[US stocks] Short-term pullback to be viewed as a pullback

Hello, I am@Lehman1980.

The S&P 500 index has risen to new all-time highs, reaching 3,824 on the 8th.

<S&P 500 index closing price / high 3824 (20210108)>

Week 2 heat map of January.(Source: finviz.com)

Because the Democrats won the Senate in a reversal, creating a blue wave, large-cap stocks like GAFAM have been on a downward trend.

Perhaps due to profit-taking, the declines in V and MA are sharp. Although Friday fell, major banks and the energy sector remain strong.

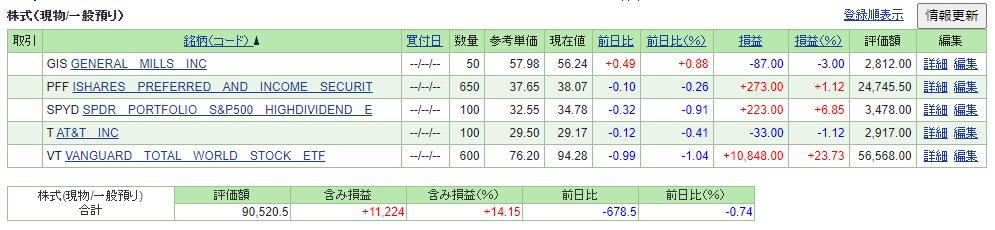

SBI Securities account summary. (as of January 15 close)

The cumulative realized losses and dividends show a net gain of about$6,400.Compared with the previous week,a gain of about $900.

Equities around about $90,000, with cash equivalents in MMF etc. around $48,000, maintaining a 65:35 ratio.

Buy: VT (580→600) GIS (20→50) T (0→100)

Sell: SPYD (300→100)

As SPYD rose perhaps due to renewed interest in small caps, most of it was sold.

Additionally, individual stocks GIS and T have been purchased.

January is expected to be without major upheaval.

However, if a short-term pullback of around 10% occurs, I plan to increase purchases focusing on VT and PFF.