Secure the number of trials by utilizing Fibonacci

Hello!

Fibo Activity! This is Satori about Binary & FX.

Over the past several months, after researching various things, I reached the conclusion that, in both binary options and FX, what matters in operation is

“to bring the sampling of trade attempts to a state where you can take samples.”

This is the key point.

If you cannot sustain trading, it has no meaning.

If you cannot sustain it, it becomes a hobby where you mood swing over wins and losses.

However, to sustain trading, you need to use a method that yields a certain win rate, otherwise

psychologically, you won’t keep going.

From now on, I will introduce one method that yields a certain win rate.

Of course, if you master it, high win rates can be expected.

That is a trading method using Fibonacci.

However, it is quite difficult to apply Fibonacci yourself.

Each time the market moves, you have to decide which points to align and subtly move your hands,

and realistically it seems difficult to sustain.

Therefore, I have developed an indicator that automatically displays Fibonacci aligned with market waves.

You can use a retracement for counter-trend trading and an expansion for trend-following and take-profit levels.

Each has a buy and a sell version, so four indicators are included.

There are buy and sell perspectives, but for example, when trading on 1-minute, 5-minute, 15-minute charts, if the 1-hour or 4-hour chart is upward, it’s better to fix on a buy perspective; if downward, on a sell perspective, to better align with the trend direction.

Therefore, if you fix the buy perspective, you can set the Fibonacci Retracement (buy) and Fibonacci Expansion (buy) on one chart.

Conversely, if you fix the sell perspective, you can set the Fibonacci Retracement (sell) and Fibonacci Expansion (sell) on one chart.

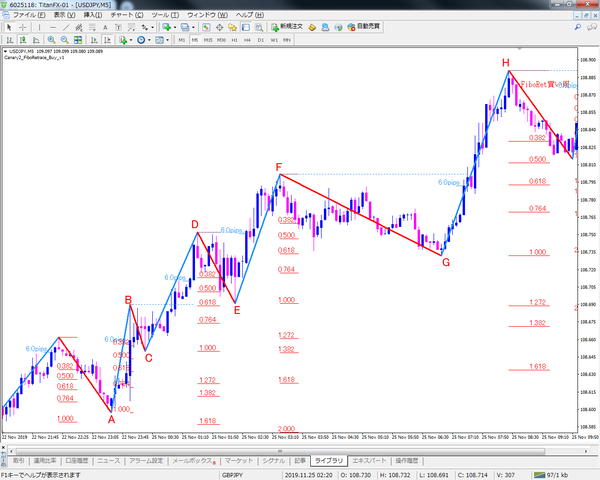

The figure below is an example of Fibonacci Retracement buy on the USD/JPY 5-minute chart.

In the above figure, point E is at the 0.618 pullback level of the preceding upward wave, drawn with a wick.

The 0.618 pullback level drawn with the wick is also the dotted level of the previous high, and after exceeding the previous high resistance line, that level becomes the support line for the low, and a reverser occurs.

After drawing that wick, it rebounded upward at the 0.382 pullback level, so buying at this level is not late.

Rather than entering at the tip of the wick, it is fine to enter after the wick forms.

Subsequently, the push from F to G also rebounded at 0.618.

Fibonacci ratios are watched by traders worldwide and indicate suitable pullbacks or retracements, thus providing one basis for reversal.

With this entry method, it is easier to estimate take profit and stop loss, and since samples of attempts are easier to obtain, there is a higher chance of sustaining operation.

From various statistics, the success rates of technical indicators like moving averages, RSI, and Stochastic are all around 50%, and since you have two choices (buy or sell), that is natural.

With a favorable risk-reward, the win rate improves, but it may not be very meaningful.

Technical indicators depend on how you use them, so using Fibonacci together with them can provide one basis for entry.

Fibonacci combined with moving averages, RSI, or Stochastic can be a good match depending on how you use them.

In any case, if things aren’t going well, try to calculate wins and losses, average profit and average loss, and test entry and exit points.

In binary options, with a win rate of 60%, your balance will grow; in FX, with a reward-risk ratio of 1:1, if you can sustain with a 60% win rate, your balance should increase.

Consider whether you are in a state where you can raise the number of trials to collect such sample data for analysis.

Please think about it.

The indicators used today are as follows.

***************************************************************

“Fibo活! Day Trading & Scalping Canary Indicator Lucky Bag”

http://www.canary2.net/fibo/

***************************************************************

Email: info at mark canary2.net

https://1lejend.com/stepmail/kd.php?no=UbHSvri