Trend-following investment strategy judged by resistance and support

What tells you the balance of supply and demand, such as the positions of market participants and the intentions of the manipulators, is the Ichimoku Kinko Hyo cloud, which provides it in hindsight. ヽ(゜◇゜ )ノ

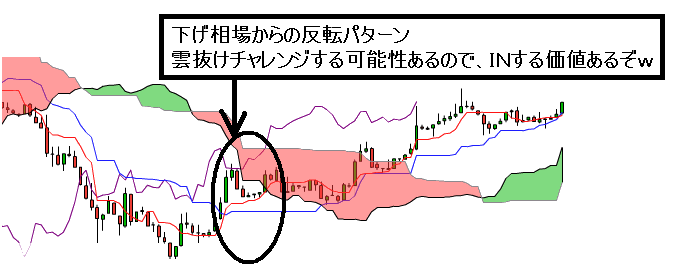

The essence of the Ichimoku Kinko Hyo is to judge price movements with consideration of the nature of the cloud. The Ichimoku cloud, despite differing in various properties and strengths, remains a resistance.

Analyzing price movements with reference to the cloud is the basic approach, and since you can infer the market participants' position ratios later, comparing with fundamental analysis allows you to read the manipulators’ intentions.

The thicker the cloud, the more investors get trapped. If you break into a thick cloud and pierce through, it means that the manipulators picked up positions that individual investors had cut losses on. If you break through the cloud but stall and crash, or move in a range, it implies the manipulators are rotating and hedging positions. Or consider that they have closed out.

Displaying the Ichimoku chart on a PC screen and tracking price movements in real time, if you assume, even retroactively, that price movement is following the above reasons, you can feel the manipulators’ setup to create an impression of entering the cloud.

The cloud's above-the-cloud and below-the-cloud levels tend to become strong resistance, making ranges prone to repeated up-and-down movement. Even after clearly breaking through the cloud, it can return immediately, making it difficult, but the basic trend-following principle is to simply build positions in the direction of the breakout.

To sense the trend, the technicals I use are MACD, moving averages, and the Ichimoku cloud. Short-term trends are judged on short timeframes like 1-minute, 5-minute, or 15-minute charts. Mid-term trends are judged on 30-minute, 60-minute, or 4-hour charts. Long-term trends are judged on daily, weekly, or monthly charts.

By looking at trends on short-term, mid-term, and long-term candles and considering market sentiment, you can sense the manipulators’ intentions.

If you don’t fall for media puff pieces and learn to infer what lies behind the information, you can graduate from being information-weak.

Read the manipulators’ investment strategies and grab explosive profits (ノ゜Д゜)よし!

With an enormous amount of capital and the fighting power to control information, manipulators can force price movements and are creating manipulative markets while dominating the world’s financial markets.

The manipulators’ basic strategy is simple.

When you want to accumulate shares, lure them to total pessimism to induce stop-loss positions; when you want to unload shares, lure them to total optimism to make late buyers cry and jump in.

Investment is a psychological and information battle, and manipulators are professionals of investment, so individual investors cannot compete.

To profit in financial markets, it is essential to read the manipulators’ motives, not take information at face value, and trade with the mindset that it’s a prearranged event from the start.

Buy, buy, buy with a bang! Buy, buy, buy with a bang! Buy, buy, buy with a bang!

This is the基本 of the manipulators’ entrapping tactics.

① Gather up the stop-loss positions of panic-stricken investors from economic indicators and puff pieces. Create ranges intentionally with consolidation, like a triangle or a flag, placing thick buy orders at the lower end and thick sell orders at the upper end. After a sharp drop and then a sharp rise, create a box range so the price movement looks natural; no one will know you are accumulating. This is how you fine-tune the supply-demand balance for accumulation.

② After the manipulators have laid the groundwork, they flood the market with large buy orders to keep buying, obtaining a large number of long positions. A substantial rise leads to a high likelihood of entering a slow-rising managed market. The reason for the slow rise is to lure the market sentiment toward total optimism.

③ Information-weak people become late buyers in tears and fear missing out, crying with jumping catches. When the market becomes totally optimistic, they push prices higher to take profits. Of course they can produce drastic moves that retrace fully after a rise, and they can cash in heavily with hedged positions. The manipulator’s basic tactic is to exit with profits at high prices, and the hardest part is profit-taking, which is why they use public opinion manipulation and price movement control to guide total optimism. In other words, the goal is to generate many investors at high prices who fear missing out. Late buyers crying, you must buy now or you’ll miss out. As they trap, they create an atmosphere that you will be saved eventually, so you don’t need to cut losses, ending in a severe blow.

The financial markets are a battlefield (ノ゜Д゜) よし!

Manipulators use economic indicators, puff pieces, and statements by key figures to influence impression. The ducks lured by total optimism swallow manipulators’ profits. Keep in mind that manipulators’ trapping strategies are always the same (o^-')b