[US Stocks] After a period of consolidation, the S&P 500 hits a new high.

Hello, Lehman (@Lehman1980) here.

The stock market has been relatively calm for about the last two weeks, with the S&P 500 around 3,900 points.

On Friday, it rose significantly towards the close and hit an all-time high, so

until long-term interest rates reach 1.8%, U.S. stocks are likely to continue hitting new highs for a while.

(Header image: CNN)

U.S. stocks Dow up 453 points, broad-based buying on hopes of economic recovery

<S&P 500 index closing price and high: 3974 (20210326)>

March 23: 2237 (COVID-19 crash bottom)

May 15: 2863

December 31: 3756

February 12: 3934

March 27: 3974

https://jp.investing.com/indices/us-spx-500-historical-data

Third-week heatmap (Source:FINVIZ)

MSFT has been steadily rising in the first half of this year.

Other software, semiconductors, and consumer defensives broadly rose.

On the other hand, adjustments continue for stocks that were advantaged during the pandemic, such as TSLA.

US stock holdings

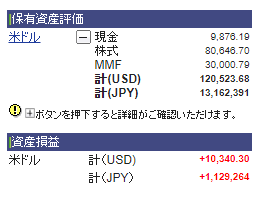

SBI Securities account summary. (as of March 26 close)

In the third week, I took some profits, so unrealized gains reached $10,340.

Cumulative realized gains and dividends remained a +$8,500 gain since the previous article.

I converted about $20,000 of MMF back into yen, reducing the invested principal to $112,000.

As a result, this year's total profit including dividends in yen is about ¥290,000.

Stock holdings are about $80,000, with MMF and other reserves around $40,000, making the ratio 67:33.

The yen is likely to stay weak for a while, but if the yen strengthens again, I plan to rebalance by converting back to dollars.

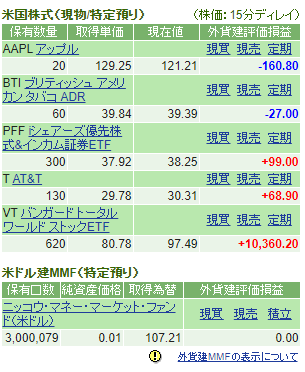

Buy: PFF (200→300) T (120→130) BTI (0→60)

Sell: VT (730→600→620) KO (40→0)

I locked in about 20% of VT at around $98, and also sold KO.

With that capital, I am buying back VT and adding high-dividend stocks.

PFF and T rose further. AAPL remained unchanged. The newly purchased BTI is negative due to dividend ex-date.

Last night I hesitated to buy STT, but it rose while I was not buying.

From next week, I think I will focus on buying back VT and won’t trade aggressively.

Until next time, see you again.

<Watch list>

Blue chips: AAPL, MSFT, TSLA

Growth stock: FSLY

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK, STT

Consumer staples: PG, KO, PM, BTI

Communication: T