The market is about to move! This is the currency to watch this time!

The market, which opened with a crash in US stocks this February,

appears to be regaining its calm,

and this weekend there is the G7 Summit; this week is anticipated as the year’s biggest political big event,

as well as a week facing the FOMC and ECB meetings, so both the US and Japanese stock prices

and the currencies have, up to last week, moved in a way that priced in all events,

more as a period of adjustment and waiting to see ahead of events than a movement driven by them.

Therefore, market participants are expected to assess the focused events from the start of the week

and participate, with the possibility that the market may swing in a different direction depending on the situation.

Moreover, the current market movement may continue its trend without changing into year-end, with ample possibility of such a transition.

USD/JPY, ahead of these big events, briefly retraced to the 110 range

and toward the weekend, both the Nikkei average and the market showed some stalls, so I would like to continue with the same strategy as before

to challenge it.

Please check here⇒Long-term USD/JPY strategy: Sell into the May-end price spike in early June!

I have highlighted one of the currencies to watch this time: the Euro/Yen

There are concerns about Italy and Spain, but they retreated early,

and since several ECB members repeated hawkish comments, there was a swift rebound in buying.

However, the Euro/Yen is moving with an awareness of the 130 level, and it has stalled somewhat toward the weekend.

※Click to enlarge

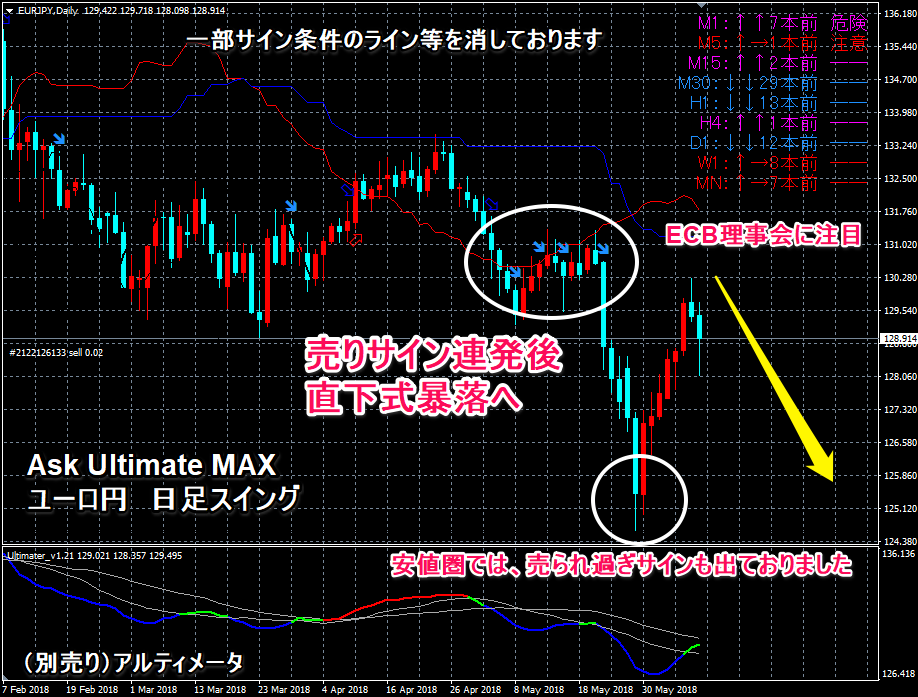

The chart shows, on the Ask Ultimate MAX Euro/Yen daily, a continuing downtrend.

Around the 130 level, after repeated sell signals, concerns for Italy and Spain caused a drop,

then a rebound from being oversold, finishing this week.

Although it looks like a strong market with a big rebound after testing lower,

the trend remains a downtrend from the year’s high, remaining within the weekly chart’s Ichimoku cloud,

and it’s merely a volatile market. Since it’s a cross-yen, it will also move in the yen market, but

attention seems to be drawn to the post-ECB meeting movements.

The strategy is to sell around the 130 level, with the target set for the daily chart’s danger signal to light up for settlement.

★Pound/Yen: the decline from the 153 yen level is within expectations!

This is the indicator with buy/sell signals that I am introducing here!

★Indicator with buy/sell signals: Ask Ultimate MAX/Kage-musha – Easy Trade

If you act now, you will receive the Battle Zone Trade Indicator, which was a big hit!