【U.S. stocks】Deterioration in sentiment is temporary

Hello, Lehman(@Lehman1980) is.

In the last two weeks, due to factors such as a sharp drop in Bitcoin and a sharp rise in US long-term interest rates,

sentiment has deteriorated rapidly.

Fear and Greed Index Fear & Greed Index was 48 as of February 27.It has fallen 11 points over this week.

The S&P 500 index, after reaching an all-time high on February 12, began to weaken,

and on the 25th it dropped sharply by 2.4% (96 points) from the previous day.

(Header image:

CNN)

Next week looks like a week of testing lower levels.

The likelihood of repeated circuit breakers like in March last year is almost zero,

and this is a temporary adjustment in a financial environment (over-liquidity market) that has occurred several times in the past year.

The January pullback did not count as a correction, so this time a full correction may be coming.

<S&P 500 index closing price and all-time high 3934 (20210212)>

March 23: 2237 (COVID crash bottom)

May 15: 2863

December 31: 3756

February 12: 3934

February 26: 3811

https://jp.investing.com/indices/us-spx-500-historical-data

Week 4 February heat map(Source: finviz.com)

GA excluding Facebook (F) and crypto-related such as PYPL and TSLA fell sharply.

Semiconductors and utilities were also cheap, and retailers like WMT, COST, and HD were cheap as well.

On the other hand, energy sector and globally active payment service companies excluding PYPL such as V, MA, and AXP performed well.

U.S. stock holdings

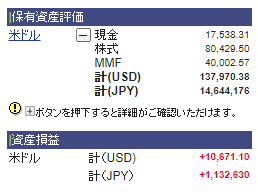

This is the SBI Securities account summary. (as of close on February 26)

Unrealized gains decreased to $10,671.

Total realized losses and dividends yield a net gain of $6,100.

Compared to the previous article, it is down by $3,100.

Recently, the yen has weakened, so the yen-denominated impact was not that large.

Although unrealized gains dropped by more than 20%, it also enabled more buying power.

Also, I accidentally placed a limit order instead of a stop order for PFF, resulting in the sale of about 450 shares,

leaving holdings at about $80,000 in stocks and about $57,000 in MMFs and other available funds, with a ratio of 58:42.

With about 10 percentage points of capacity to buy more, I’ll take that as a positive sign, haha.

Buy: VT (680→700) AAPL (10→15) KO (20→40)

Sell: PFF (650→100→200)

AAPL would have been better to start buying after waiting another week, but

I am buying more as I average down together with KO.

With the proceeds from selling PFF, I bought a bit of VT.

Next week I want to focus on NVDA, PYPL among the names mentioned in the previous article.

<Continuing watchlist>

Large-cap: AAPL, MSFT, TSLA

Growth stocks: FSLY, DOCU, CRWD, ZM

Semiconductors: QCOM, NVDA, INTC, AMD

Finance: PYPL, BLK

Consumer staples: PG, KO, PEP, PM, BTI

Communication: T, DIS, CMCSA