The world stock market crash is about to trigger a reaction in USD/JPY! Can it hold the near-term support? The cross yen support will be the key moving forward!

Global stock markets fall together, and at least this year the starring US stocks are likely to drop again at some point.

They have fallen sharply this month in a form that resembles a double top.

The Nikkei Average also moved in a double-top pattern after briefly surpassing the early-year high, and

we are very curious about the price action toward the end of the year.

■ Dow: Is a double-top forming? Be cautious of a full-scale yen buying move!

The currency market is currently showing a stance of buying USD, buying yen, and selling other currencies, causing the cross yen to fall sharply.

If you look at the previous article, you’ll see that this cross-yen decline was anticipated in advance.

I think you’ll understand that it was posted ahead of time.

■ Immediate target reached for USD/JPY, start of a corrective sell-off! A sudden risk-off market could follow as US and Japan stock prices plunge…

Now, are you prepared for the US midterm elections? As mentioned in the previous article, if you were prepared,

you might have anticipated this move. But how long will this movement continue?

This is also important for investors.

To discern the trend, one must exert a considerable effort, or else you’ll be stuck trading the near-term moves forever.

.

September 2016 article update

■ USD/JPY: The 100 yen defense was within expectations! If support holds, another upward wave will come

This article is from quite a while ago and outlines the USD/JPY scenario,

the low’s support was broadly accurate, but subsequently USD/JPY stalled at 118 yen and now

the resistance line drawn from the 125.85 yen high in 2015 to the 118 yen high in 2016–17 is being watched; on the monthly chart, the line finally broke upward last month, but

this month the price moved back into the cloud, making the year-end price movement highly

significant.

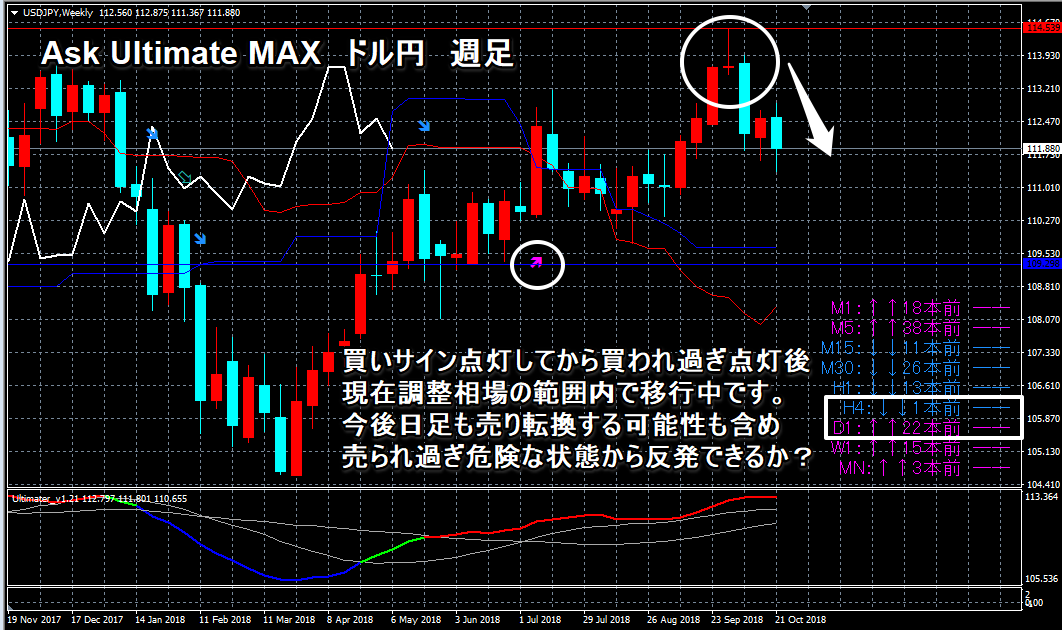

■ Short-term new highs break expected? Be cautious of upper shadows on daily and weekly charts!Please review the USD/JPY chart from the previous post

Currently, this is merely a selling strategy anticipating a correction after being overbought, but with the global stock sell-off

there is a strong possibility USD/JPY could break down, with a temporary dip toward 110 or 108 yen being possible

so from this point, price action becomes crucial.

Of course, market conditions change daily; even if there is a rebound, around 112 yen may become the next resistance

and a potential return to a selling stance should be considered.

Current USD/JPY chart can be enlarged by clicking

Ask_Ultimate_MAX by “Kawaseri Gui” trading signals with exit timing

Detects precursors of a major market reversal and guides you to exit at a precise moment!

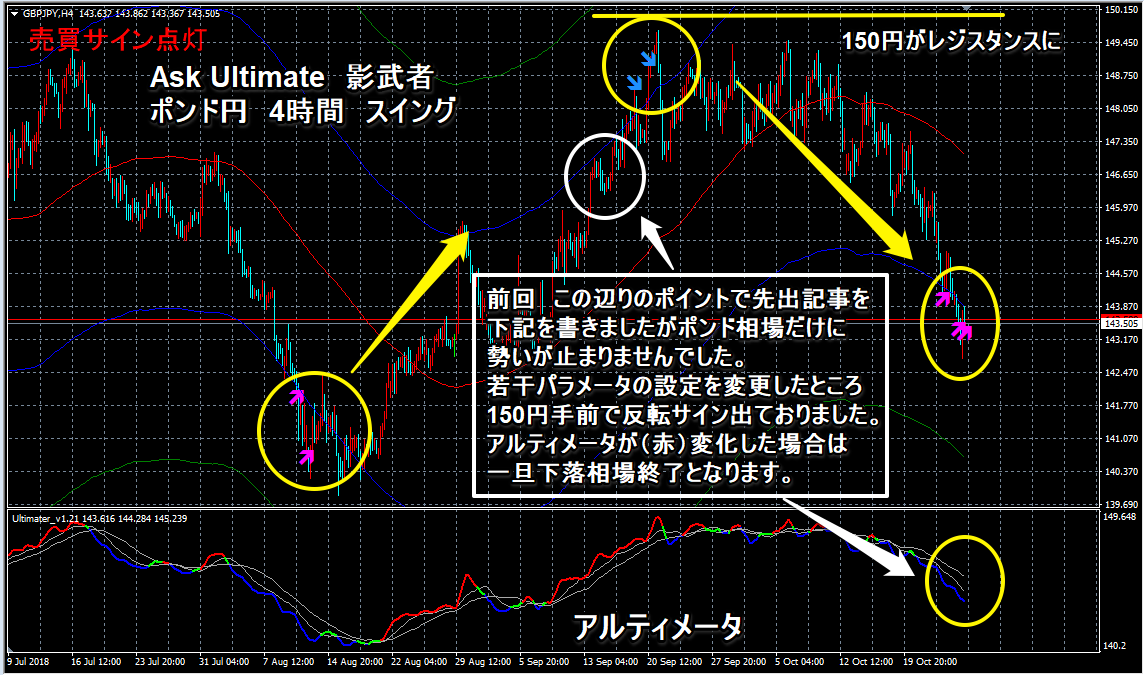

Meanwhile, cross-yen pairs like GBP/JPY and EUR/JPY are updated regularly, so

as you may know, this year’s lows are in sight, and in the near term the price may

be a point to take profits? Also, EUR/JPY has clearly fallen below the weekly cloud

and may become entwined with the monthly cloud; even with lighter positions, you’d still want to keep some exposure

to participate if possible.

However, if it shows a hold near the year’s low, USD/JPY could, as noted above,

relaunch attempts to push higher.

Currently, EUR/JPY chart can be enlarged by clicking

Ask_Ultimate_MAX by “Kawaseri Gui” trading signals with exit timing

Detects precursors of a major market reversal and guides you to exit at a precise moment!

Currently, you can enlarge GBP/JPY by clicking

Ask_Ultimate Shadow by “Kawaseri Gui” trading signals with exit timing

Detects the ultimate strength/weakness market and guides you to exit at the exact timing!

As we approach year-end, there are catalysts discussed in the previous update, but in the near term

will the market reverse after the US midterm elections?

will risk-off accelerate all at once? Also, around Thanksgiving is typically when the main market closes

so this may be a key point; December’s FOMC also draws attention

around 12/20, when forex markets may again be influenced as participants take a winter break, and the year ends

may see continued volatility through year-end into the new year.

Currently, the USD/JPY and US/JP stock prices are forming a double-top pattern,

so there is a high likelihood of testing the year’s lows; whether they rebound from there will influence the market environment.

The basic trading approach is to confirm the longer-term trend and time entries on the shorter-term charts,

holding day trades or swing positions and rotating to take profits.

If signs of a reversal appear on the longer-term chart, avoid forcing positions.

Notable books

■ A widely discussed book among investors: “Japan to Be Sold”

■ A highly anticipated book among investors! Central Bankers: 39 Years of Experience

■ A Talk I Want to Share About Politics

★ Recently popular articles

■ USD yield surges, but USD/JPY did not react…

Learn more about indicators in detail

★Strong in USD/JPY! Battle Zone Trade Giveaway Campaign! Trading techniques guaranteed to boost your win rate

★Identify market reversals! Look long-term, accumulate profits with short-term signals! If you can identify reversals, trading becomes so much easier…