[U.S. stocks] Upward trend and signs of overheating due to coronavirus vaccine development news.

Hello, this is Leeman (@Lehman1980).

In the U.S. stock market, during the second week of November, funds flowed into old economy and value stocks due to vaccine development news, pushing the market higher.

The S&P 500 rose to a new all-time high for the first time in two months, reaching 3,626 points since September. .

The NASDAQ, on the other hand, turned to selling pressure.

In the third week, due to overheating from a stock rise before the presidential election and further increases in U.S. COVID-19 cases, the market slightly declined.

<S&P 500 index closing price and all-time high 3626 (20201116)>March 23: 2237 (COVID shock bottom)May 15: 2863Sept 2: 3580Oct 23: 3465Nov 20: 3557https://jp.investing.com/indices/us-spx-500-historical-dataVarying outcomes. Within sectors, there are wins and losses. Based on optimistic views for demand, oil prices rose, so the energy sector advanced.(Source: finviz.com)U.S. stock holdingsThis is SBI Securities account summary (as of close on Nov 20).Unrealized gains or losses and accumulated profits from dividends have finally turned positive since the March COVID shock.Cumulative profit is just under +$1,000.Compared with the previous period,an increase of +$4,400approximately.Currently, yen is strengthening again, but I am watching it around 103 yen per dollar.Stock holdings are about $80,000, with cash equivalents such as MMFs around $47,000, making the ratio 63:37.I aim to reach 70:30 by year-end.

This is SBI Securities account summary (as of close on Nov 20).

Unrealized gains or losses and accumulated profits from dividends have finally turned positive since the March COVID shock.

Cumulative profit is just under +$1,000.Compared with the previous period,an increase of +$4,400approximately.

Currently, yen is strengthening again, but I am watching it around 103 yen per dollar.

Stock holdings are about $80,000, with cash equivalents such as MMFs around $47,000, making the ratio 63:37.I aim to reach 70:30 by year-end.

Stocks bought and sold

Buy: PFF (200→300) VT (510→530) PYPL (6) QCOM (8) TSLA (0→3→5→3)

Sell: SPYD (700→500)

This time, there were relatively many trades.

First, partial sale of SPYD, which had risen sharply.

Over the past six months, after a sharp drop it had traded weakly, but with vaccine development news, capital flowed into value and high-dividend stocks,

ranging from the $28 to mid-$32 range, rising by as much as about 15%.

Sold 100 shares in two installments, and used the proceeds to buy more PFF to adjust the position.

I made opportunistic buys of PYPL, QCOM, TSLA; TSLA was added after being selected for the S&P 500, surging over 20%.

Angle: S&P 500 index, Tesla surge expanding impact on large-cap stocks

The day after the announcement, I set a 10% higher limit order and bought 2 more shares, but then sold 2 shares for profit.

I think there will be more large price fluctuations for a while, so I want to pick up on dips smoothly.

What happened to the watchlist stocks afterward?

FSLY: bottomed around $63, jumped through the $70s, and rose to $83, up over 30%.

PM: held firm around the $70s and rose to $76.

BTI: bottomed around $32, rose significantly, briefly up over 15% to $37.

NFLX: $470s seem sturdy; up about 10% from the bottom.

KMB: hovering around the low $130s.

The presidential election appears to be ending with Biden's victory.

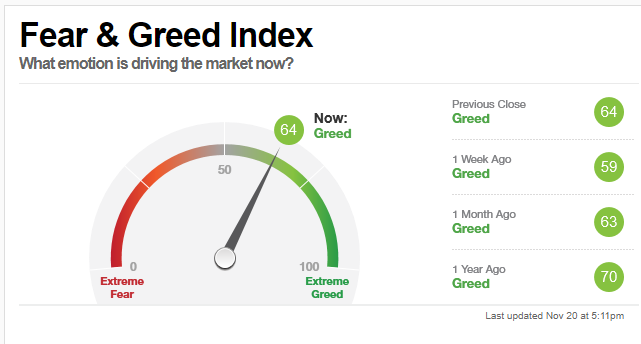

The market is gradually becoming less reactive to continued vaccine development news, showing some overheating as well.

Next, the key factors will be the timing of economic stimulus passage and the scale of the domestic lockdowns.

For the rest of the year, I plan to continue adding to investments with a bullish outlook, allowing for small adjustments along the way.