【U.S. Stocks】Is it a short-term adjustment phase

Hello, I’m Lehman (@Lehman1980).

The S&P 500 index fell from a closing value of 3232 on June 8 to about 7% lower from June 9 through June 11.

SPYD has fallen about 10%, so smaller, lower-priced stocks seem to have taken a heavier hit.

After that, the S&P 500 recovered a little on the back of the sharp drop.

<S&P 500 index closing values>

https://jp.investing.com/indices/us-spx--500-historical-data

GAFAM & PAYPAL, tech, healthcare, and consumer staples rose this week. Real estate and utilities declined. (Source: FINVIZ)

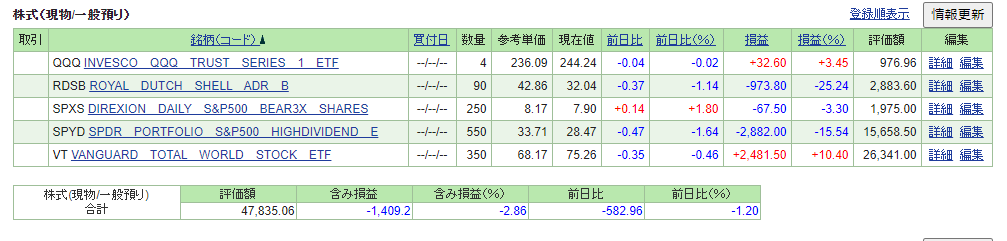

SBI Securities account summary. (as of June 19 close)

It unsurprisingly slipped back into the red.

Current unrealized gains/lossesare as below, and when including realized losses and dividends,$6,800 is the overall negative amount.

Holding value is about $48,000, with about $30,000 in reserve. As the yen strengthens, I converted about 1,000,000 yen to dollars at around 107.50 on average. The reserve has increased.

Trades

Buy: QQQ, VT, SPXS

In the previous article, I increased my RDSB holdings, but it has fallen again.

Meanwhile, SPYD’s unrealized loss has grown, returning to negative territory.

For these two stocks, I had planned to sell if they turned positive, but

it may have finished its peak, making it difficult.

As a precaution against further declines, I sold PG and T for a small gain.

Together with buying more SPXS and reducing the number of VT shares, I have adjusted positions.

Additionally, as a new trial, I started buying QQQ two shares every week.

Summary

There was a brief drop, but it did not continue, and since then it has been a back-and-forth movement.

Will capital flow into large-cap tech stocks again, driving to record highs, or will funds flow out from stocks during the second wave of COVID-19?

Forecasts are uncertain, but I suppose I will continue to adjust cash positions and observe.

(Please rewrite this section when publishing to readers)