[U.S. stocks] Goldilocks market or plateau before a plunge

“An economy that is not overheating nor stalling, with steady growth and long-term interest rates staying low and stable—an appropriately balanced market.”

<S&P 500 index close and intraday high 4185 (20210416)>

March 23: 2237 (COVID-19 crash bottom)

May 15: 2863

December 31: 3756

March 27: 3974

April 23: 4180

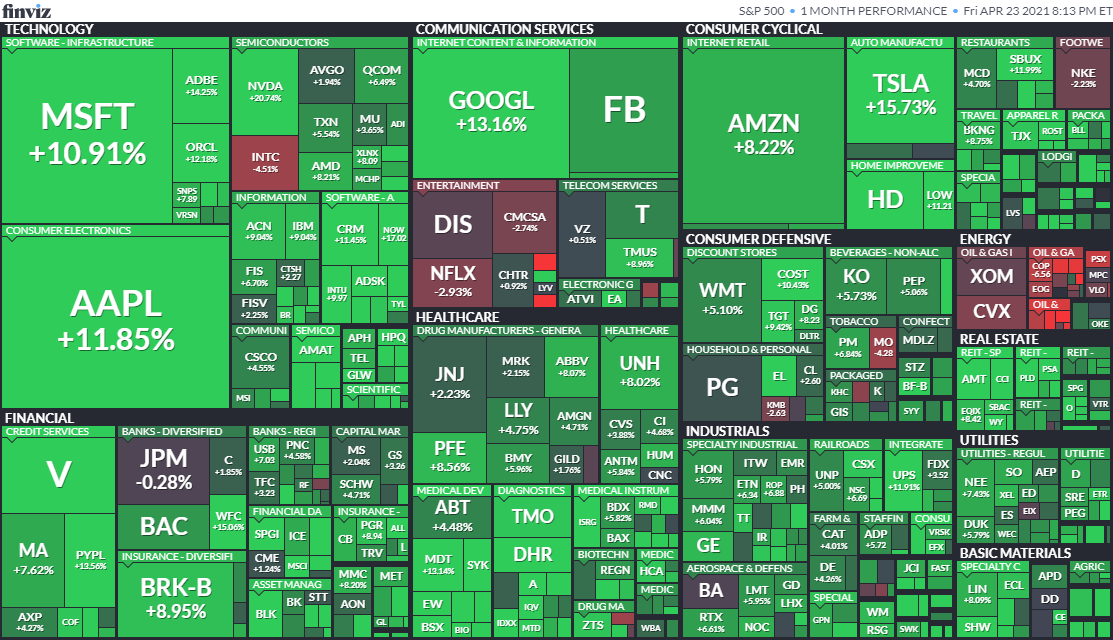

Heatmap for the past month. (Source:FINVIZ)

There is broad upside, but NFLX and INTC have fallen as their earnings were not well received.

STT also fell sharply at one point.

As mentioned in the previous article, the energy sector has not been energetic.

Perhaps because REITs are doing well, SPYD rose to around $40, near pre-COVID levels.

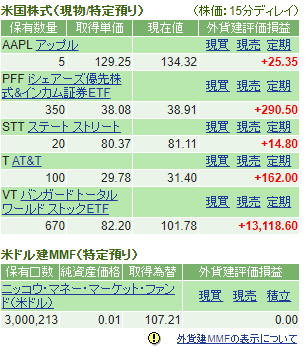

U.S. stock holdings

SBI Securities account summary. (as of close on April 23)

Unrealized gains amount to $13,611, nearly $1,200 higher than in the previous article.

Cumulative net profit including realized losses and dividends is $11,950 in the plus.

Stock holdings around $87,000, cash equivalents such as MMFs around $36,000, maintaining a roughly 70:30 ratio.

The yen has strengthened suddenly, breaking below 1 USD = 108 JPY, making currency trading less favorable at this level.

I would prefer yen to strengthen to the mid-106s, at least.

Buy: VT (640→670), PFF (300→350), STT (20)

Sell: AAPL (20→5), BTI (60→0), T (130→100)

I adjusted individual stocks; BTI was sold just before a sharp drop by coincidence.

New position: STT, one of the big three asset management companies, has been purchased.

I picked up a bit during the decline caused by quarterly earnings disappointment.

I hope it is not at the plateau just before a drop.

Well then, until next time.

<Continued watchlist>

Large-cap: AAPL, MSFT, TSLA

Growth: FSLY

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK, STT

Consumer staples: PG, KO, PM, BTI

Communication: T