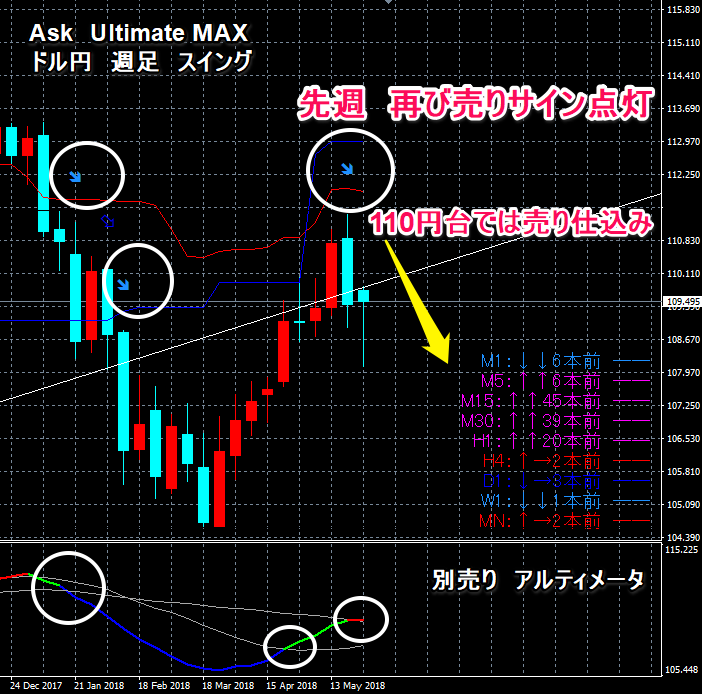

USD/JPY Long-Term Strategy: Sell the spike in early June!

In the previous USD/JPY strategy, I recommended selling at tight points, but

the May highs brought the price to the 111 yen range, and buying intensified from around 109 mid.

★Read the previous article

However, on a monthly chart, it closed in the 108 yen range after forming a long upper shadow

Above 110 yen, selling pressure strengthened.

Furthermore, at the MAX indicator, a new sell signal lit up again, and on the monthly chart,

we expect a test of the upper prices in early June but a slowdown from mid-month.

The target is near the March low, but if breached, there may be a decline toward around 100 yen in the second half of this year.

After the U.S. jobs report, the most recent moving factor

personally, this year's biggest big event in history

The U.S.-North Korea summit is scheduled to be held as planned on the 12th in Singapore

I want to pay attention to the market changes around this event.

The U.S. stock market, which crashed in February this year, may be heading toward continued action

and now could be the time to act,

which I view as a sufficient trigger.

★GBP/JPY: a drop from the 153 yen range was expected and within range!

★Indicator buy-sell signals included—Ask Ultimate MAX / Shadow Trader—easy trading

If you act now, you’ll receive the incredibly popular Battle Zone Trade Indicator as a gift!