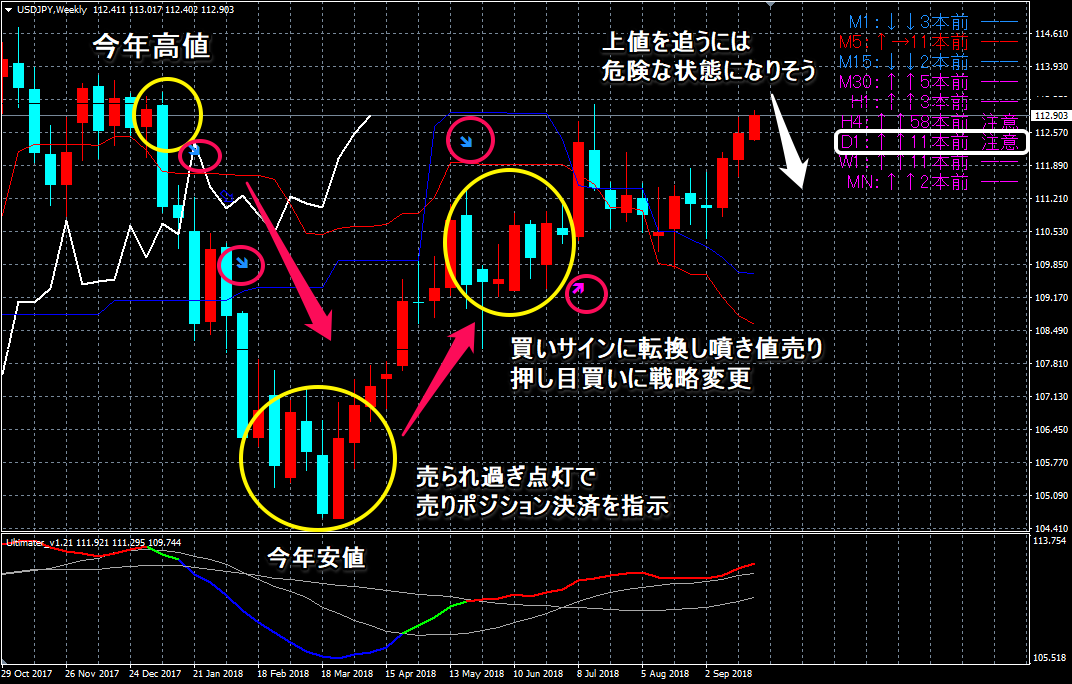

A break of the immediate high is within expectations! Caution for the appearance of upper wicks on the daily and weekly charts!

The dollar/yen has, after handling various factors, tried again at the 113 yen level.

There were times this year when the market fell below 105 yen, but looking at the year as a whole,

it has been a see-saw motion, and toward the year-end it already looks as if it may attempt to move higher.

The development is turning into this kind of pattern.

However, it is currently an important period for the dollar/yen, and depending on how things unfold,

there remains a possibility that it could peak and stall.

As for near-term highs to watch, the high in July this year at 113.161 and the January high—the year’s high at 113.38—have already been reached as targets.

They have already been reached.

With only two trading days left in the monthly chart, unless something extraordinary happens, it seems unlikely to form a upper wick,

and the upper gap of the monthly cloud may be broken and closed above.

However, with only two trading days remaining and with events such as the U.S.-Japan summit and the Federal Reserve FOMC ahead, there is pressure for the price to push toward new highs.

Is there a hold on the movement due to these events?

If it rises after these events, the dollar/yen could become overbought

and even if it updates the year’s high, it could move from a dangerous state

to a likely first shift toward a quick drop as positions are adjusted.

Therefore, going forward, while the 110.00 support may help turn upward,

further sharp gains are expected to occur only after the bottom-building phase completes.

Click to enlarge

★ Dollar/Yen turned to selling at the start of the year! Short-term caution on rebounds!

According to the indicator (Ask Ultimate MAX), in the early part of this year the selling bias did not expect further declines around 105 yen

and supported the rebound. However, after 110 yen was broken, it shifted to selling into spikes and buying on dips,

and the strategy has been adjusted to its current state.

Currently on the daily chart there is a caution sign, and further ascent from here is becoming a dangerous state.

It is a time to close long positions and observe, or switch to a short position.

Pound/yen and euro/yen have also been retraced to dangerous levels

and are likely to reach near-term highs.

Market Compass Ask Indicator Strategy Delivery Free

★ Pound/Yen set to resume decline

Entry timing: aim for here!

Dollaryen strong! Battle Zone Trade Giveaway Campaign!

Trade techniques that will definitely improve your win rate if you know this much!

Latest articles from “Market Compass” free