Practical Guide to the Nanpin Martingale Method

Hello, this is Capital Cat! To succeed in the world of investing, you need smart strategies and their practical application. What we will introduce this time is the "Numpin-Martingale method," which aims for profits while managing risk. On this page, we will explain the method in detail and deliver a practical guide you can actually use.

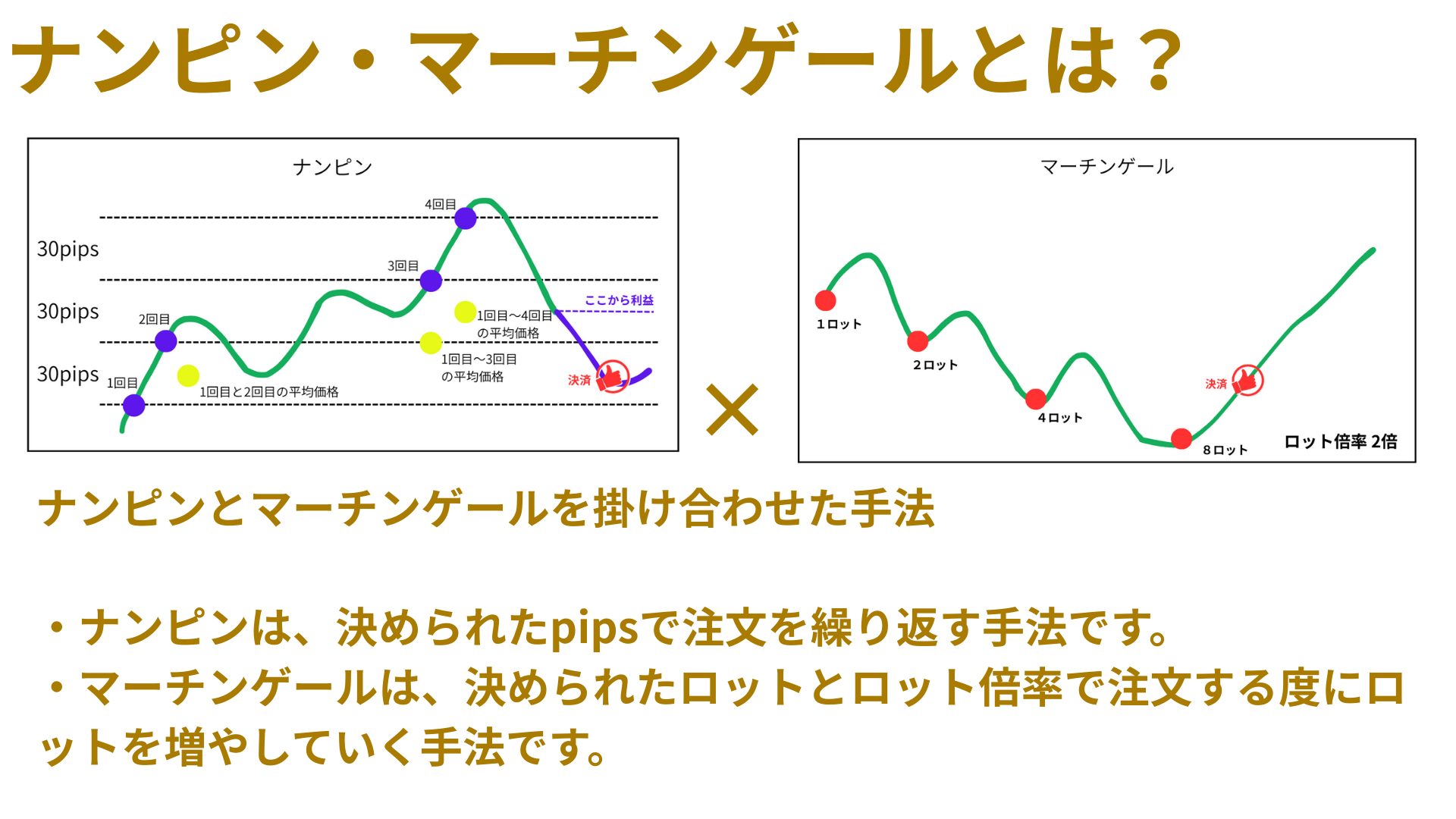

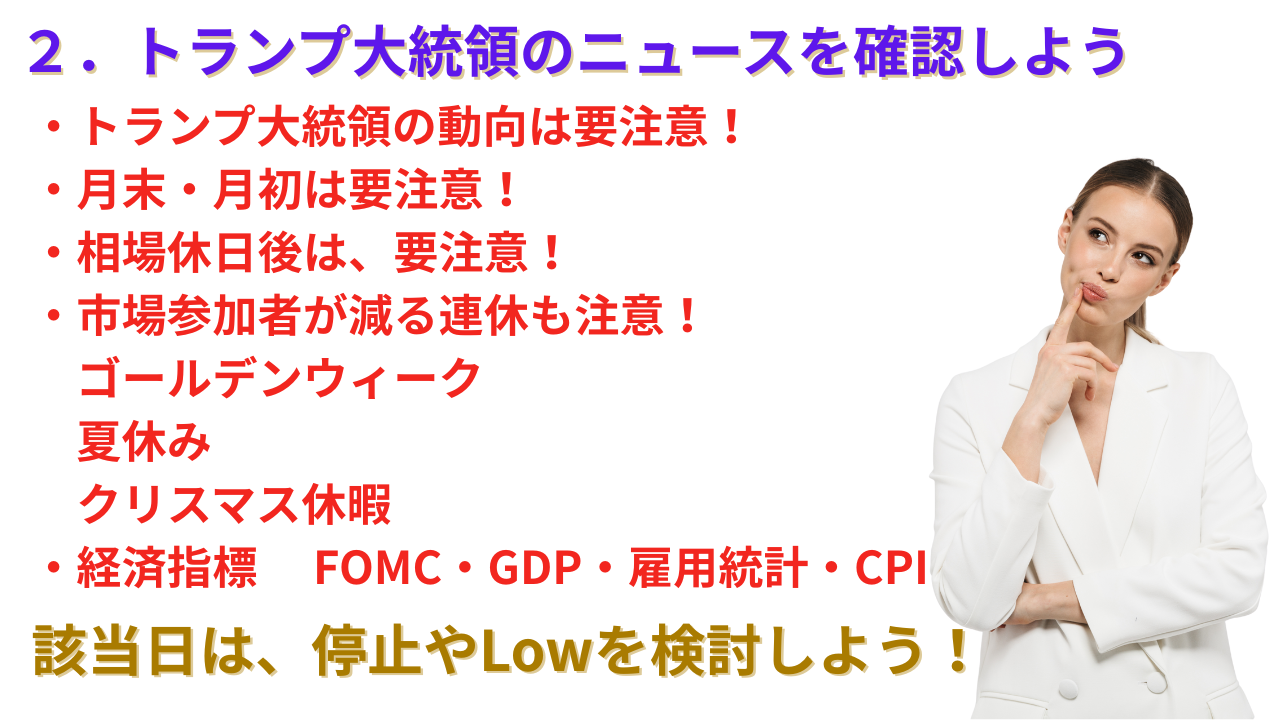

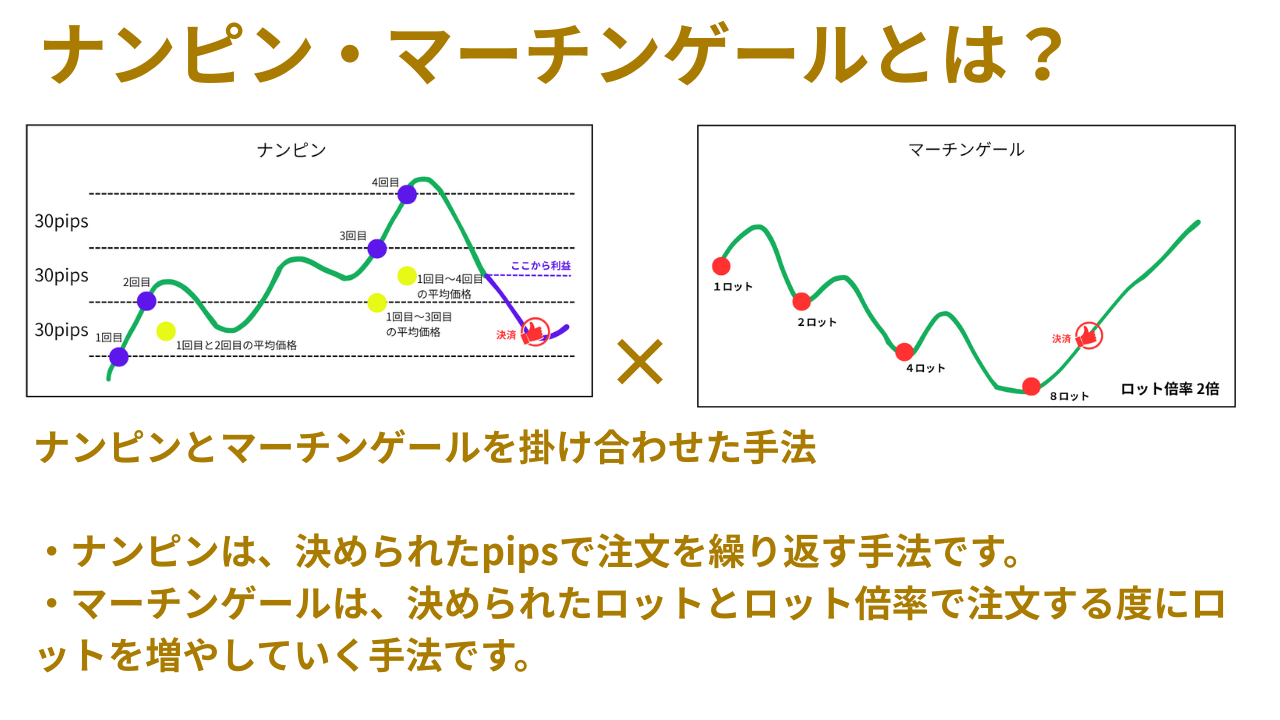

1. What is the Numpin-Martingale Method?

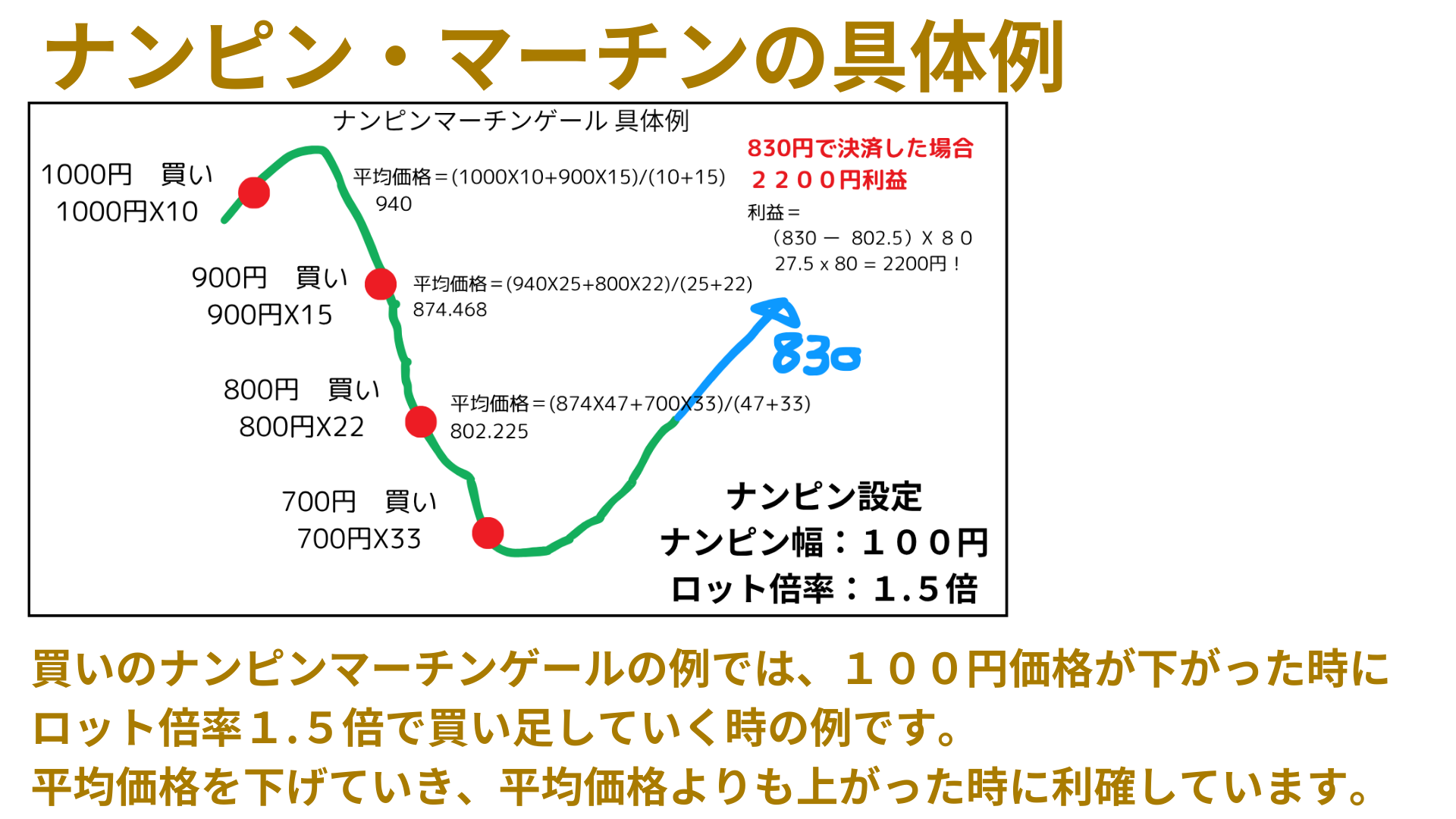

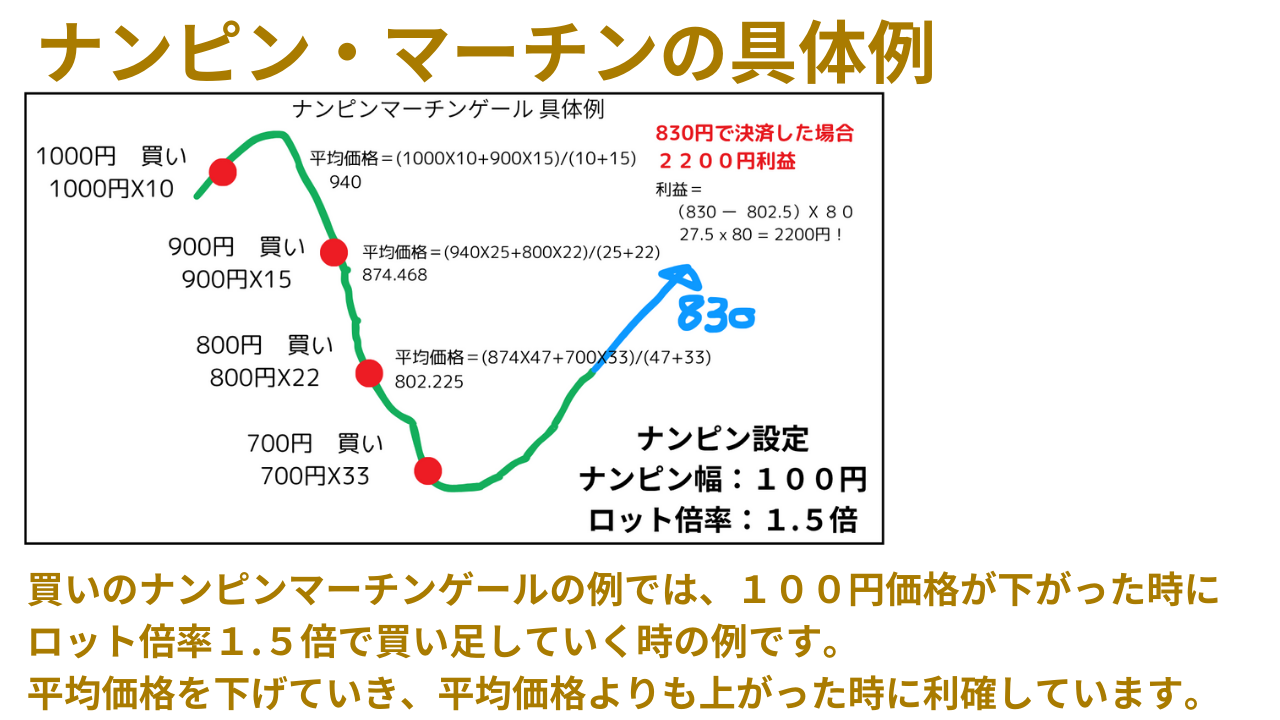

The Numpin-Martingale method is a technique in trading that adds to your position when prices fall, lowering the average acquisition cost to maximize profits when a rebound occurs. This method has the following characteristics:

- Numpin:Adding to a position during a decline

- Martingale:Doubling the investment amount each time the price falls

This method can overcome adversity and generate profits if risk is properly managed.

2. Benefits of the Method

- Risk management:Distribute funds in a planned manner to minimize risk.

- Profit maximization:Increases opportunities to gain substantial profits when a rebound occurs.

- Flexible strategy:Can adjust the strategy according to market movements.

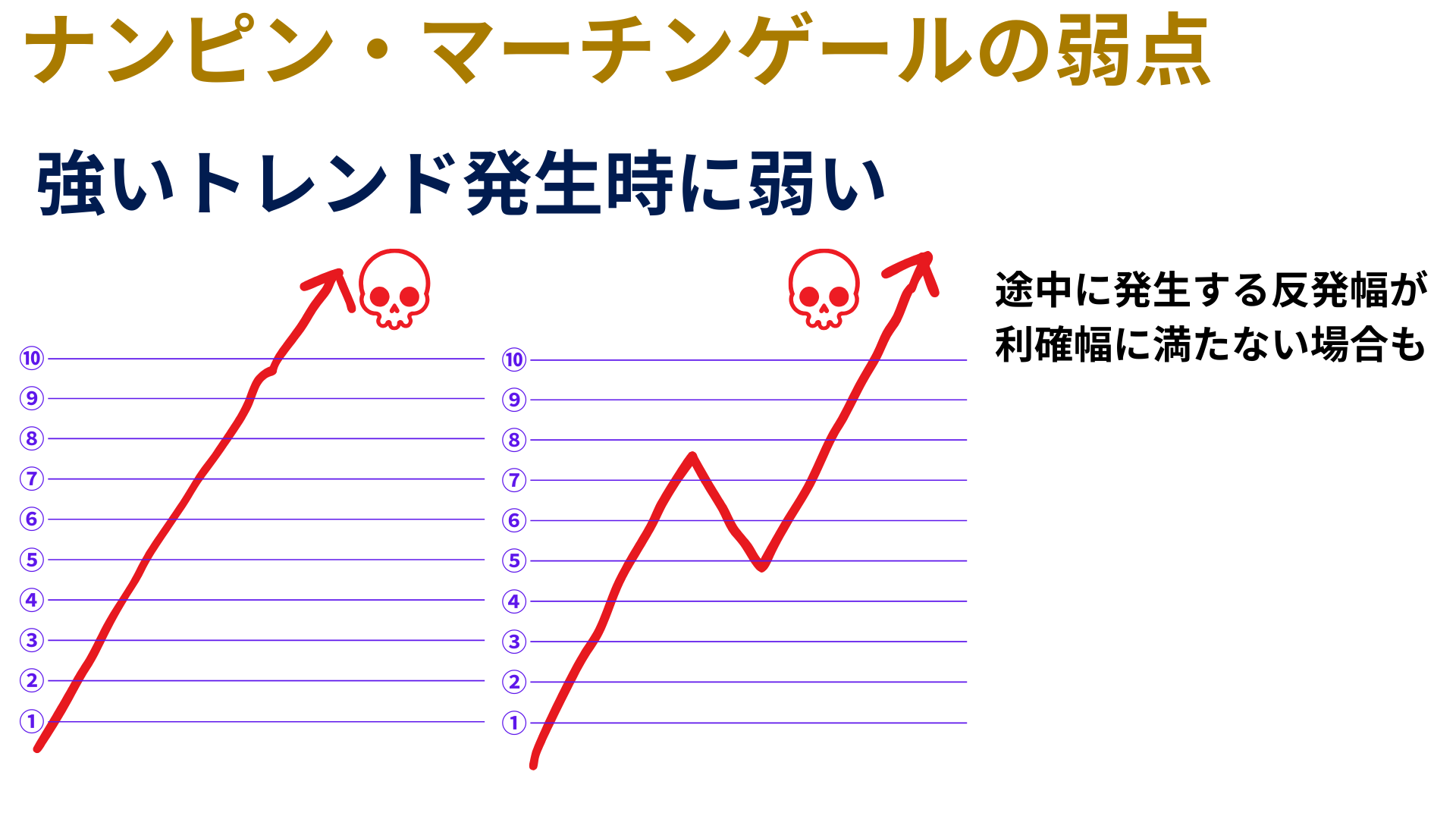

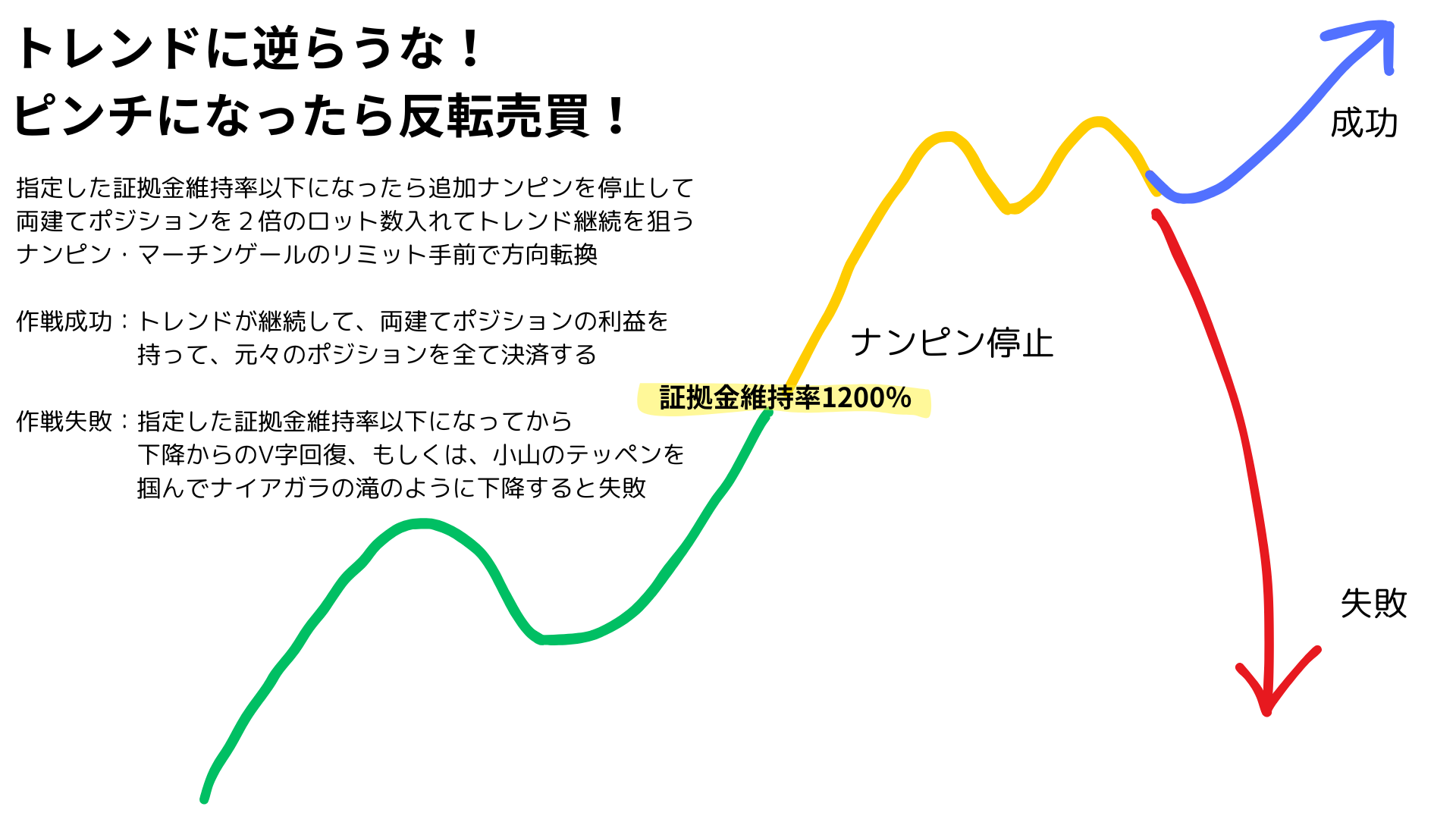

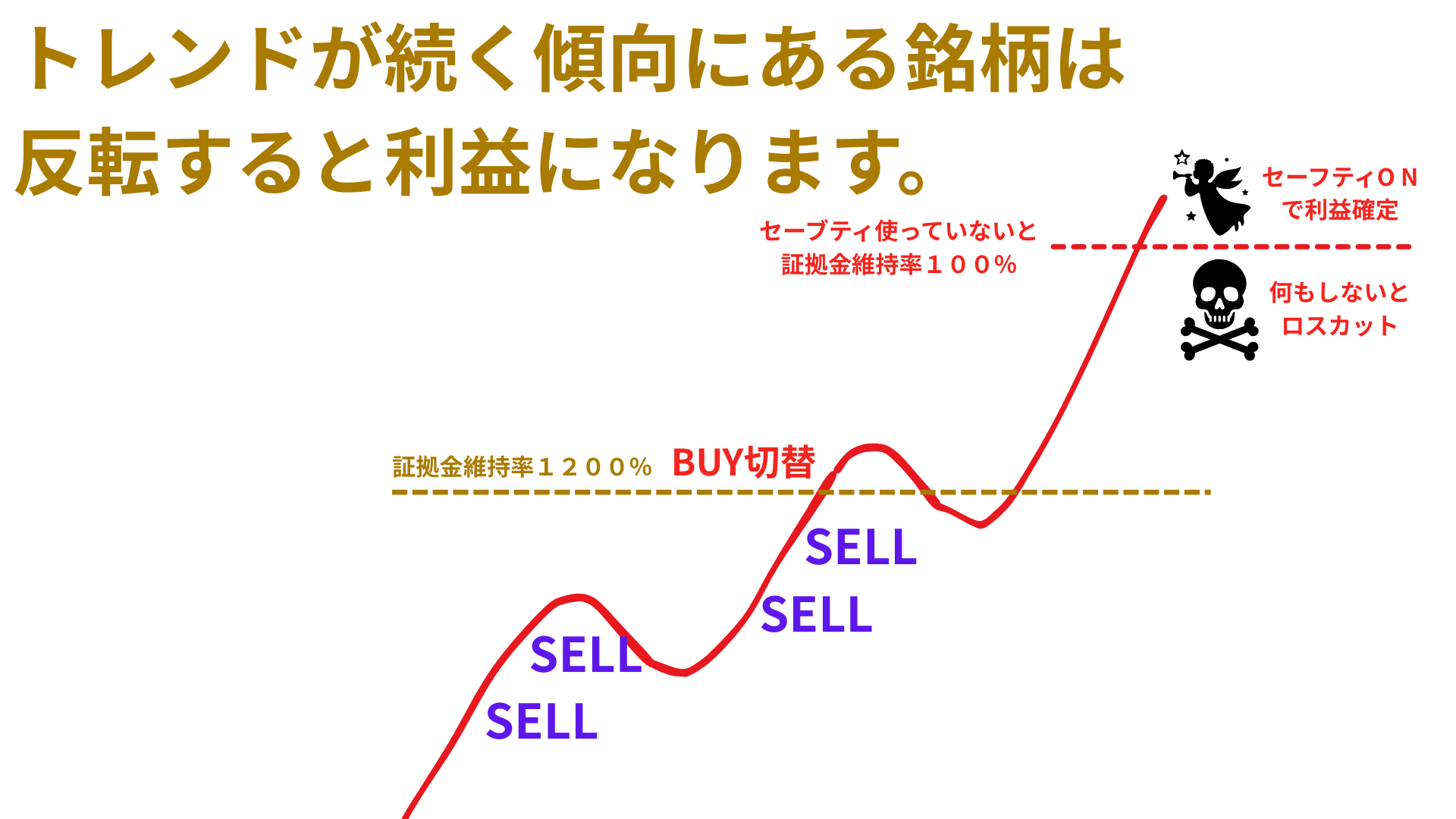

3. Disadvantages of the Method

- Increased risk:If prices continue to fall over a long period, losses can widen.

- Importance of capital management:If funds run out, the strategy may not function, so careful management is required.

4. How to Practice the Numpin-Martingale Method

- Decide the initial investment amount:Set the initial investment amount according to your risk tolerance.

- Buy more on declines:Each time the price declines, double the previous investment amount.

- Set a target price:Predefine the price to sell when it rebounds and realize profits systematically.

- Thorough risk management:Always manage funds to prepare for unexpected market fluctuations.

5. Key Points for Success

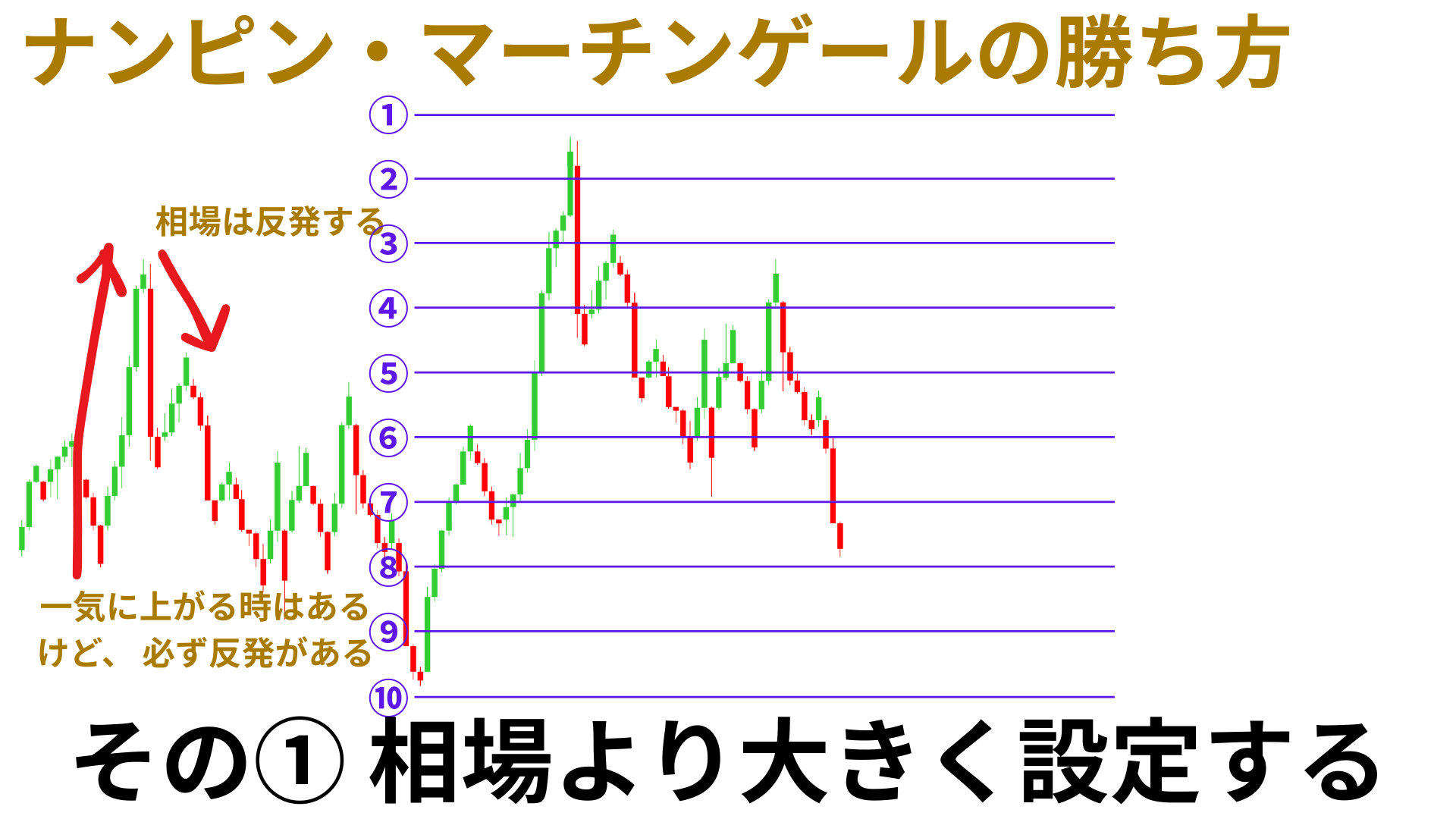

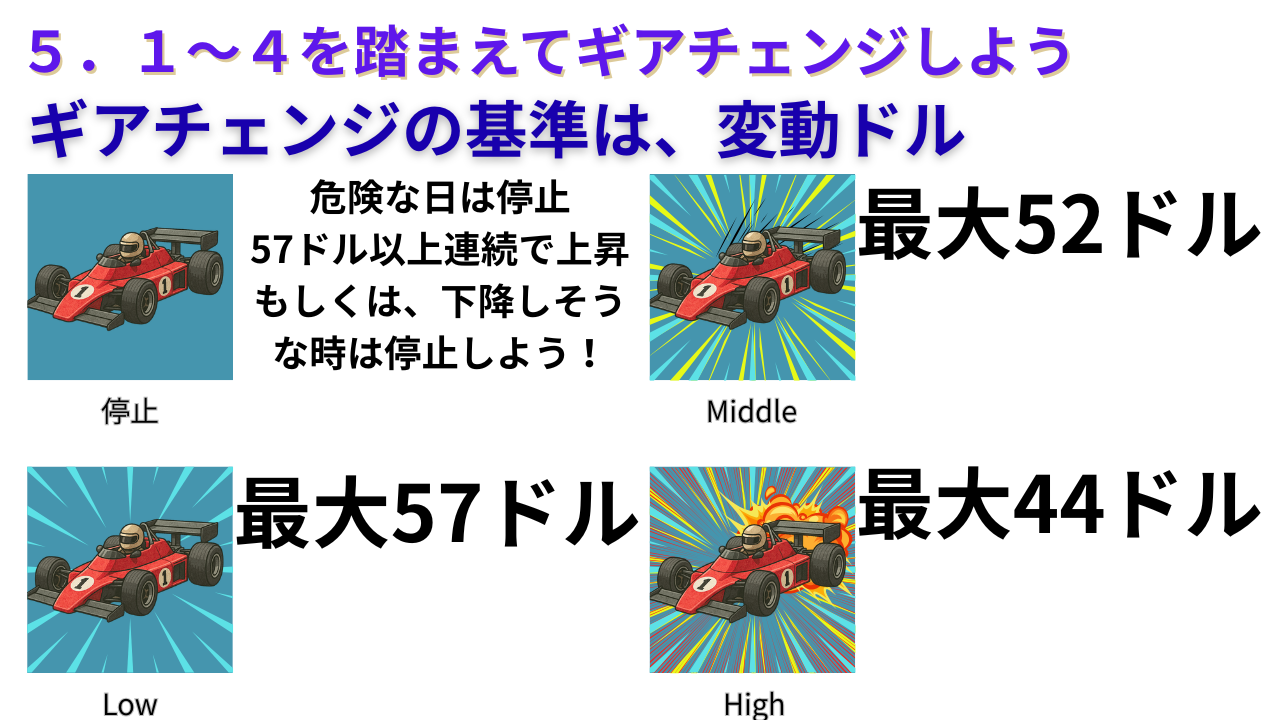

- Have ample funds:Ensure financial room to withstand large price swings. Setting lots within a feasible range is important.

- Set lots that do not trigger a stop-out:Plan to maintain positions without being stopped out to ride out market fluctuations.

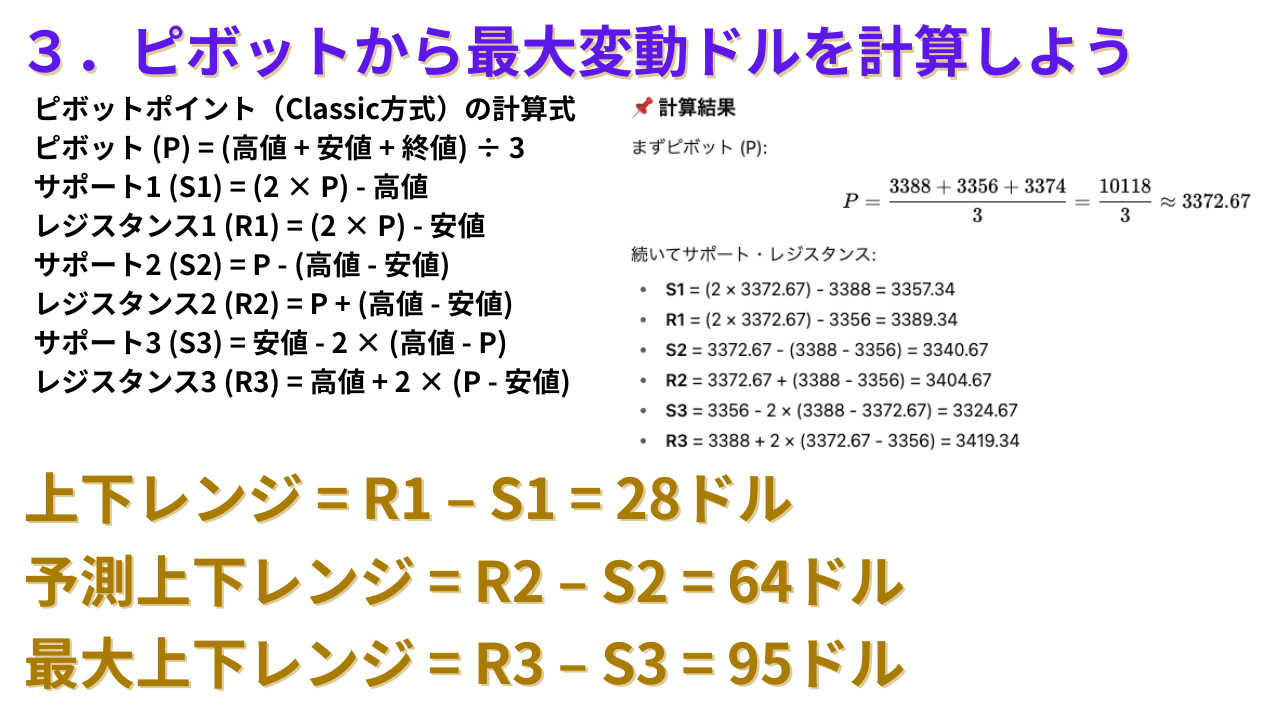

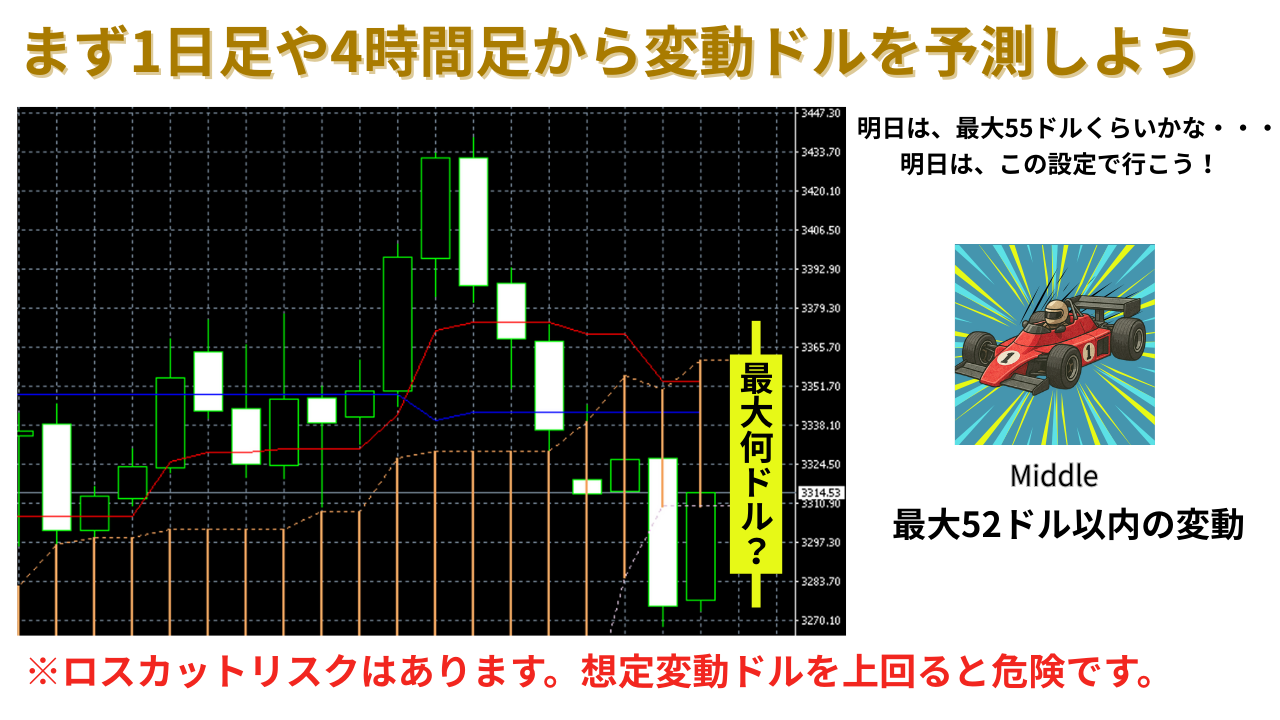

- Understand past maximum fluctuations:Analyze historical market data to grasp the maximum fluctuations. Based on this, ensure sufficient funds and assess risk.

- What to do if fluctuations exceed past maximums:To avoid stop-outs even if fluctuations exceed past maxima, set even more generous funds. Anticipate the worst-case scenario and prepare funds to respond.

Message from Capital Cat

“Aim to set a start lot that does not incur a stop-out even if the fluctuation is 1.5 times the past maximum!”

Not just a time-saver! Always assume fluctuations can exceed past maximums!

Numpin-Martingale can win, but you must also consider that potential losses can be large.

Knowledge and experience are essential for investment success. I hope this “Practical Guide to the Numpin-Martingale Method” enriches your investment life and helps pave the way to success. Please use this guide and experience the enjoyment of investing with me!

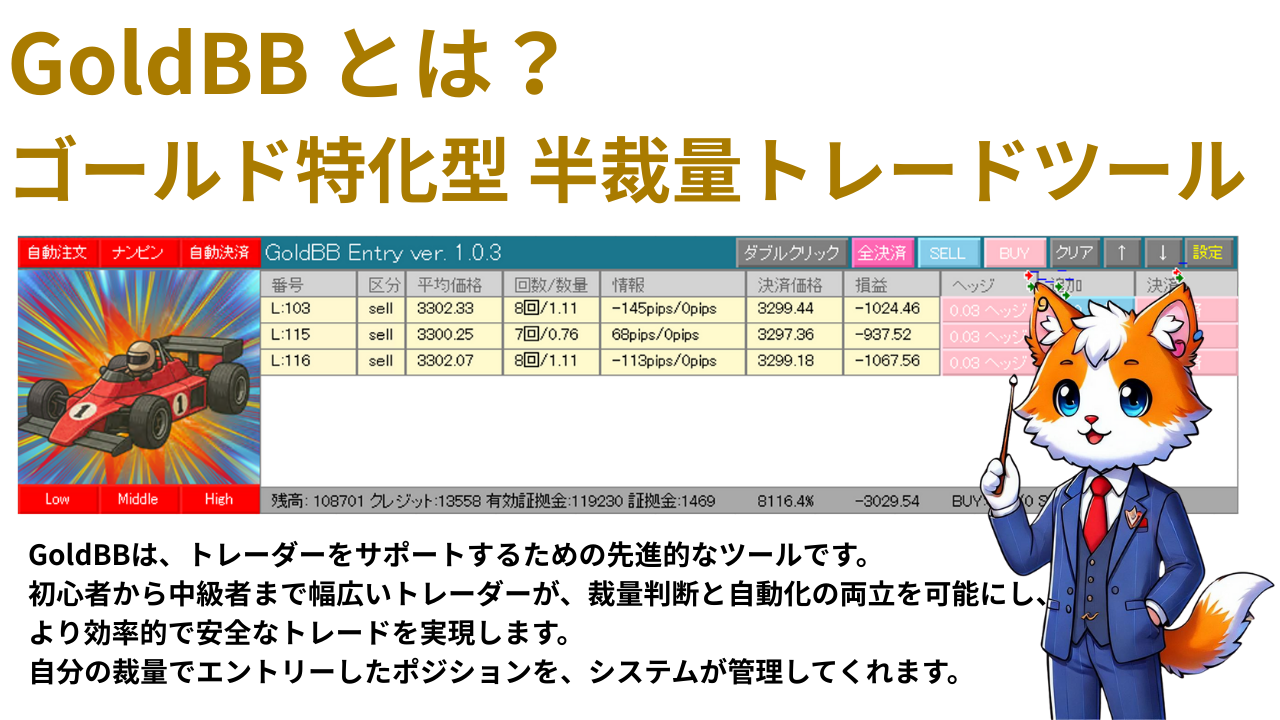

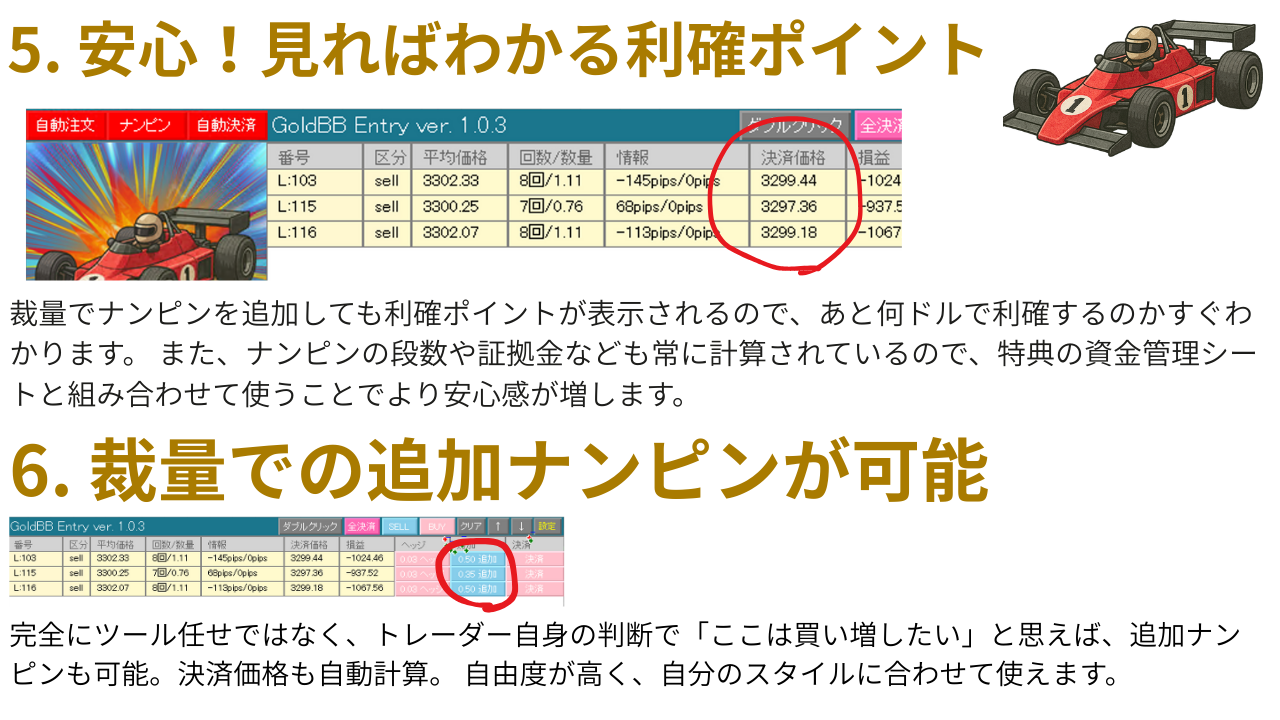

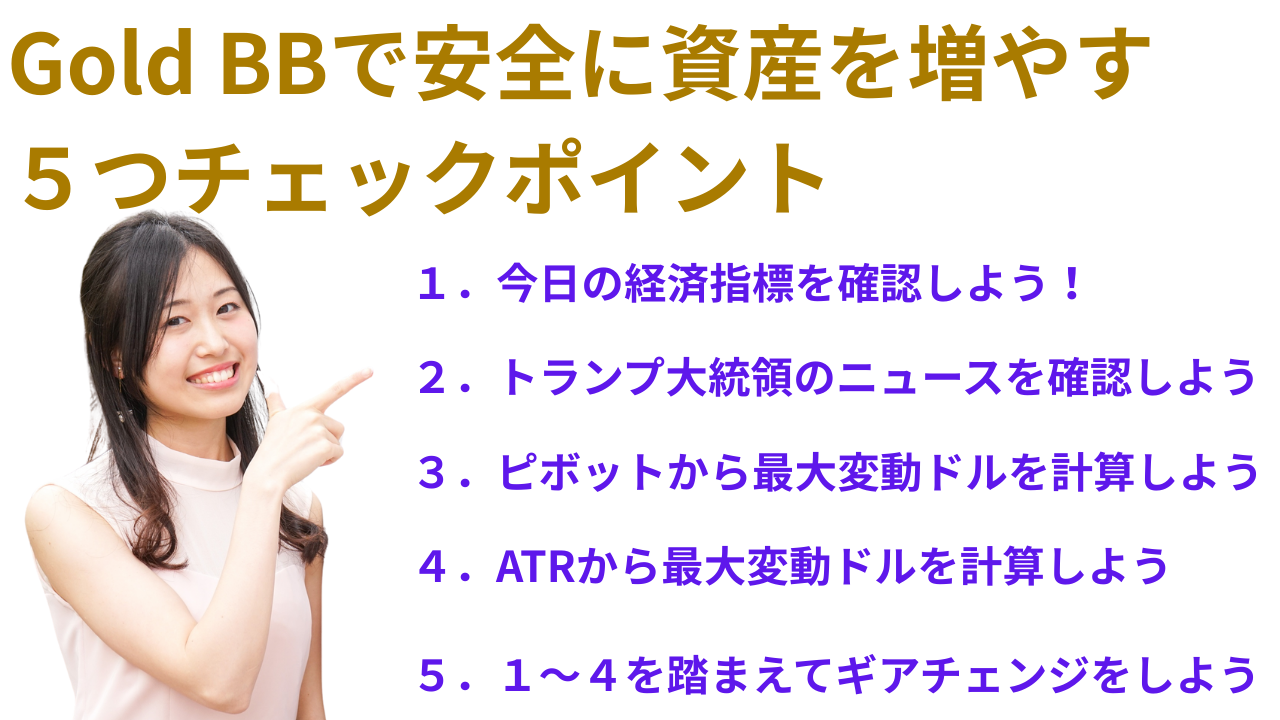

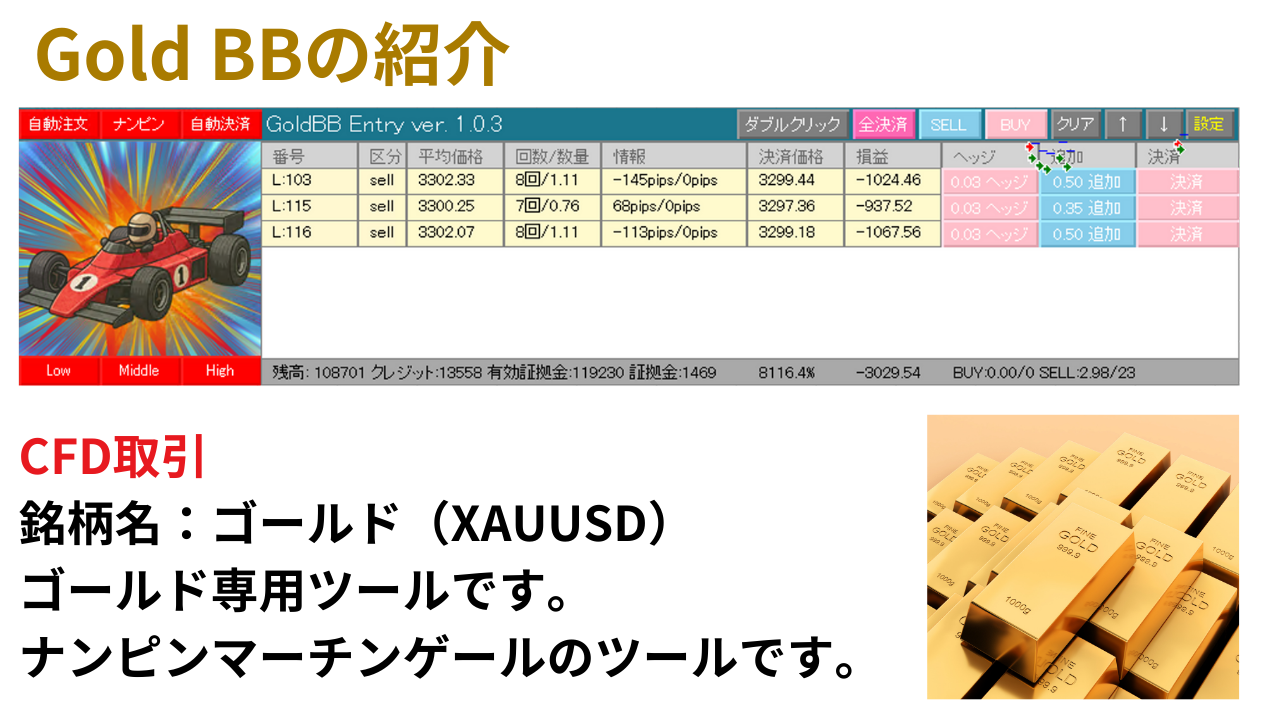

Recommended tools for those who want to start Numpin-Martingale

Monthly fee 1,800 yen, first month free!

First month free. You can try it for 30 days!!

https://www.gogojungle.co.jp/tools/indicators/66388?via=users

Credit screening applies, but it is free.

If you cancel within 30 days, there is no charge!

The profits you earn during the trial are yours to keep.

Please give it a try.

Gold BB Entry :https://www.gogojungle.co.jp/tools/indicators/66388?via=users

Gold BB Micro :https://www.gogojungle.co.jp/tools/indicators/67766

Gold BB Mini :https://www.gogojungle.co.jp/tools/indicators/67898

Numpin-Martingale Simulation Sheet (800 yen) on sale now!

From here, articles are paid, and I will give you the password to download the “Numpin-Martingale Capital Simulation.”