複雑なロジックは不要でした。

ゴトー日の仲値、それだけで十分でした。

ゴトー日の深夜2:00にエントリーチャンスを探し始めます。

ポジションは、9:00から決済チャンスを探します。

チャンスがなければ、9:55に決済します。

デフォルト設定(10日、15日、20日、25日)で月4回。

それ以外の日は何もしません。

Translating...

複雑なロジックは不要でした。ゴトー日の仲値、それだけで十分でした。

複雑なロジックは不要でした。

ゴトー日の仲値、それだけで十分でした。

ゴトー日の深夜2:00にエントリーチャンスを探し始めます。

ポジションは、9:00から決済チャンスを探します。

チャンスがなければ、9:55に決済します。

デフォルト設定(10日、15日、20日、25日)で月4回。

それ以外の日は何もしません。

| 通貨ペア | USDJPY専用 |

|---|---|

| 狙う現象 | ゴトー日(10日・15日・20日・25日)の仲値公示に向けたドル買い戦略 |

| エントリー | JST 02:00〜08:55 / 高値掴みを避けつつロングエントリー(RSIで判断) |

| 決済 | JST 09:00〜09:55 / ピークアウトで決済(RSIで判断)、それ以外は時間決済 |

| 損切り | 50pips固定 |

| 休日処理 | ゴトー日が休日の場合は、直前の営業日でトレードします |

| パラメータ名 | 初期値 | 説明 |

|---|---|---|

| 複利運用する | いいえ | はい/いいえ |

| ┗ リスク割合% | 2.0 | 複利時の1トレードリスク |

| ┗ 固定ロット数 | 0.01 | 固定ロット時の数量 |

| パラメータ名 | 初期値 | 説明 |

|---|---|---|

| 損切(SL) Pips | 50 | ストップロス幅 |

| 利確(TP) Pips | 0 | 設定しない |

| 許容スリッページ | 3 | pips |

| 許容スプレッド | 5 | pips |

| 週末ポジション持越し | はい | 金曜ポジションの扱い |

| マジックナンバー | 25123001 | EA識別番号 |

| EAコメント | 74381:NakaneShikaKatan | 取引履歴に表示されます |

| パラメータ名 | 初期値 | 説明 |

|---|---|---|

| GMTオフセット(冬) | 2 | ブローカーのGMT |

| GMTオフセット(夏) | 3 | ブローカーのGMT |

| エントリー開始 | 02:00 | 日本時間 |

| エントリー終了 | 08:55 | 日本時間 |

| 決済開始 | 09:00 | 日本時間 |

| 決済終了 | 09:55 | 日本時間 |

| パラメータ名 | 初期値 | 説明 |

|---|---|---|

| 5日をトレードする | いいえ | |

| 10日をトレードする | はい | |

| 15日をトレードする | はい | |

| 20日をトレードする | はい | |

| 25日をトレードする | はい | |

| 30日をトレードする | いいえ | |

| クリスマスをスキップ | はい | 12/23-25 |

| パラメータ名 | 初期値 | 説明 |

|---|---|---|

| Pips表示 | ON | 損益pipsをチャートに表示 |

| ┗ フォントサイズ | 30 | |

| ┗ 色(+/0/-) | Aqua/Gray/Magenta | |

| 日付表示 | ON | 日付をチャートに表示 |

| ┗ フォントサイズ・色 | 18 / Gray | |

| 次のゴトー日表示 | ON | 次回トレード日を表示 |

| ┗ フォントサイズ・色 | 18 / Gold |

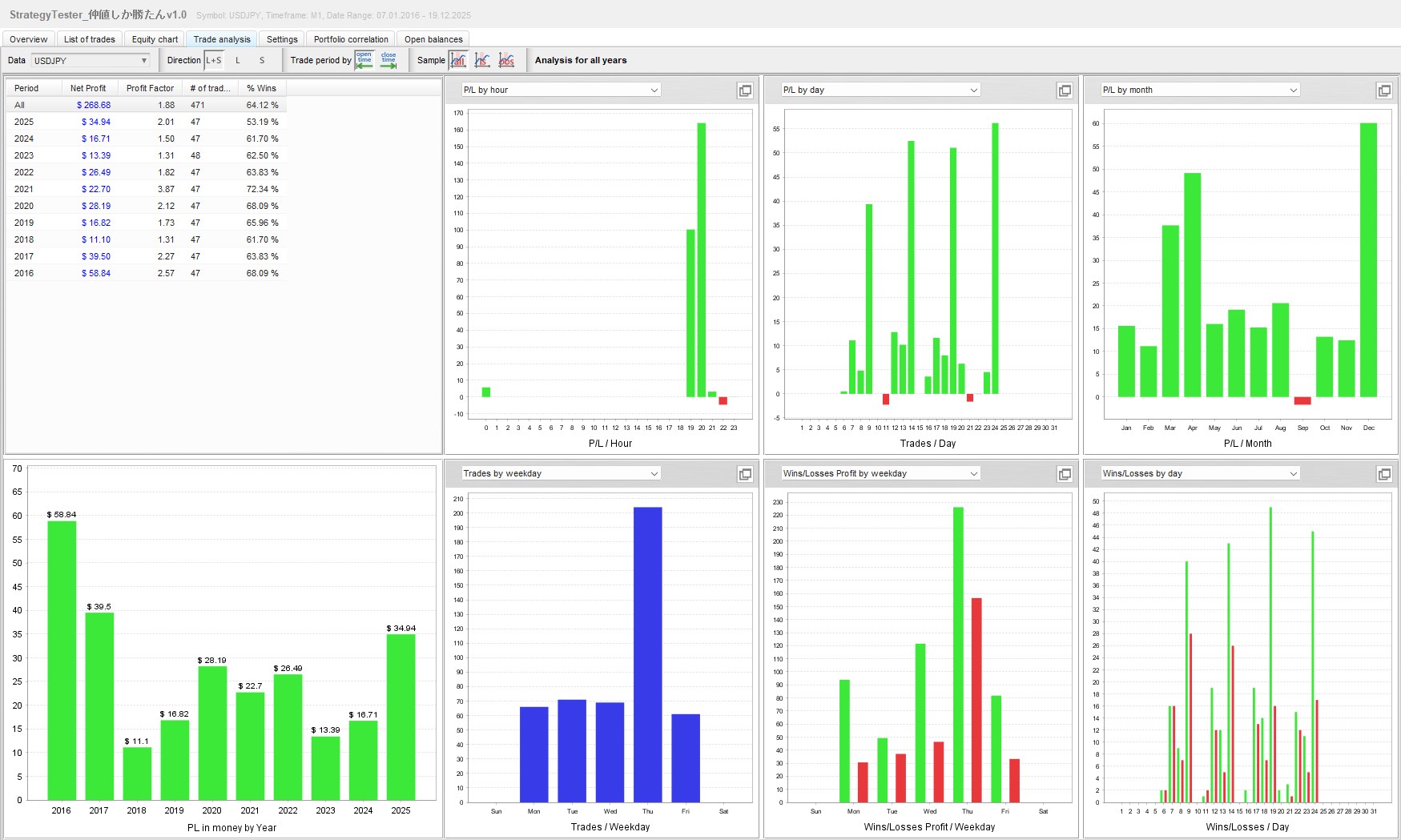

| 項目 | 数値 |

|---|---|

| テスト期間 | 2016年1月〜2025年12月(10年間) |

| テストモデル | 全ティック |

| 初期資金 | $1,000 |

| 純利益 | +$270.26(固定0.01ロット運用) |

| 最大ドローダウン | 1.44%($17.84) |

| 最大連勝 / 連敗 | 10回 / 6回 |

| 年間取引回数 | 約47回 |

※全ティックモデルによるバックテスト結果です。実運用ではスリッページ・約定拒否等により結果が異なる可能性があります。

向いている人

向いていない人

運用上の注意

相場環境の変化について

仲値アノマリーは日本特有の市場構造に依存しています。

将来この構造が変化すれば、優位性が失われる可能性があります。

定期的にパフォーマンスを確認し、必要に応じて停止判断をしてください。

| プラットフォーム | MetaTrader 4(MT4) |

| 推奨ブローカー | サーバー時刻がGMT+2/+3のFX会社 |

| 通貨ペア | USDJPY |

| 時間足 | M1(1分足) |

| 推奨環境 | VPS(24時間稼働) |

Price:¥14,800 (taxed)

●Payment

Price:¥14,800 (taxed)

●Payment