[US Stocks] Three weeks of gains, and once again the S&P 500 hits a new high.

<S&P 500 index close and high: 4128 (2021-04-09)>

March 23: 2237 (COVID-19 pandemic low)

May 15: 2863

December 31: 3756

March 27: 3974

April 9: 4128

This is the heatmap for the second week of April. (Source:FINVIZ)

This week was the week of GAFAM. Large-cap stocks, especially AAPL, were strong.

Broad gains across financials, tech, and consumer cyclicals, including MVP.

On the other hand, energy sector fell as crude oil prices declined.

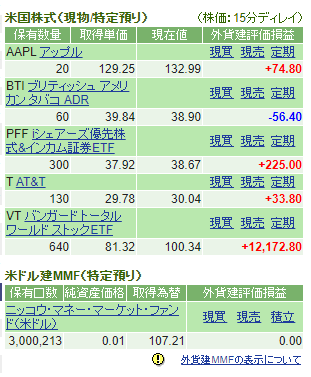

U.S. stock holdings

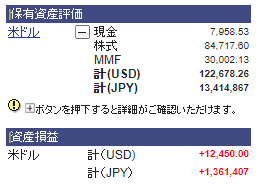

SBI Securities account summary. (End of April 10)

Progressed smoothly, with unrealized gains of $12,450.

Also, dividends were about $157 (2021 cumulative dividends: $288).

In cumulative profit and loss including realized losses and dividends, plus $10,765.

Since starting U.S. stock investment, first time breaking the $10k mark.

Stock holdings about $84k, cash and equivalents (MMF, etc.) about $38k, ratio 69:31.

As the U.S.-Japan interest rate gap narrowed, the yen weakened and then settled, so dollar and yen conversions will be on hold for a while.

Buy: VT (620→640)

Sell: none

AAPL turned positive, and BTI was briefly in positive territory as well.

Next week I plan to focus on buying back VT.

See you next time.

<Continued watchlist>

Large caps: AAPL, MSFT, TSLA

Growth stocks: FSLY

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK, STT

Consumer staples: PG, KO, PM, BTI

Communication: T