[US stocks] The Uptrend Continues for Now

Hello, I am Lehman (@Lehman1980).

Last night the April US employment report, announced during trading, came in much weaker than expected, sending stocks higher and the dollar lower.

Normally, before the COVID shock, bad news would push stocks down, but it’s odd that they were bought due to reassurance from continued monetary easing. (Headline source:CNN)

Personal summary

・Nonfarm payrolls for April were recorded at a historic low, well under expectations, and March was revised downward.

・Unemployment rate rose vs. March, but labor participation rate and average hourly earnings also increased.

・Supplementary unemployment benefits are highly attractive, so perhaps people aren’t rushing to rejoin the workforce?

・The supplement is scheduled to end in late September (no extension), which could cause stock price volatility?

・Inflation concerns retreated, and the US 10-year Treasury yield fell to around 1.53% (bond prices rose), yet closing levels did not change.

・Conversely, gold prices remained firm.

・All major sector indices of the S&P 500 rose.

・Energy, real estate, and industrials showed notable gains. In the morning, technology stocks led the market.

・Yen strengthened to around mid-108 per dollar (about 70 sen per ¥1 move)

In any case, it seems the Goldilocks market will continue for a while longer.

<S&P 500 index closing/highest 4232 (202100507)>

March 23: 2237 (COVID shock bottom)

May 15: 2863

December 31: 3756

March 27: 3974

May 7: 4232

https://jp.investing.com/indices/us-spx-500-historical-data

In just over a month, it rose 6.5% and reached a new all-time high. From the bottom, it nearly doubled.

The statistical annual rate of increase has been achieved in about one month, but the lack of high-price vigilance is eerie.

Heat map for the first week of May. (Source:FINVIZ)

Some of the technology sector and names like AMZN, TSLA fell. Is this a temporary correction?

Financials, healthcare, and industrials are maintaining strength.

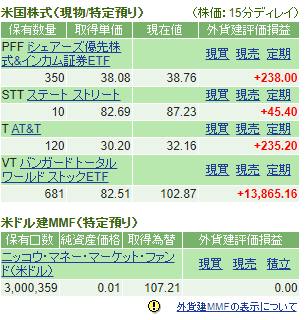

US stock holdings

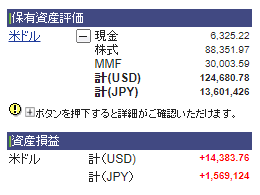

SBI Securities account summary. (as of May 7 close)

Unrealized gains are $14,383, up from the previous article.

Cumulative profit including realized losses and dividends is $12,767 in the black.

Stock holdings are about $88,000, and cash equivalents such as MMFs are about $36,000, making the ratio 71:29.

Bought: VT (670→681), T (100→120)

Sold: AAPL (5→10→0), STT (20→40→10)

On May 6–7, when I increased holdings in individual stocks, the Nasdaq plummeted briefly.

To be safe, I sold mainly AAPL and STT; AAPL was sold early successfully, but

STT continued to perform well, so it might have been a bit of a mistake.

Also, for VT I slowed the purchase speed and decided to try regular daily purchases of one share.

<Ongoing watchlist>

Large cap: AAPL, MSFT, TSLA

Growth stocks: FSLY (significantly down)

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK, STT

Consumer staples: PG, KO, PM, BTI (solid bottom and rising)

Communication: T