Thoughts on Logic Using Bollinger Bands ① (Series No.001)

We will examine trading logic using Bollinger Bands.

One representative method among Bollinger Band-based logics is a technique that chases the price action after a rapid expansion from a state of at least partial calm, and here we will formalize this in language.

Each of these logics is a common approach in discretionary trading, but if we formalize them and automate them as an EA, you wouldn’t need to trade manually using this method.

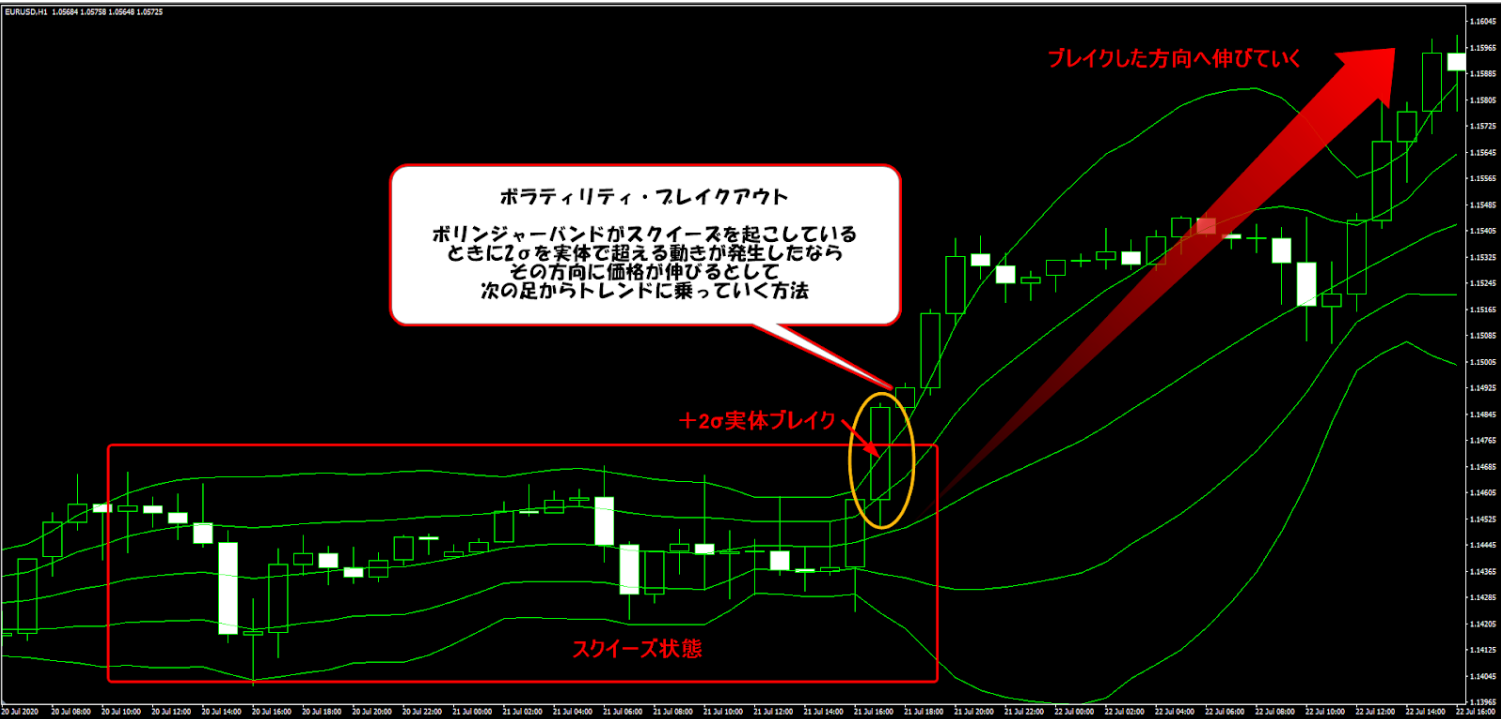

“Volatility Breakout” aiming for expansion after a squeeze

Volatility breakout is a trend-following trading method,aiming for the initial move of expansion where the Bollinger Bands squeeze and the price remains in a calm range before breaking out.

It targets sudden price movements that exceed recent volatility, and when the price breaks out of the range and the Bollinger Bands expand,we follow in the direction of the breakout with a trend-following approach.

The idea is to follow the momentum when the movement goes beyond the ±2σ of the squeezed Bollinger Bands.

The exit point is when the price returns to the middle line, or when the expansion of the Bollinger Bands subsides.

To formalize this for automation, first we need to determine whether the Bollinger Bands are currently squeezed.

This involves obtaining the current width between the bands and comparing it to the prices depicted by each band.

Based on that, set “entry ready if width is below a certain threshold,” then simply wait for the expansion to occur.

The expansion can be detected by comparing how much wider the bands have become compared to the previous period, by obtaining the prices.

And once these two conditions are met, if the closing price breaks out beyond the ±2σ in the direction of the Bollinger Band tilt, enter the trade.

For exit, you can freely decide whether to exit when the price reaches the middle line or when the closing price breaks out again.

× ![]()