[U.S. stocks] In a directionless move, the S&P 500 reaches new highs.

Hello, Lehman (@Lehman1980) is.

Not as much as the late February level, but in the past two weeks the trends of U.S. long-term interest rates influenced daily stock movements.

Every day the stock prices moved significantly.

However, when looking at week-over-week stock trends, the Dow, Nasdaq, and S&P 500 all rose in the second week of March.

The major trend remains profit-taking on growth names and shorts, with a reconsideration buying on value names centered around the old economy.

(Header image:CNN)

Both the first and second weeks of March saw the S&P 500 advance, while

Nasdaq fell for the third and fourth weeks of February and the first week of March, dropping about 8.5% in total.

In the second week of March, a rebound of about 3% finally occurred.

The S&P 500 reached new highs on March 11 and 12.

Next week, I will be watching U.S. long-term rates and the FOMC to see whether the stock market will rise further.

Dollar strength due to rising U.S. yields; focus on next week's FOMC

<S&P 500 index closing level and peak 3943 (20210312)>

March 23: 2237 (COVID-19 crash bottom)

May 15: 2863

December 31: 3756

February 12: 3934

March 12: 3943

https://jp.investing.com/indices/us-spx-500-historical-data

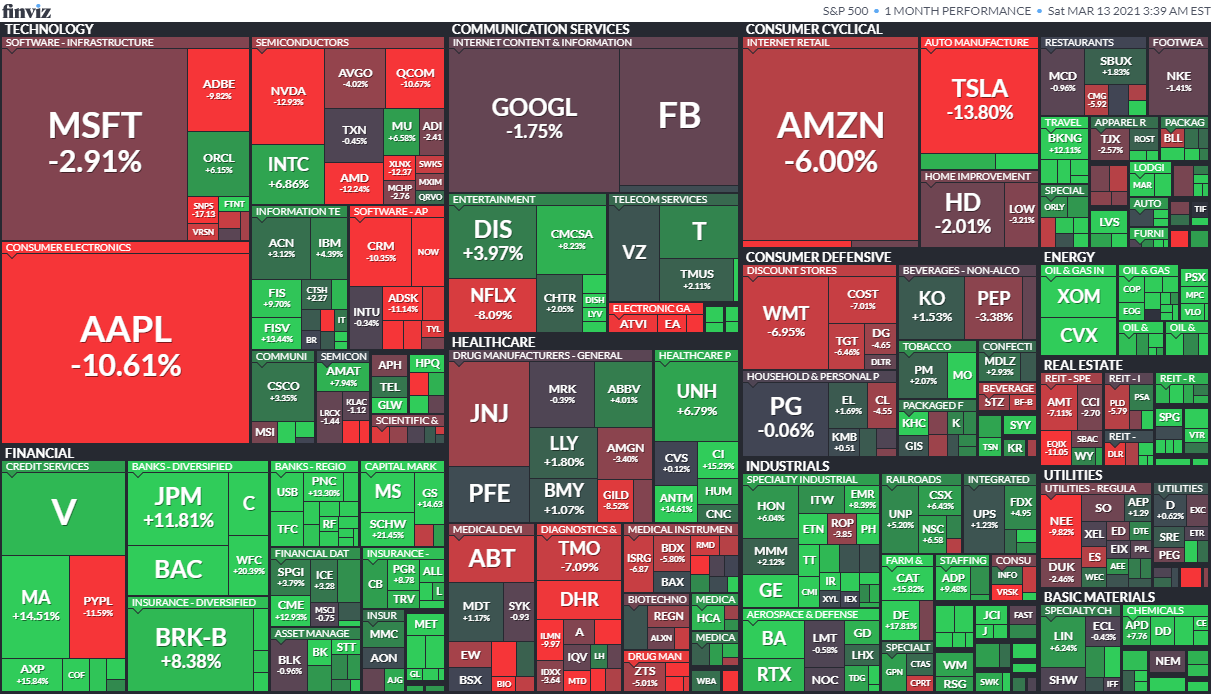

Here is the heat map for the most recent month.

Financials (excluding PYPL), industrials, and energy sectors have risen.

On the other hand, semiconductors-centered high-tech, and COVID-19 beneficiaries like NFLX and AMZN, as well as crypto-related stocks, declined sharply.

U.S. stock holdings

This is SBI Securities account summary (as of March 12 close).

Unrealized gains are almost back to the original level, at $13,185.

Cumulative gains including realized losses and dividends amount to +$8,500.

Compared with the previous article, +$2,400.

Stock holdings about $87,000, cash equivalents (MMF, etc.) about $53,000, resulting in a ratio of 62:38.

At some point the S&P 500 and Dow have hit record highs again, and while there is no overheating, I expect the market to remain directionless for a while.

Regarding the current yen depreciation and stock market dip, U.S. dollar MMFs have provided sufficient cushion, so

I will slightly reduce risk assets and aim for a target ratio of 60:40.

Consequently, I plan to take profits on VT by about 20%, and add $10,000 to MMF.

Buy: VT (700→730) AAPL (15→20) T (100→120)

Sell: none

PFF and T have turned positive. The declines in AAPL and KO have narrowed.

I am eyeing TSLA, FSLY, NVDA, etc., but cannot quite buy yet.

Until next time, see you again.

<Stocks to keep an eye on>

Blue chips: AAPL, MSFT, TSLA

Growth stocks: FSLY

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK, STT

Consumer staples: PG, KO, PM, BTI

Communication: T