The Way of Investment (Part 123)

The Path to Investment Success (Part123)

Special Edition on Foreign Exchange Intervention

1. BOJ FX Interventions

When the USD/JPY rate rose above 160 and yen weakness accelerated,160yenwas the trigger,29日

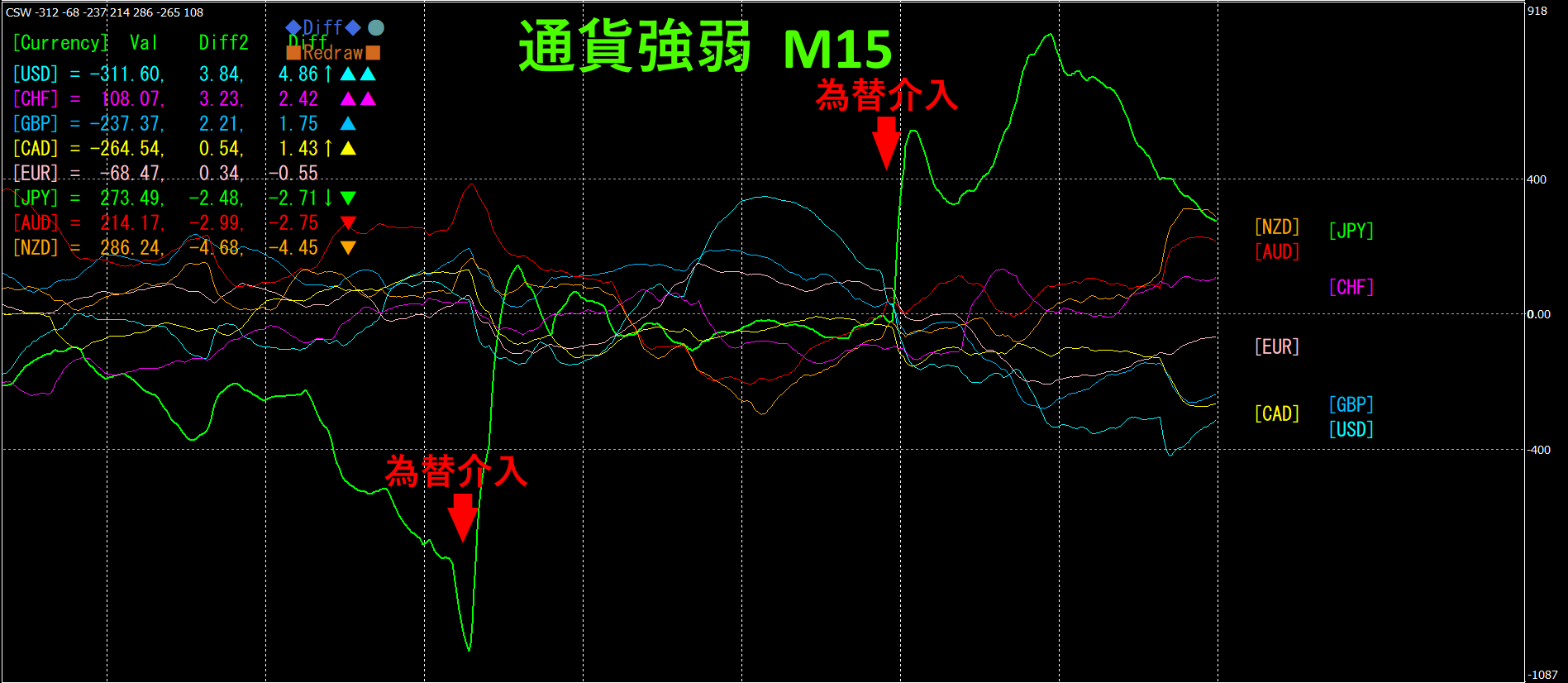

The figure below is a15-minute currency strength chart.

On the currency strength chart,JPYwas the only one that fell unilaterally.1stintervention causedJPYstrength to return to the same level as other currencies. Moreover,2ndintervention leftJPYin a stronger position than other currencies. Since then, the chart for JPY has gradually declined and seems to be returning to the same level as other currencies.

Looking at the JPY chart, three rising peaks appear, indicating interventions were conducted.

The scale of yen-buying intervention was1st round estimated at about5.5 trillion yen, so this intervention is estimated to be about10trillion yen in scale.

In the previous instance (September to October2022,10month), a total of9.2 trillion yen of yen-buying intervention was conducted, and this time is believed to be similar in scale.

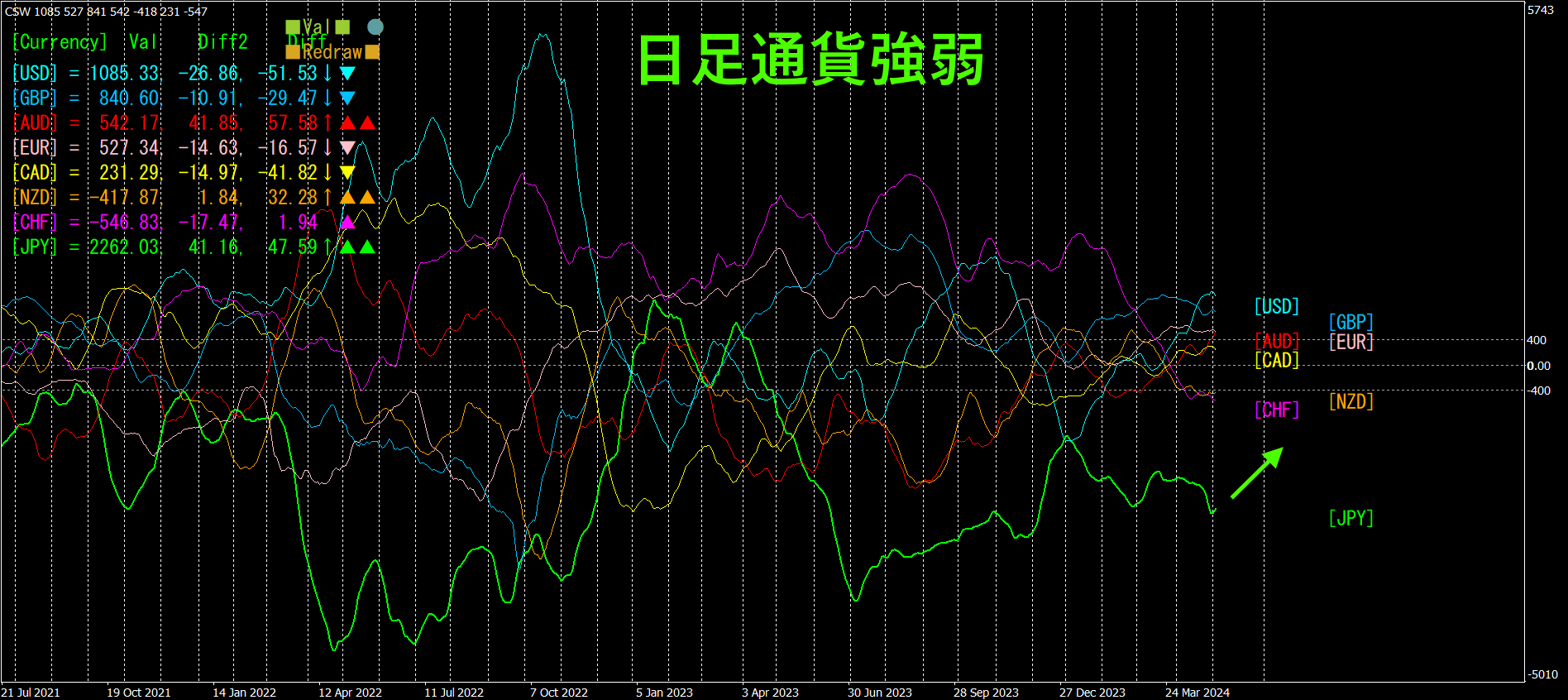

2. Daily Chart: Currency Strength

Looking at the daily currency strength chart,JPYhas a rising vector, but compared with other currencies, it remains at a relatively low level.10 trillion yen worth of intervention would be far from making the yen strong in earnest.

3.

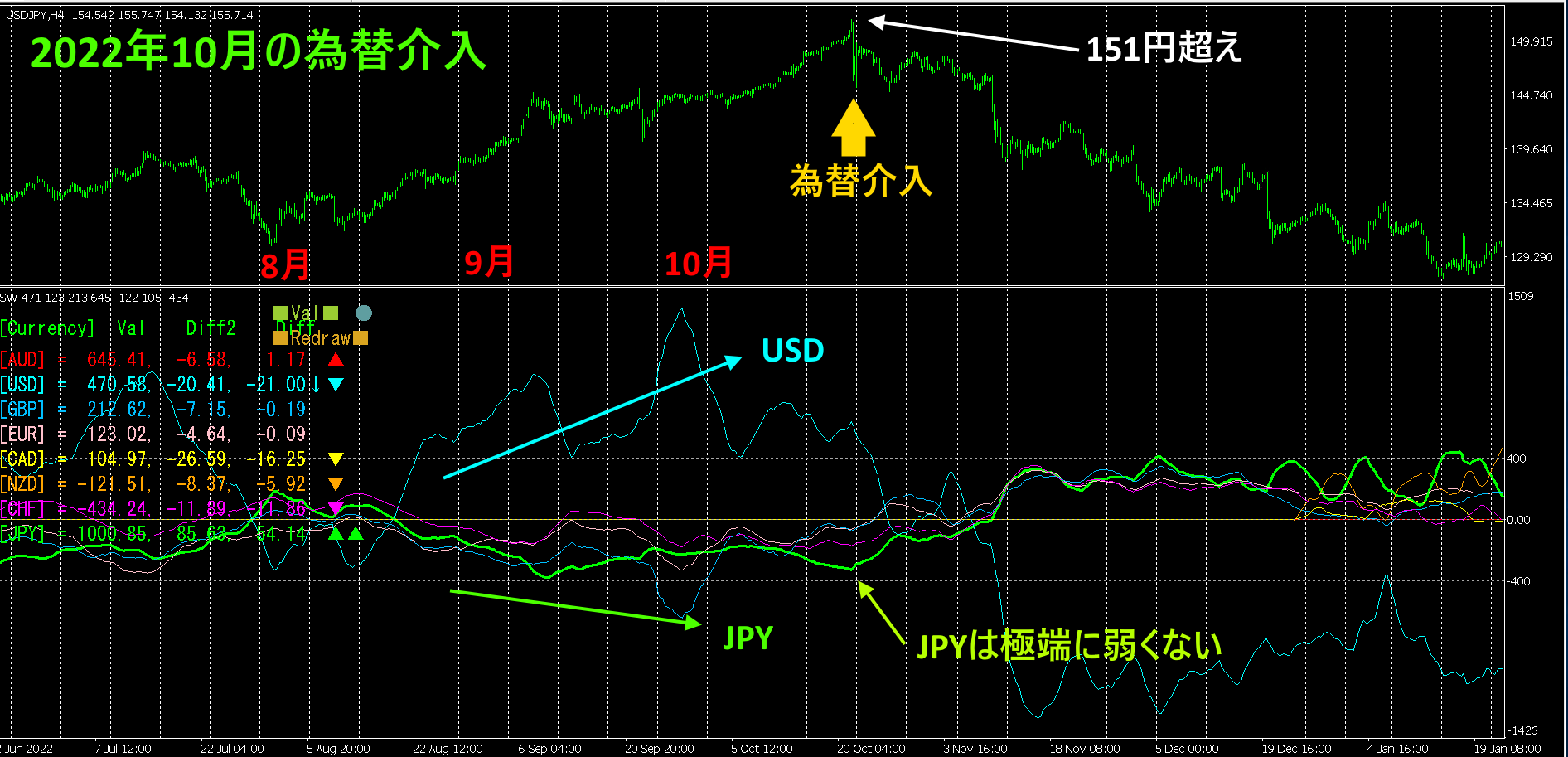

Previous Intervention (2022)

Comparing to the previous intervention.

In three rounds during September and October 2022, the BOJ conducted yen-buying interventions totaling9.2 trillion yen. Let's look at the currency strength chart from that time. (Time frame shown is4 hours.)

At this time, the USD/JPY rate exceeded

On the other hand, in this intervention, the effect seems to be limited despite some impact.15-minute currency strength chart showsJPYmoving downwards,USDmoving upwards, suggesting that going forward USD/JPY may revert to a weaker yen (yen depreciation and rising dollar/yen).

4. To Revitalize the Japanese Economy

The recent FX intervention was about1010 trillion yen in size, but this level is unlikely to pull the USD/JPY toward a stronger yen. Compared with other countries, the Japanese economy is fundamentally weaker. The lost30 years, the economic slowdown30 years are not easily recovered.

year4month Japan's foreign exchange reserves stand at1 trillion2600billion dollars (about196 trillion yen). If FX intervention is to be done, this20% of40 trillion yen should be continuously invested to signal a strong resolve by Japan’s currency authorities to “maintain the yen’s strength.”

Also, Japan’s foreign exchange reserves were accumulated when the USD/JPY rate was still yen-strengthened. If the entry-rate had been1 USD80 yen, the current difference of155 yen would yield a difference of75 yen (48%)19 trillion yen would arise.

Japan is the world’s fourth-largest trading nation. (Following China, the United States, and Germany) Annual imports amount to7,734 billion dollars (about120 trillion yen). As a resource-poor country that depends on imports of energy, raw materials, and food, if the USD/JPY rate falls by10%, the amount paid in dollars for imports decreases, yielding12 trillion yen in profit.

The windfall and the increase in trade profits from a stronger yen amount to about31 trillion yen. This should be used for Japan’s economic revitalization.

With3123 trillion yen) could be zeroed. Alternatively, for two years, consumption tax could be reduced to 5%. Widespread cash payouts or masks to citizens incur large administrative costs, but if consumption tax is made zero through temporary legislation, such costs can be avoided.

In any case, instead of simply letting Japan’s economy deteriorate, some measures to stimulate the economy should be taken.

Money has to circulate to generate economic vitality.

Recommended indicators

“8CP Visualization Indicator” please refer to the following page.

MT4 Version

8CP Visualization Indicator4 Point Full Set(Oceania,London,NewYork,AnyCP)

https://www.gogojungle.co.jp/tools/ebooks/32043

MT5 Version

8CP Visualization IndicatorMT5_4 Point Full Set(Oceania,London,NewYork,AnyCP)

https://www.gogojungle.co.jp/tools/ebooks/39133

“8C Currency Strength Visualization Indicator” please refer to the following page.

MT4 Version https://www.gogojungle.co.jp/tools/indicators/39150

MT5 Version https://www.gogojungle.co.jp/tools/indicators/39159