【U.S. stocks】A single decline did not occur, and the market has entered another rising phase.

Hello, Lehman (@Lehman1980).

The U.S. stock market has been steadily rising since October.

Since the last week of September, it has risen for two consecutive weeks.

In the previous article, it was expected that the market would remain volatile for a while, but the VIX index also declined, remaining stable.

Only around the time of President Trump’s coronavirus infection did it dip slightly.

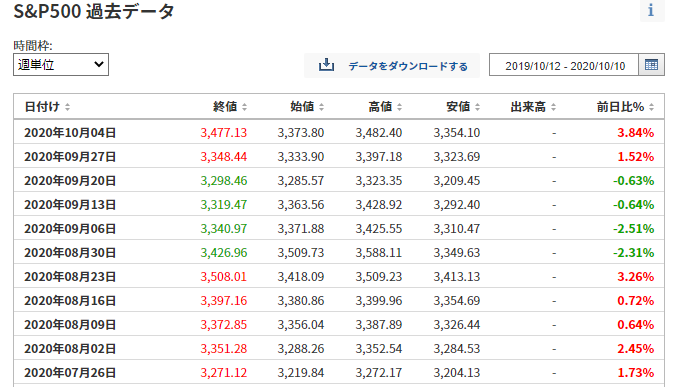

Some prominent U.S. investors consider the September decline to have been an ideal adjustment. (Source: jp.investing.com)

<S&P 500 closing price and high of 3580 (20200902)>

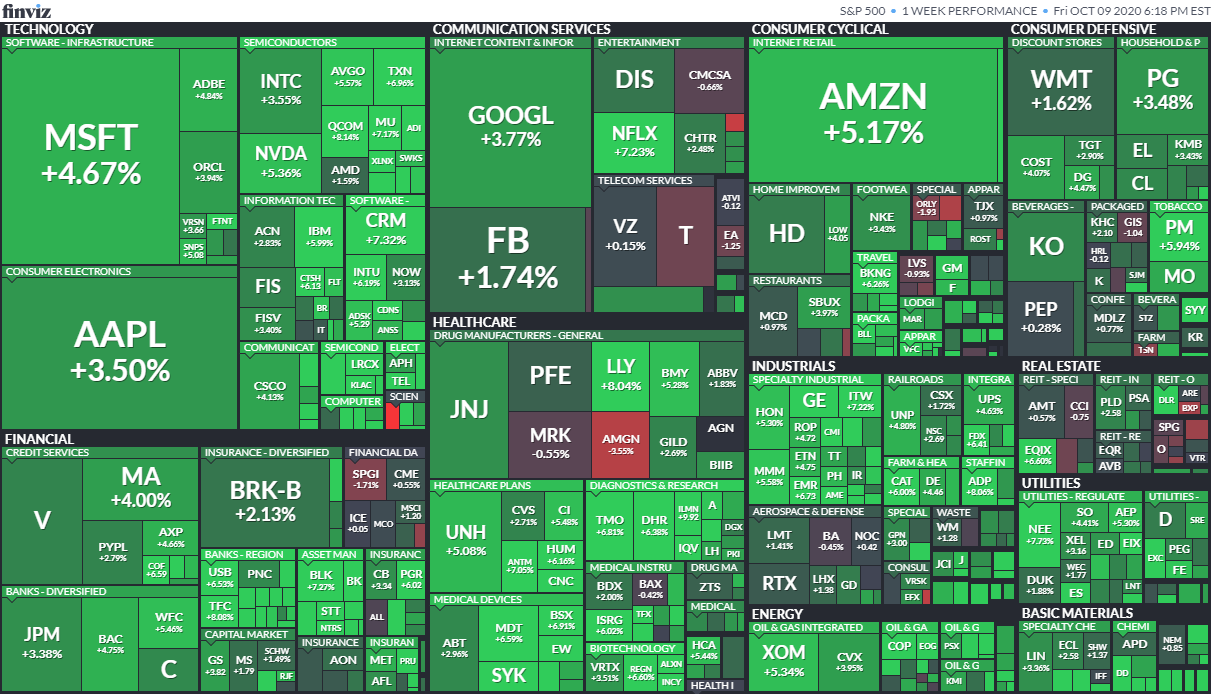

The U.S. stock market this week was almost broadly higher. There are expectations for a rebound in crude oil to the $40 range and for additional economic stimulus to pass. (Source: finviz.com)

SBI Securities account summary. (Closing price on October 9)

Earlier, it temporarily turned negative but has recovered significantly.

In terms of realized losses and cumulative profit from dividends,$3,400 of loss has occurred.

Stock holdings are about $69,000, and available funds (MMF) are about $42,000, yielding a ratio of 62:38.

Bought/Sold stocks

Buy: AAPL (15→20) MSFT (10→12) VT (430→460)

Sell: PFE (60→0)

We exited nearly at parity on PFE. Slightly profitable from past profits and dividends.

We are exploring replacement stocks, but are aiming for consumer staples at the moment.

Although the risk factors mentioned in the previous article still remain,

it seems likely we will attempt another all-time high, incorporating short-term adjustments.