Forecast for USD/JPY exchange rate next week (July 28, 2025 to August 2, 2025)

Forecast for USD/JPY for next week (July 28 – August 2, 2025)

The USD/JPY is likely to remain in a range-bound environment. Below is a detailed analysis and forecast.

1. Current market trend

Recent price action:

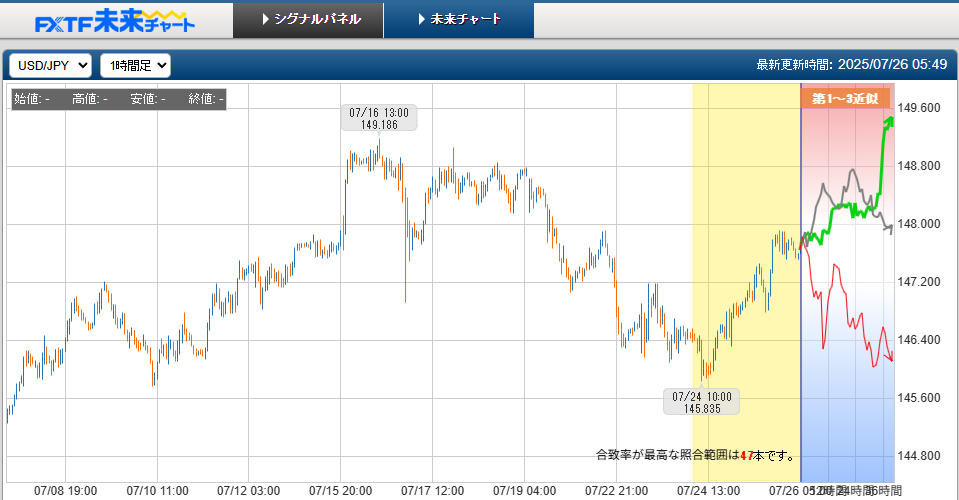

As of July 26, USD/JPY traded around 147.64–147.66, up by +0.84% from the previous day.

Year-to-date high: 158.84 (January 10); low: 139.88 (April 22).

The current vicinity of 147 yen is considered a psychological level.

Technical analysis:

According to Fibonacci retracement, the 147 yen area is the 61.8% retracement support line.

If yen strength continues, the next downside target is the 144 yen area (76.4% retracement).

On the upside, resistance lines are around 148.20 yen and 149.60 yen.

Traders' views:

Some traders expect yen to strengthen and even target 136 yen.

Many views suggest a short-term range of 145.7–149.2 yen.

Expectations for a BOJ rate hike have strengthened; if CPI shows strong inflation, yen buying pressure could rise.

The Federal Reserve is expected to remain cautious about cutting rates, but if labor data or the PCE deflator are weak, dollar depreciation pressure could intensify.

U.S. GDP (advance), JOLTS job openings, ADP employment, PCE deflator, ISM manufacturing index, etc., will be released.

In particular, employment and inflation indicators are expected to influence USD/JPY.

Tariff negotiations between Japan and the U.S. and between the U.S. and China are set to resume from August 1, and any progress could lift the dollar and weigh on the yen.

U.S. moves regarding Israel-Iran conflict could trigger dollar buying, but impact may be limited.

U.S. long-term rates around 4.34%, and Japan aiming toward 2% from around 1.61%.

A narrowing rate gap supports yen strength, but room for U.S. rate rallies remains.

3. Next week's forecast range

Forecast range: 145.70 yen – 149.60 yen

Downside: 145.70 yen (76.4% Fibonacci retracement, support line).

Upside: 149.60 yen (resistance line).

Main scenario:

A range-bound movement around the 147 yen area is expected to continue. A major trend reversal is unlikely, but volatility is expected to remain high.

4. Risk factors

Risks of a stronger yen:

If BOJ rate hike expectations align with disappointing U.S. data, there is a risk of a sharp drop toward the 144 yen region.

Risks of a weaker yen:

Progress in U.S. tariff negotiations or risk-on sentiment could push the pair above 150 yen.

Next week, USD/JPY is expected to move within the 145.70–149.60 range. The main drivers will be the Japan-US monetary policy meetings and U.S. economic indicators. Traders should focus on the support and resistance near 147 yen and stay readily responsive to economic data and statements by major figures.