What is fund management considering the probability of Balsara's bankruptcy?

There are many investors who go all-in with full leverage in FX and end up expelled many times. They should manage their funds strictly and trade with an amount that won’t bankrupt them, but because they become covetous and go all-in with full leverage, they are forced to exit after just one loss. But well, with a capital of 500,000 yen, I can understand why one would want to go all-in with full leverage.

Suppress your emotions, operate USD/JPY or EUR/USD with low leverage, commit to an average-odds approach, and steadily accumulate profits—that is the proper way.

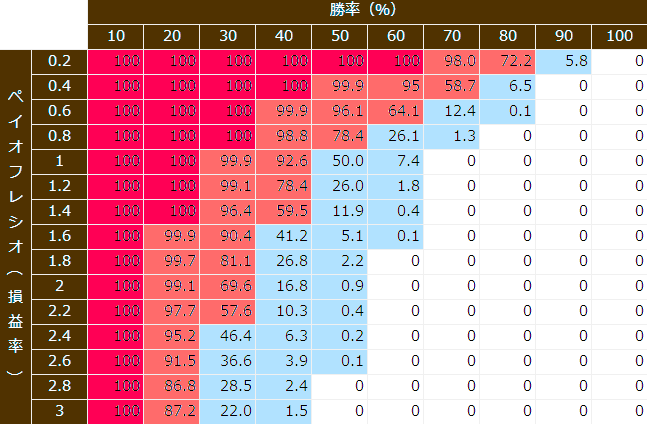

That is where the Balsara bankruptcy probability comes in. How much risk do you take before going bankrupt? How much risk can you take without worrying about bankruptcy?

We calculate the probability of bankruptcy considering startup capital, win rate, and loss risk. The bankruptcy probability in Balsara is the only way to know exactly how likely you are to go bankrupt in the future.

Whether you should continue using your investment method or quit immediately. The bankruptcy probability of Balsara tells you the chances of bankruptcy. The key to note are win rate and the profit/loss ratio.

Let's verify the bankruptcy probability with the above Balsara bankruptcy probability table \(^o^)/

Win rate = number of winning trades ÷ total number of trades

Profit/loss ratio = total profit ÷ total loss

Ideally you should manage assets with a small loss and large profit, but if you focus on small losses and large profits during trading, you will become poor through frequent stop-outs, and as losses accumulate you will lose balance and psychologically find it hard to cut losses.

In my case, I don’t pay attention to the amount, but to the price range. That allows me to automatically cut losses. If you still hesitate, rely on automated trading software.

The purpose of risk management is only meaningful for investors who can trade with a performance metric better than 1.5. If your performance metric is 0.8 or lower, you should rethink your investment method.

Even with a performance metric from 1.0 to 1.4, there is a high chance of bankruptcy. An investor with only 1.4 or less cannot justify going all-in with full leverage; that would be suicide.

Suppose you trade with low leverage that allows you to hold the same position after ten consecutive losses. If your monthly total is positive and your performance metric is 1.5 or higher, that is ideal.

Win rate is not something you can help worrying about. It would be bad if it’s too low, but even 30% win rate is decent. Even I, when I’m not performing well, have a win rate below 10%.

When I’m on a good run, my win rate is around 90%—in other words, my performance oscillates dramatically. That’s why I have to operate with low leverage so I can hold the same amount of positions even after ten consecutive losses.

So what should I do? The answer is already decided. Trade with an investment method where the maximum loss per trade is no more than 2% of total assets. If startup capital is 1,000,000 yen, you must keep maximum loss under 20,000 yen, and in USD/JPY, if you set stop-loss at a suitable width within 50 pips, you can hold four positions.

With capital management that accounts for Balsara’s bankruptcy probability, to avoid bankruptcy you would need at least 10,000,000 yen of capital. Otherwise you wouldn’t even be able to cover monthly living expenses. For a full-time trader, you would need to earn about 5,000,000 yen per year to live comfortably.

Roughly speaking, you’d need about 400,000 yen per month. That’s about 20,000 yen per day.

That’s the calculation for USD/JPY with 100,000 units traded daily and 20 pips gain.

Considering the win rate, you should hold at least 20 lots to be able to live, since most ordinary investors have win rates between 40% and 60%... At most, with my funds, I can only trade USD/JPY with 10,000 units. I’m poor, so it can’t be helped.

However, as long as you trade one lot of USD/JPY, according to the Balsara bankruptcy probability, it seems I won’t go bankrupt. Tears are welling up (^。^)y-.。o○

For day trading USD/JPY, it’s normal to set stop-loss within 30 pips ±20; for swing trading, I would set stop-loss within 30 to 150 pips.

If you have confidence in your ability, you should go all-in with full leverage right now.

Grr. I hear the demon’s whisper. If you manage capital with bankruptcy-probability-aware risk management, you won’t mind the whispers, but you can hold fewer positions than you’d expect. That reduces risk, but you know.

But still… when you clearly have confidence, there is value in going all-in with full leverage. If conditions only occur a few times a year, and you can clearly judge the stop-loss point in the market, then it’s not a bad idea.

If you can imagine the maximum acceptable loss and set a clear stop-loss order, even if you fail you’ll only take a non-fatal hit. If you follow trading rules, the chance of instant death is low, so gambling with full leverage isn’t entirely bad, but considering the bankruptcy probability, low-leverage trading might be safer and good as well.

Asset management with bankruptcy-probability-aware capital management eliminates luck from the equation, so whether you win or lose, it depends on your ability (ノ゜Д゜) yoshi!