For those using GOLD's averaging down and martingale EA, your EA’s averaging-down design! Is it safe to use?

Checkpoints for openness chat safety

1. Trustworthiness of the administrator

- Administrator background check: Check the backgrounds and trustworthiness of the chat group's administrator and moderators. It’s important to see if they have extensive investment experience and a proven track record.

- Transparency: If the administrator公開 their trading records and strategies, assess that transparency. Determine if they provide reliable information.

2. Members’ activity

- Quality of members: Check the quality of other members in the chat. If many actively participate and share valuable information, reliability is higher.

- Community atmosphere: Look for an open and cooperative vibe. Ensure negative comments or aggressive behavior are not prohibited in a way that hides unfavorable information (if prohibited, it may prevent negative information like bankruptcy from surfacing).

3. Thorough risk management

- Risk warnings: Confirm that there are clear warnings about the risks of Nempin-Martin. Emphasizing risk management is crucial.

- Risk management guidelines: Check for clear risk management guidelines. If there is no mention of Nempin width or lot multipliers, or if settings are fixed without justification, that’s a sign of sloppy open chat.

4. Beware of “compassionate stop-out” and “plants (fakes)”

- What is compassionate stop-out: Members who have been stopped out may claim they also stopped out when they appeared, or pretend they were stopped out due to an economic indicator, even if they weren’t stopped out. Be wary.

- Sakura (fake testimonials): There are who report profits from demo accounts even though real accounts aren’t showing profits. Be careful.

5. Support and feedback

- Support structure: Ensure there is solid support for questions and issues. Check whether administrators or moderators respond promptly.

- Accepting feedback: See whether member feedback is actively accepted and used to improve. Assess the community’s commitment to growth.

- Pay attention to how negative information is handled.

If any of the following apply, you’re out immediately!

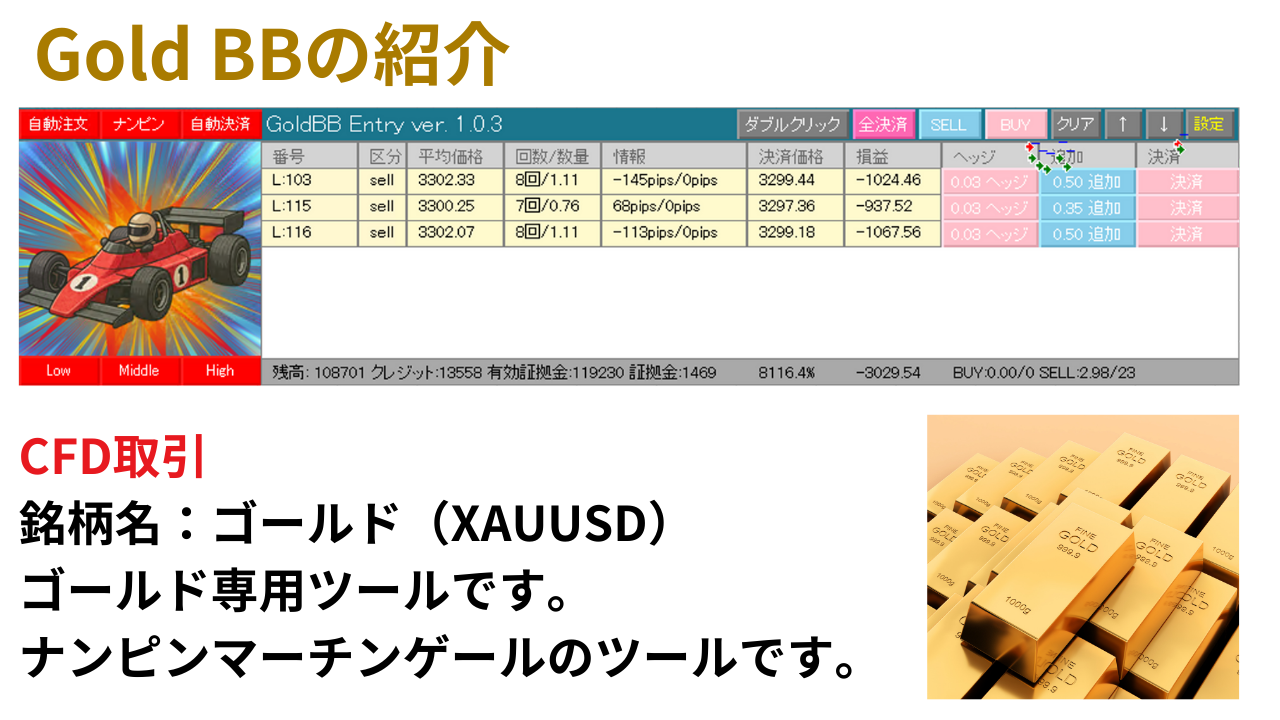

・Nempin-Martin design not disclosed or cannot be set(Nempin lot, Nempin multiplier, take profit pips)

This is like handing your money to others; if it’s a malicious group colluding with a securities company, you’ll go bankrupt.

・Recommended settings aren’t actually recommended

If it recommends 100,000 yen and 0.01 lot, but if the market moves unfavorably by 5 dollars, you could get stopped out!

This is a designed value; if calculated properly you’ll see it, but the calculation is tedious and hard for beginners to grasp.

・Negative statements lead to immediate expulsion

Why? Because allowing negative statements would be inconvenient for the operators. So they don’t care about the users.

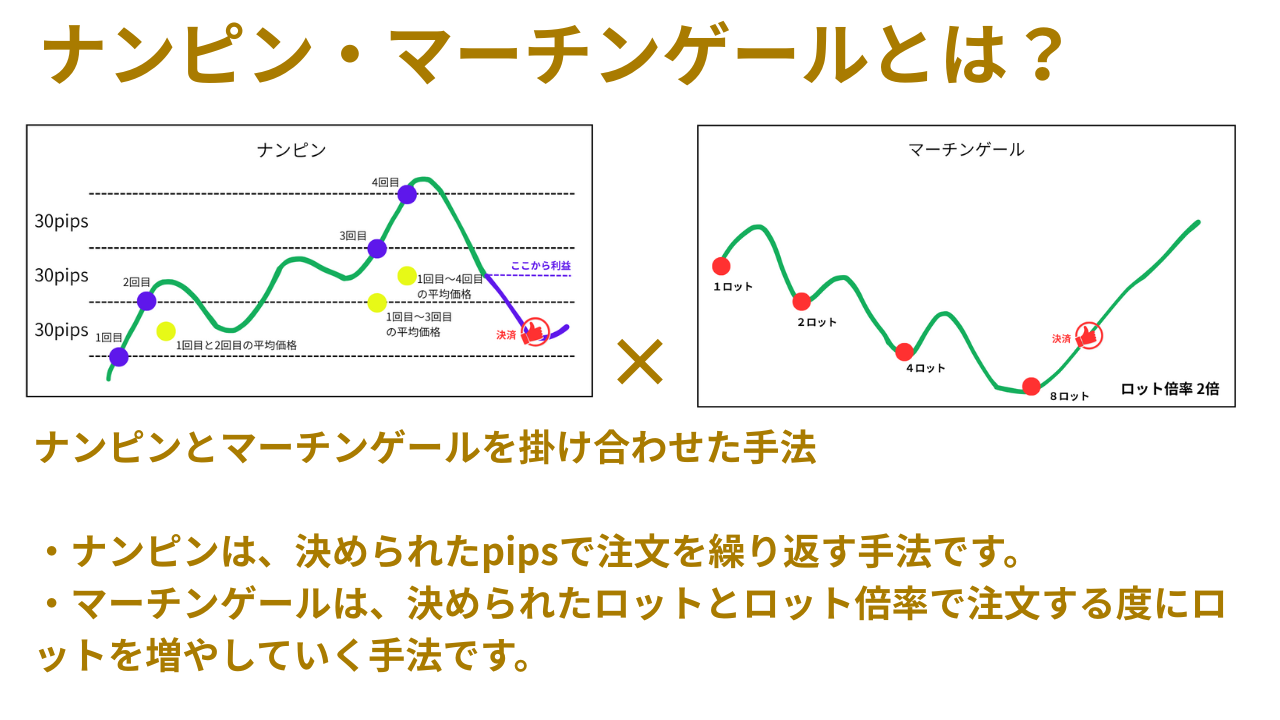

Checkpoints for using the Nempin-Martin system

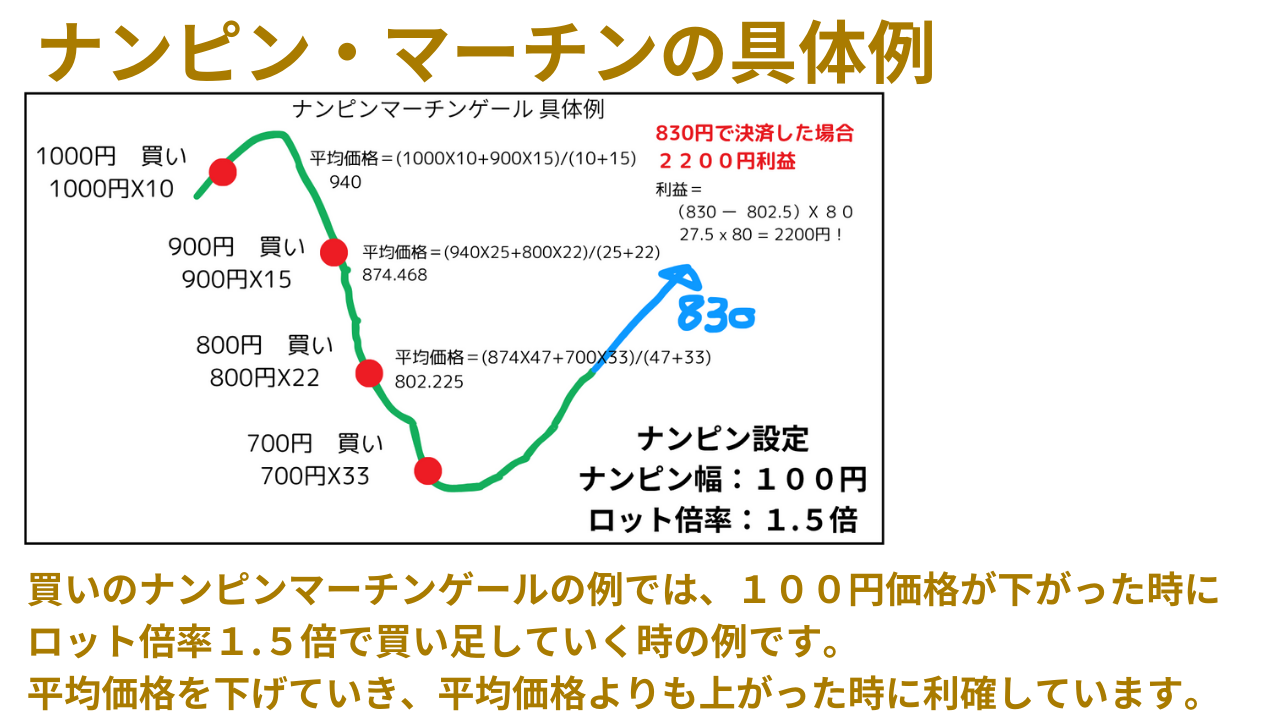

1. Funds management

- Confirm initial funds: It’s important to prepare sufficient initial funds. Nempin and Martingale require adding positions, which easily leads to running out of funds.

- Set risk tolerance: Clearly define your risk tolerance and set a maximum loss. This helps avoid unexpected large losses.

2. Position size and leverage

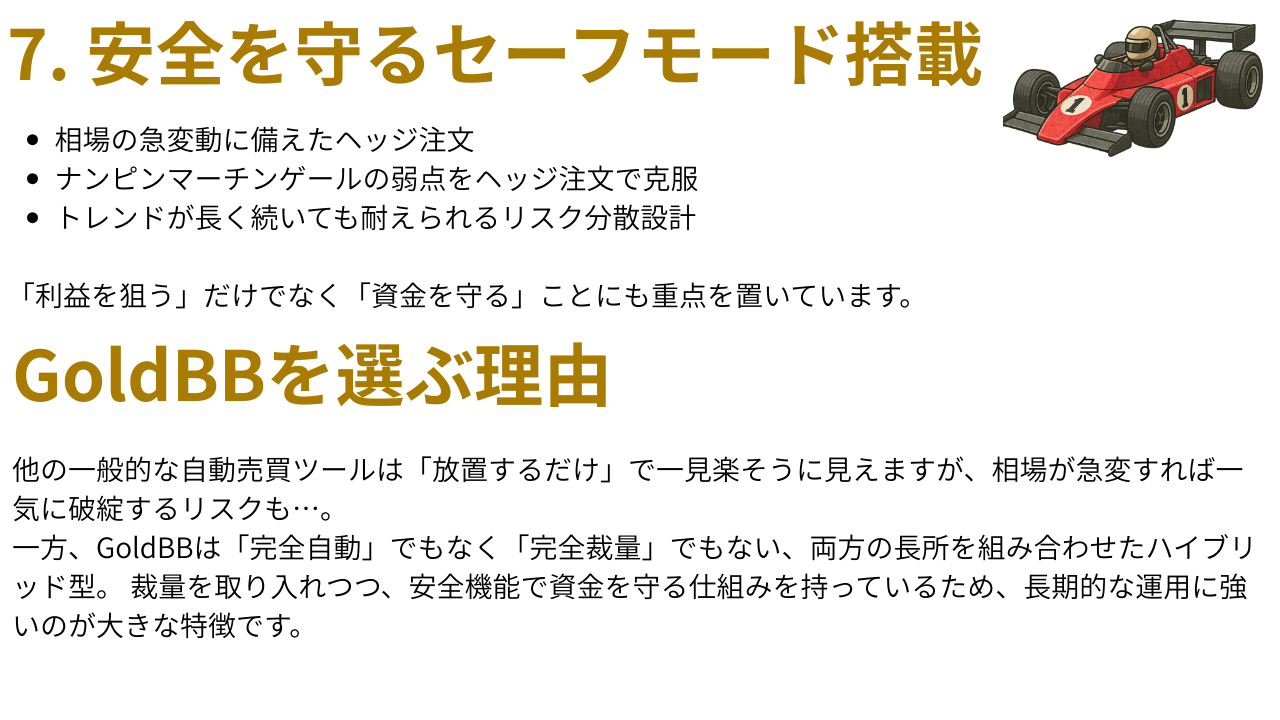

- Appropriate position size: Start with a small initial position to allow room for multiple Nempin and Martingale positions.

- Use of leverage: Use leverage cautiously. High leverage increases risk, so choose an appropriate level.

3. Setting Nempin levels

- Decide Nempin levels: Clearly decide at what price movements you add positions. Usually set at fixed pips intervals.

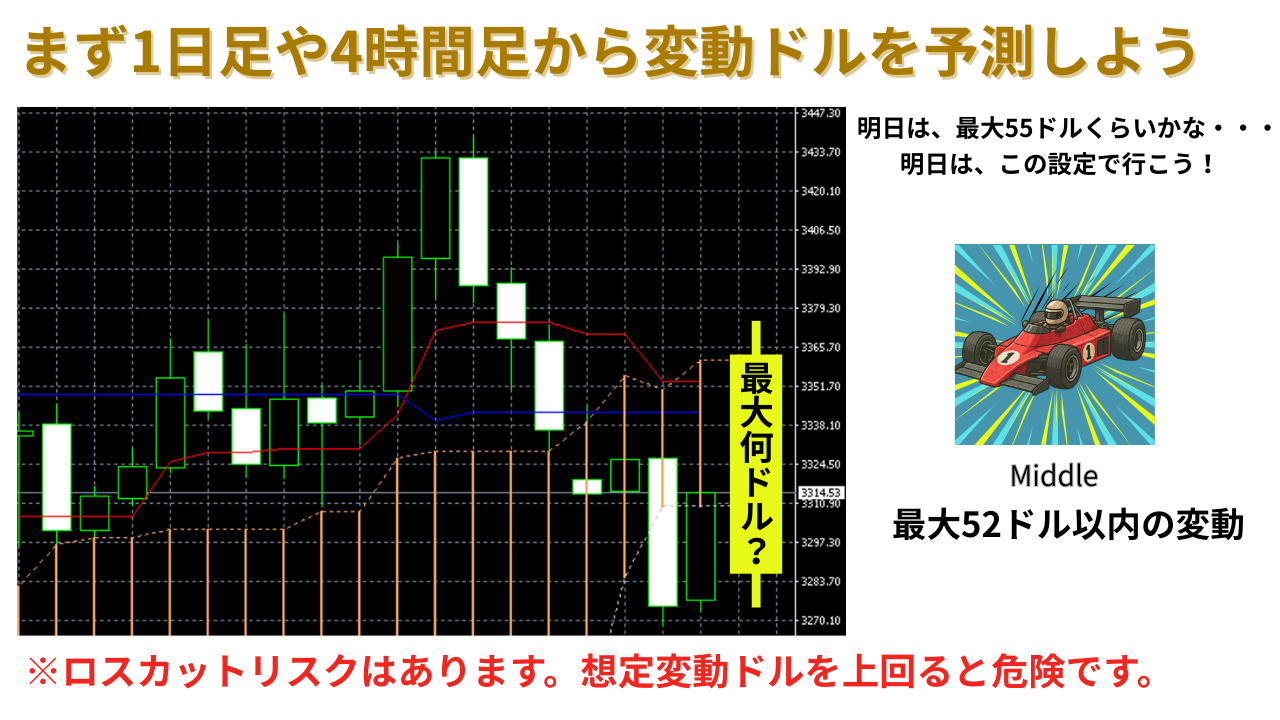

- Market volatility: Adjust Nempin levels according to market volatility. In high volatility, widening Nempin levels is effective.

4. Martingale multiplier

- Set multiplier carefully: Carefully set the Martingale multiplier. Too high a multiplier increases risk, so choose an appropriate rate.

- Risk of consecutive losses: Consider the risk of consecutive losses and set the multiplier accordingly. Avoid reckless increases.

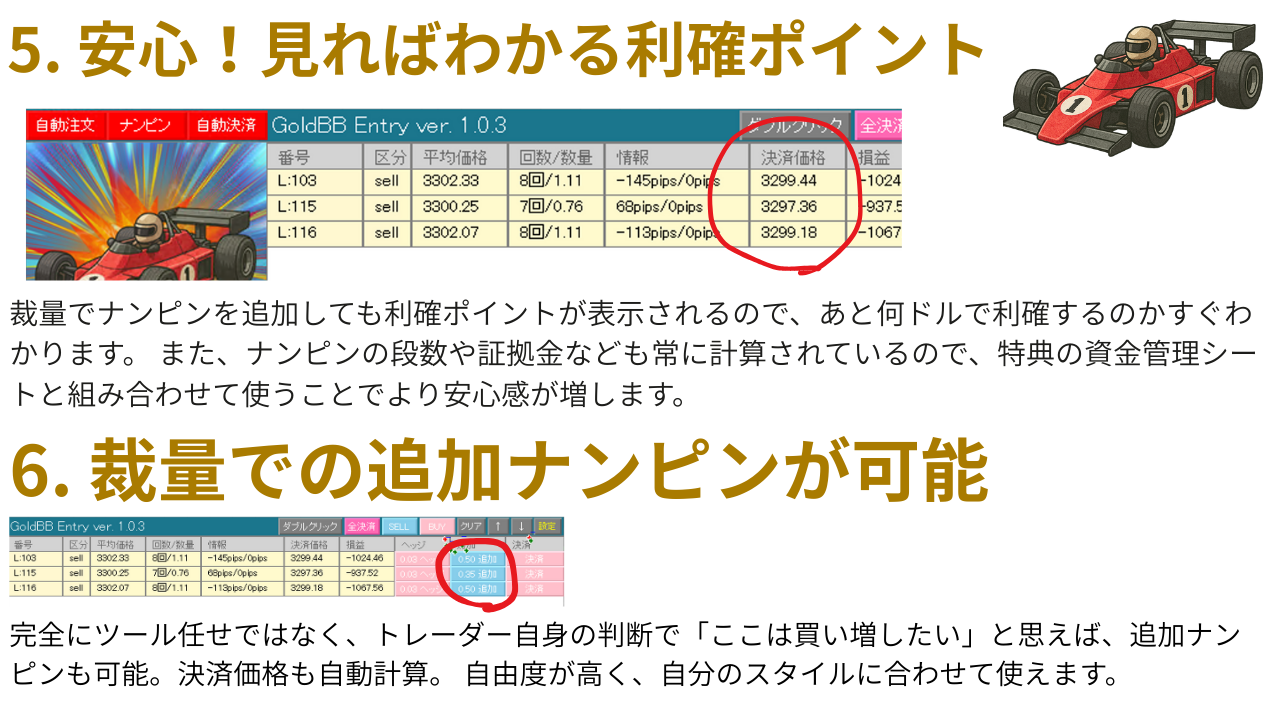

5. Stop loss and take profit settings

- Set stop loss: Apply stop loss to each position to cap losses.

- Set take profit: Also set take profit points to secure certain profits and manage risk.

6. Real-time monitoring and automation

- Real-time monitoring: Real-time monitoring is important when using Nempin-Martin systems. Be ready for sudden market shifts.

- Use automated trading systems: Use automated trading systems to implement Nempin-Martin strategy efficiently. Automation helps trading without emotional influence.

7. Backtesting and forward testing

- Backtesting: Before actually using Nempin-Martin, perform backtesting with historical data to verify strategy effectiveness.

- Forward testing: Conduct forward testing in real-time market conditions to confirm performance. Real trading environment testing is important.

Summary

The Nempin-Martin system can be an effective strategy when used properly, but it carries high risk. By following the checkpoint guidelines above and enforcing risk management, you can safely utilize the Nempin-Martin strategy. Before joining an open chat that promotes the Nempin-Martin system, it’s essential to thoroughly review the chat’s checkpoints.

Use these checkpoints as reference for your own trading!

Monthly fee 1,800 yen; first month free!

First month is free. A 30-day trial is available!!

https://www.gogojungle.co.jp/tools/indicators/66388?via=users

Credit screening is required, but it’s free.

If you cancel within 30 days, there is no charge!

The profits you experienced during the trial are yours.

Please give it a try.