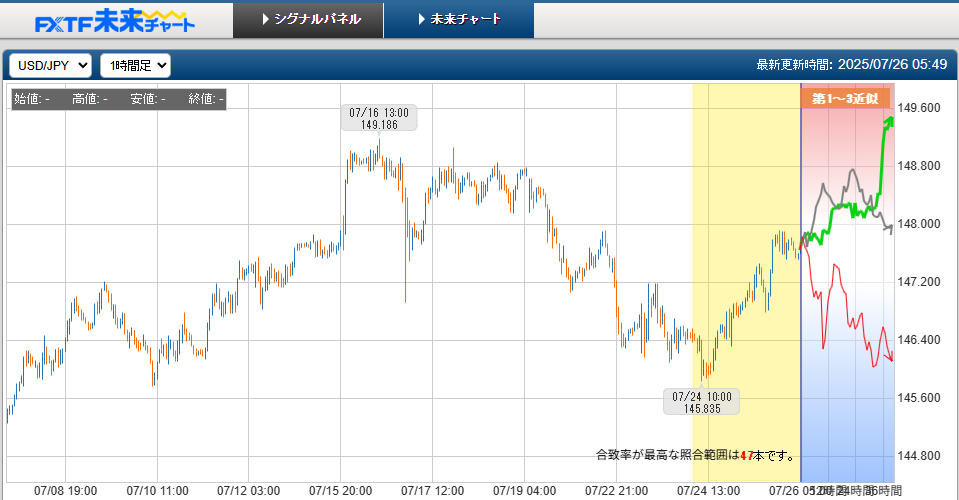

Dollar/Yen 2025/08/04(Mon) Week opening is range

ForecastThe price movement 4 hours from now is most likely to be within the range.Prediction LogicBelow is an analysis and overall judgment based on daily, 4-hour, and 15-minute information.

Supplementary AnalysisElliott WaveForecast: Currently, it is likely in the final stage of a corrective wave (Wave 2 or Wave 4).

Logic:

Logic:

Logic:

ConclusionFor USDJPY at the start of the week, the most likely scenario is a range. The daily uptrend coexists with the 4-hour and 15-minute down pressures, while the oversold condition on the 4-hour suggests a rebound, but the volatility is tempered by BB squeezes, limiting large moves.

- Daily Analysis

- The large cycle is considered to tend to persist and rise steadily, indicating a potential long-term uptrend.

- ADX is rising, indicating the trend is strengthening.

- Price is within BB1 sigma and BB2 sigma squeeze is confirmed, implying volatility is decreasing and price is stabilizing.

- RSI at 40.47 is neutral, not overbought.

- 200-day EMA is trending downward, and the current price is below it, showing lingering long-term downward pressure, though it conflicts with the overall rising tendency of the large cycle.

- 4-Hour Analysis

- The large cycle is at the "entry to a downtrend," suggesting the start of a short-term downtrend.

- Standard deviation and ADX are rising, indicating increasing volatility and trend strength.

- Break below BB1 sigma indicates price below the lower band, showing strong downside pressure.

- RSI at 14.20 is extremely low, indicating oversold conditions and potential short-term rebound.

- 200-hour 4-hour EMA is rising and price is above it, suggesting short-term support may be functioning.

- 15-Minute Analysis

- The large cycle is considered to “persist and tend to decline steadily,” signaling potential continuation of a short-term downtrend.

- Standard deviation is rising, increasing volatility.

- Break below BB1 sigma and BB2 sigma squeeze indicate simultaneous downside pressure and volatility decline.

- RSI at 38.23 is slightly near oversold territory.

- 200-minute EMA is declining, and the current price is below it, indicating continued short-term downtrend.

- Overall Judgment

- Daily suggests a long-term uptrend, but being below the 200-day EMA means downward pressure still remains.

- In the 4-hour, at the entrance to a downtrend, RSI is oversold and a rebound is possible.

- In the 15-minute, a stable downtrend continues, with strong near-term downward pressure.

- BB squeezes on the daily and 15-minute imply lower volatility and make large trend changes unlikely in the near term.

- Therefore, with a rebound potential due to oversold conditions on the 4-hour, the downward pressure on the 15-minute, and the stability on the daily, prices are likely to, 4 hours from now, move within a range.

Supplementary AnalysisElliott WaveForecast: Currently, it is likely in the final stage of a corrective wave (Wave 2 or Wave 4).

Logic:

- The daily large cycle "stable rise" suggests the early stages of impulsive waves (Wave 1 or Wave 3) in Elliott Wave Theory.

- The 4-hour "entry to a downtrend" and the 15-minute "stable decline" may represent short-term corrective waves (Wave 2 or Wave 4).

- RSI (14.20) on the 4-hour being oversold indicates a possible end of the corrective wave or a reversal approaching.

- The daily RSI (40.47) being neutral suggests that it is not the end of a major impulse wave, but rather a corrective phase.

Logic:

- A break below BB1 sigma on the 4-hour and oversold RSI imply a potential rebound from a support zone, suggesting a possible double bottom formation.

- BB2 sigma squeeze on the daily and 15-minute indicate decreasing volatility and the possibility of triangle or range patterns forming.

- No clear breakout yet; the pattern formation within a range is considered ongoing.

Logic:

- In Dow Theory, trends are defined by higher highs and higher lows. The daily “stable rise” and rising ADX suggest a potential uptrend driven by higher highs and higher lows, but price below the 200-day EMA hints at long-term downward pressure.

- The 4-hour “entry to a downtrend” and break below BB1 sigma, along with lower lows on the 15-minute, indicate a short-term downtrend.

- However, the 4-hour RSI (14.20) being oversold implies a possible short-term rebound, leaving some uncertainty about trend continuation.

ConclusionFor USDJPY at the start of the week, the most likely scenario is a range. The daily uptrend coexists with the 4-hour and 15-minute down pressures, while the oversold condition on the 4-hour suggests a rebound, but the volatility is tempered by BB squeezes, limiting large moves.

- Elliott Wave: It is likely positioned toward the end of a corrective wave.

- Chart Patterns: A double bottom or triangle formation is in progress.

- Dow Theory: Short-term downtrend persists, but a rebound is possible.

× ![]()