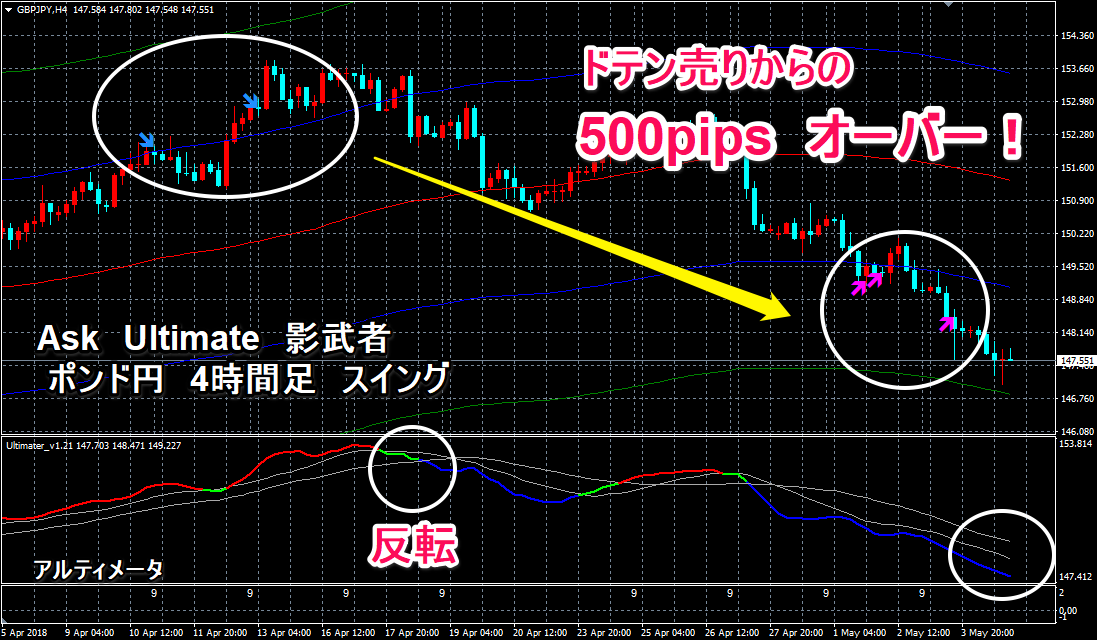

The decline from the 153 yen range is within expectations!

The pound-yen market since the last reversal signal has been an intense downtrend

Recently, UK economic indicators have been weak and expectations for rate hikes have greatly diminished

and as a result, pound selling has accelerated.

After generating a buy signal from the 145 yen level and posting over +600 pips, the signal flipped to sell for another +500 pips!

From here, we want to time buying, using the Ultimater

reversal timing and Takeda Pharmaceutical's Shawyer acquisition, if completed, will temporarily accelerate selling yen and buying pound

which is likely to push the rise further.

Other notable factors include the (10th) UK policy rate decision and quarterly inflation report

which could tilt towards pound selling, so caution is warranted!

※ Regarding Takeda Pharmaceutical's acquisition proposal for Ireland's major drugmaker Shire

has been raised to 7 trillion yen and negotiations are ongoing, with the negotiation deadline

set for 5:00 PM London time on May 8 (1:00 AM Japan time on the 9th).

If formally decided, it could coincide with a rebound in prices.

★ The indicators used in the Pound-Yen Strategy article are these!

★ The indicator used in the Dollar-Yen long-term strategy chart is this!

Details of the above products are ↓↓↓↓↓

“Kawaseerigui” trading technique, Ask Ultimate MAX (long-term) / Shadow (short-term) with indicators

● For each currency pair, entry and exit times are predetermined!

● Participants switch rapidly in each time zone! Grasp the flow of the day’s market!

■ About Summer and Winter time zones ■ One week ■ One month ■ Yearly market flow

● Trading technique: “Tokyo morning session is hot! This is where the currency market battle originates!”

● Trading technique (long-term position)

● Ask Ultimate MAX / Shadow set package

What is Battle Zone Trade?

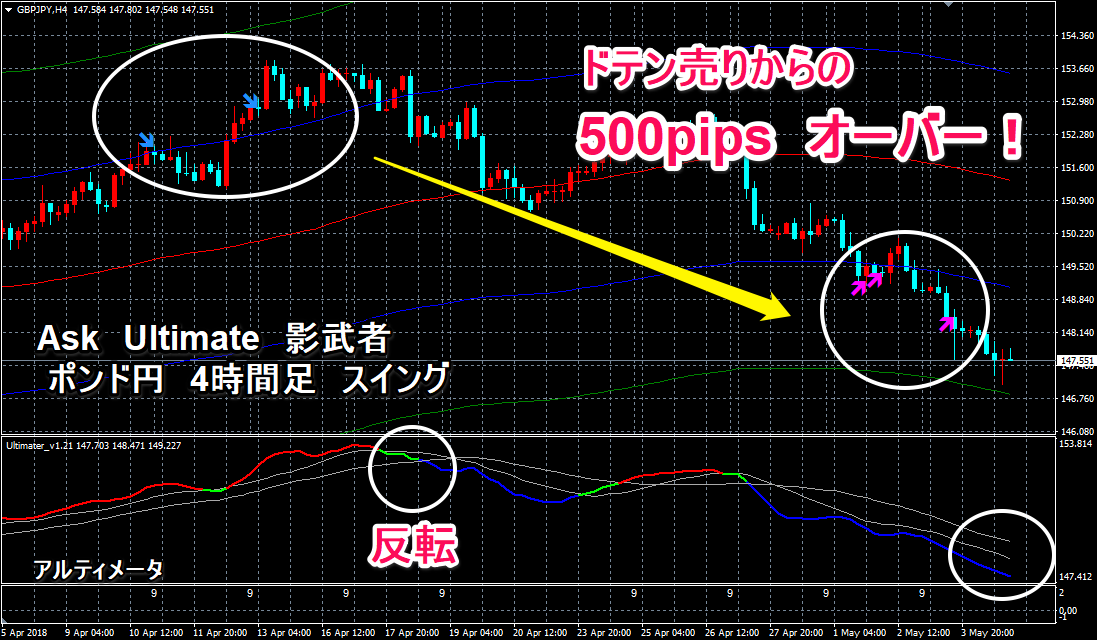

Recently, UK economic indicators have been weak and expectations for rate hikes have greatly diminished

and as a result, pound selling has accelerated.

★ Pound-yen Strategy: Previous Article 4/22

After generating a buy signal from the 145 yen level and posting over +600 pips, the signal flipped to sell for another +500 pips!

From here, we want to time buying, using the Ultimater

reversal timing and Takeda Pharmaceutical's Shawyer acquisition, if completed, will temporarily accelerate selling yen and buying pound

which is likely to push the rise further.

Other notable factors include the (10th) UK policy rate decision and quarterly inflation report

which could tilt towards pound selling, so caution is warranted!

※ Regarding Takeda Pharmaceutical's acquisition proposal for Ireland's major drugmaker Shire

has been raised to 7 trillion yen and negotiations are ongoing, with the negotiation deadline

set for 5:00 PM London time on May 8 (1:00 AM Japan time on the 9th).

If formally decided, it could coincide with a rebound in prices.

★ The indicators used in the Pound-Yen Strategy article are these!

Ask Ultimate Shadow Trader¥19,800

● An indicator with scalp-capable entry & exit signals★ The indicator used in the Dollar-Yen long-term strategy chart is this!

Ask Ultimate MAX¥17,800

● Medium- to long-term trend-following methodStrong in Dollar-Yen! Battle Zone Trade present!

Ask ver 1.0¥17,800

● Day trading breakout methodDetails of the above products are ↓↓↓↓↓

“Kawaseerigui” trading technique, Ask Ultimate MAX (long-term) / Shadow (short-term) with indicators

● For each currency pair, entry and exit times are predetermined!

● Participants switch rapidly in each time zone! Grasp the flow of the day’s market!

■ About Summer and Winter time zones ■ One week ■ One month ■ Yearly market flow

● Trading technique: “Tokyo morning session is hot! This is where the currency market battle originates!”

● Trading technique (long-term position)

● Ask Ultimate MAX / Shadow set package

What is Battle Zone Trade?

× ![]()