[US Stocks] Continuing to view as a short-term pullback

Hello, I am Lehman (@Lehman1980).

The S&P 500 index has further and further reached record highs, hitting 3,855 points on the 25th.

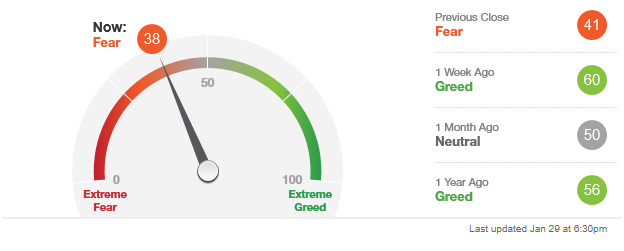

Since October, the market, which had been rising, can be said to have finally entered a correction.

That said, this is a correction in an uptrend, and I expect it to settle in about 7 trading days at the shortest, around two weeks at most.

I plan to accumulate the index while looking at individual stocks to buy once things stabilize.

Source:CNN.com

<S&P 500 index closing price and peak 3,855 (20210125)>

January Monthly heat map(Source: finviz.com)

The final week was almost all declines, but the month shows divided fortunes within sectors. The same within GAFAM.

Strength is notable in the auto sector’s three major players, semiconductors, and healthcare.

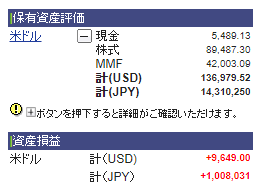

SBI Securities account summary. (as of January 29 close)

Net cumulative profit/loss including realized losses and dividends is around plus $5,000.Compared to two weeks ago, down about $1,400.

Last week it rose to a record high of plus $7,500, but a third of it was lost in a week.

Stock holdings were about $89k, with MMF and other cash around $47k, keeping the ratio at 65:35.

Buy: VT (600→640)

Sell: SPYD (100→0)

Sold all SPYD and bought a bit more VT.

This year I want to emphasize capital gains over income,

and I hope to carefully pick the following watchlist stocks from next week onward.

In large caps: AAPL, MSFT, TSLA. In semiconductors: QCOM, NVDA, INTC, AMD.

In finance: PYPL, BLK. In consumer staples: PG, KO.