Review of yesterday's US employment data with video!

Hello!

This is Satori, researching Binary FX.

Today I will look back on the moves after yesterday's U.S. employment statistics release.

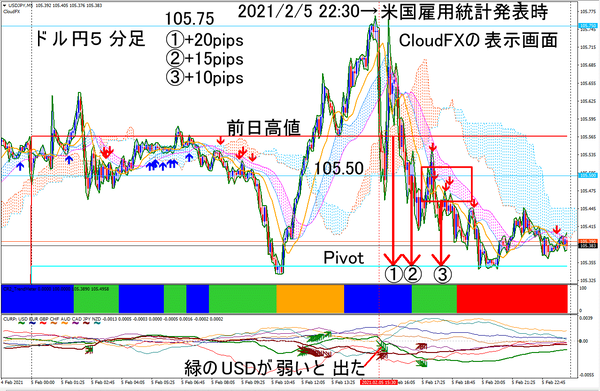

The figure below shows the USD/JPY 5-minute chart movement around 22:30 on February 5, 2021.

https://livedoor.blogimg.jp/fxmt4indicator/imgs/3/0/30990c19-s.png

In the above figure, CloudFX is displayed.

1) The profit when selling at the resistance-turning point of the previous day’s high and closing the position with Pivot.

2) The profit when selling at the resistance-turning point of 105.50 and closing the position with Pivot.

3) The profit when the volatility settled and a signal appeared at the Heikin-Ashi Cloud touch, selling and closing with Pivot.

Yesterday, after a sharp drop, the price fluctuated a lot, so entries could only be made in the latter half beyond ②.

Of course, those who can take risk or, with binary options, those who could sell at the peak 105.750 or buy a Low option might have profited nicely.

If you could sell at 105.750 and close at the previous day’s high, it would have been +18 pips.

Accumulating such reflections should lead to results.

The indicators used today are as follows.

Scalping Indicator CloudFX

https://www.gogojungle.co.jp/tools/indicators/27332

A YouTube video also looks back on it.

https://youtu.be/274qMKYLTD0

Thank you very much for reading up to here today.

Email: info.atmarkcanary2.net

※Register for the "FX Wave Riding" Free Newsletter

https://1lejend.com/stepmail/kd.php?no=UbHSvri