[U.S. Stocks] AMAZON, FACEBOOK, and APPLE deliver strong results. Is capital flowing into high-performing tech stocks?

Hello, I am Lehman (@Lehman1980).

In the United States, IT giants such as AAPL and AMZN (GAFAM) rose due to solid earnings and optimistic future prospects.

In particular, AAPL announced a stock split (1:4), and it rose about 10% in a single day on July 31.

Meanwhile, the S&P 500 index was almost flat in the latter half of July.

<S&P 500 index closing values>

It was a week where the performance varied across sectors. However, the energy and materials sectors overall left a strong impression of decline.

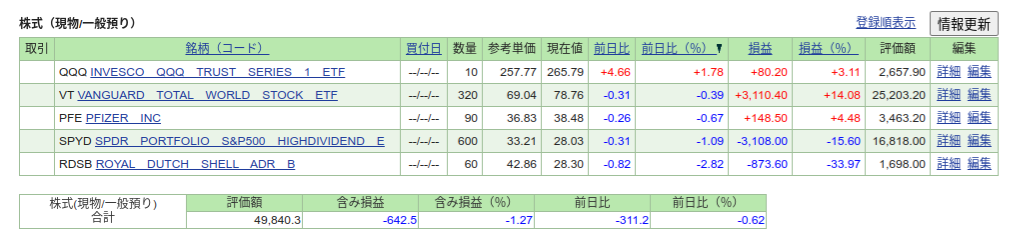

SBI Securities account summary. (July 31 closing price)

There were days when the closing price turned positive, but it remains negative overall.

In terms of realized losses and cumulative gains from dividends,$5,900 overall negative.

There were two occasions where the exchange rate fell below 106 yen and then below 105 yen, prompting dollar conversions.

Stock holdings are about $50,000, and available funds (MMF) are about $43,000.

Stocks traded

Buy: PFE (60→90), VT (310→320), QQQ (8→10)

Sell: none

Summary

Hopefully, I plan to opportunistically buy quality stocks that have safely weathered the COVID-19 era.

While some stocks are surging, stocks like TSLA and AMD also seem to be undergoing a bit of adjustment,

so I would like to accumulate quality stocks and ETFs rather than jumping in eagerly.