data

Tends to fit only the period that happened to be profitable

・Validation is a one-off

The moment of creation is a peak,

hard to notice degradation

hard to notice degradation

This isn’t about developers being bad; it’show designs tend to behaveby nature.

AI

What鬼速AI emphasizes is not “hitting” but “being hard to break”

Key points

・Don’t cut to targets and chase wins

・Balance frequency, expectancy, and drawdown

・microAI continues validating and detects signs of degradation

・Balance frequency, expectancy, and drawdown

・microAI continues validating and detects signs of degradation

In short,not a “signal that only hits now”but

a long-term, robust logicthat resists degradation.

a long-term, robust logicthat resists degradation.

※ Trading involves risk. Past performance does not guarantee future results.

One final word

“snipped results” feel satisfying to watch.

But if you want to win continuously, focus onthe numbers and the structure.

鬼速AI is built to keep validating with the philosophy of preserving that structure.

But if you want to win continuously, focus onthe numbers and the structure.

鬼速AI is built to keep validating with the philosophy of preserving that structure.

× ![]()