[US Stocks] Unexpected substantial rise. Presidential election progress not going as expected.

Hello, I’m Lehman (@Lehman1980).@Lehman1980.

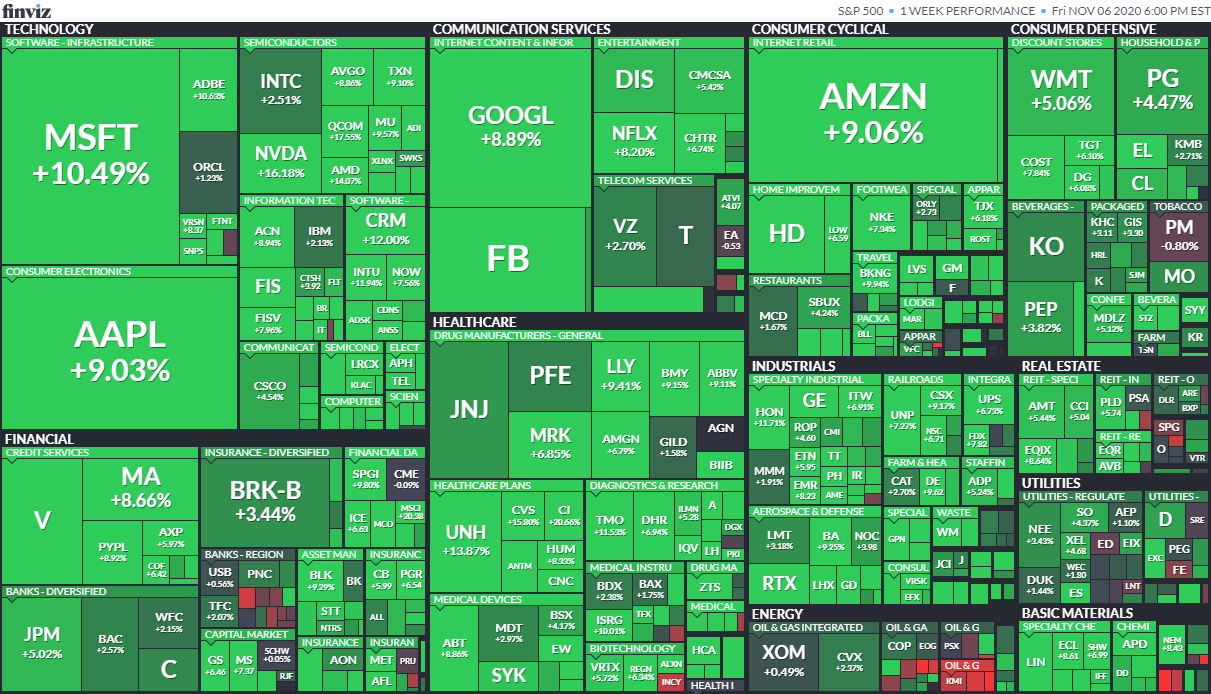

The U.S. stock market dipped slightly at the end of October, but in November it turned around and rose sharply.

In the first week of November, the market surged by more than 7% for the week, with the S&P 500 reclaiming 3,500 points.

The NASDAQ even rose by 8%.

Here is the view of Scott Meinard of Guggenheim Partners, an investment advisory firm.

Why the market can rise even without a Blue Wave: Scott Meinard

One interpretation is the continued effect of monetary easing by the Federal Reserve.

Money moving back and forth, in and out.

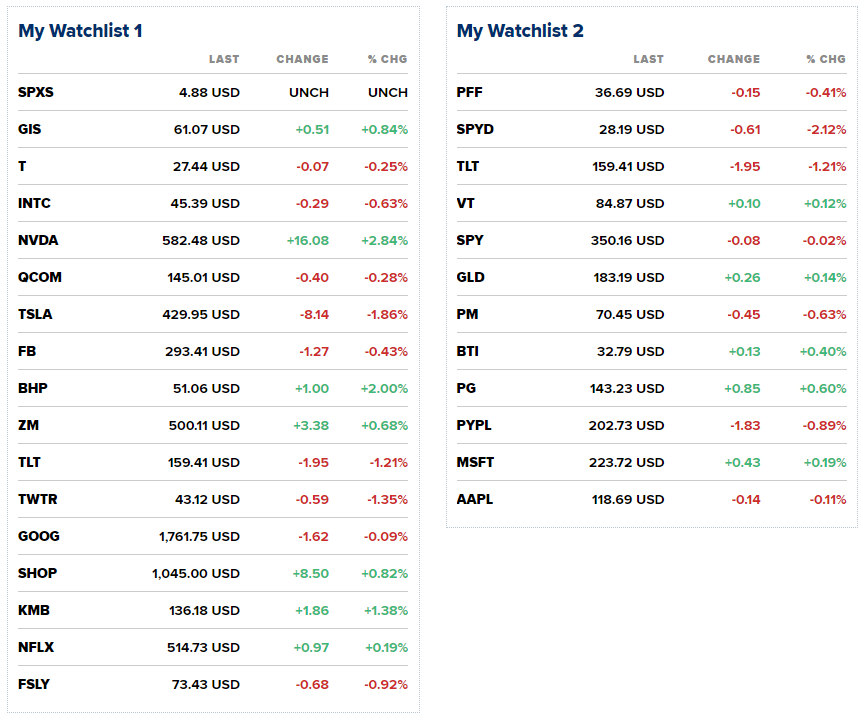

Account summary for SBI Securities. (End of day Nov 6)

Unrealized losses or cumulative gains from settled losses and dividends remain at$3,400 negative.

As of a week earlier, at the end of October, the loss was $6,900, so it has halved.

Furthermore, with the yen appreciating to around 103 per dollar, I moved about 800,000 yen to dollars more heavily.

Stock holdings about $73,000, MMF and other dry powder about $50,000, making the ratio 59:41.

Trades

Bought: PFF (100→200) VT (470→510) TLT (0→20)

Sold: none

I bought a small amount of TLT, which had fallen below $160. It was also an ex-dividend date.

At the end of October, I wonder if I should have started with individual stocks, but even being able to buy VT at 40 is a good result.

VT’s target is 60,000 shares, so I’m getting quite close.

What happened to the previous picks?

FSLY: expected support around $75, but fell to the $63 range. Half of the high of $130. Up about 15% from the bottom.

PM: seems solid around the $70s. Is BTI appealing?

BTI: a stock I mentioned on Twitter. Dividend yield over 8%. Just below $32, it briefly dipped and then rebounded about 2%.

NFLX: seems solid around the $470s. Up about 10% from the bottom.

KMB: hovering in the low $130s.

Finally, I’m listing my CNBC checklist.

SBI Securities and others show only 15-minute-delayed quotes, so this is recommended.

Until next time.