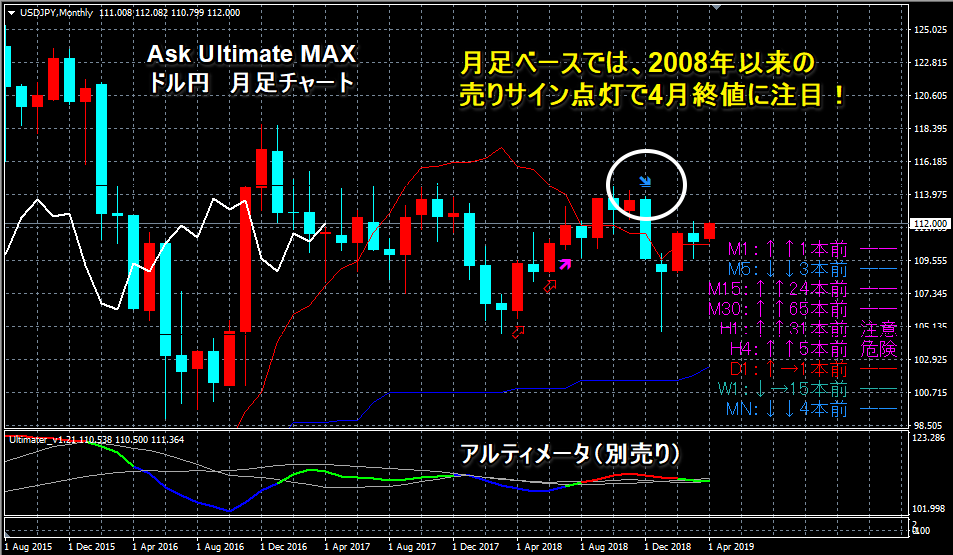

Dollar/yen shaken this week! On a monthly basis, the strong selling signal lights up for the first time since the Lehman Brothers collapse!

"The Negotiations on the US-JJapan Trade Agreement Begin at a Point Noticed"

From the start of the week, negotiations on the US-Japan trade agreement that are likely to weigh on the dollar/yen will take place.

Treasury Secretary Mnuchin said that in trade agreement talks, “the exchange rate will also be on the agenda, and the agreement will include

a currency-devaluation restraint provision,”

and it is extremely unusual to insert provisions regarding currency issues into the legally binding text of a trade agreement, so all eyes are on whether the dollar/yen can continue to rise ignoring this!

Technically, it has risen to an overbought mid-term level,

and although a sharp rise is unlikely, a sharp decline is quite possible,

so from this week through around Golden Week, it would be prudent to anticipate large fluctuations.

★ Signaling the year-end dollar/yen plunge in the market!

Dollar/Yen rises to the 111 level!

— Kawaseri Gui (@kawaserigui)February 14, 2019

But, in the overheated state, it is very dangerous!

The indicator that signaled selling in the year-end and New Year market...#Indicator #DollarYen pic.twitter.com/4KTIkRlULr

Ask Ultimate MAX, a long-term strong indicator, shows a sell signal on the monthly chart

for the first time since the Lehman shock!

As an indicator that warned early of the 2015 pound-yen drop from the 190 range,

it is the indicator to watch for the dollar/yen in April and May!

■ 2015 pound-yen chart is here

■ 2015 euro-dollar historical low range rebound was spot on!

There is also a peak rise signal!