[U.S. Stocks] Stagnation phase

Hello, Lehman (@Lehman1980) is.

The NY market moved with a lack of direction.

The S&P 500 index did not rise to the intraday high of 2,954 points reached on April 29,

after May 12 it rose to 2,945 points and then began to decline.

In the short term, it has formed a double top,

and around 2,950 points may act as an upside resistance level to be watched going forward.

<S&P 500 index closing price>

https://jp.investing.com/indices/us-spx-500-historical-data

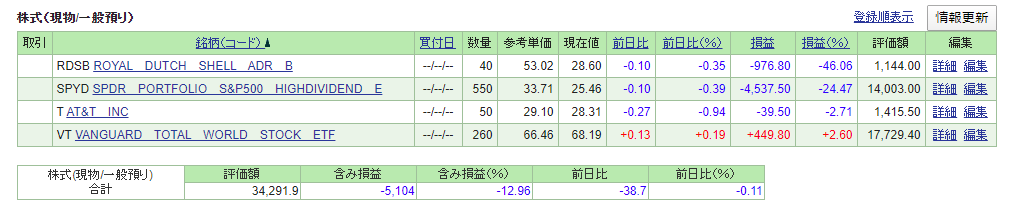

SBI Securities account summary. (May 15 closing price)

The current unrealized loss is as follows, and when combined with realized profits and dividends,$10,600 losshas been recorded.

Most of the individual stocks have been reorganized, and with two major ETFs in a downtrend, unrealized losses have expanded.

Trades

Sell: GIS, MSFT, WBK, WMT

Buy: SPYD, VT, T

By reorganizing individual stocks and buying more ETFs, I’ve shifted toward increasing ETF holdings. It may be time to start buying other high-dividend ETFs instead of SPYD.

Summary

The sharp rise in the past two months after a rapid drop may be a mini-bubble caused by liquidity chasing nowhere.

I still believe the main path is toward a second bottom scenario.

Whether that will be this month or around August is unclear...

If stock prices move up and down one by one, I think it’s necessary to be prepared with ample dry powder and make frequent purchases.

Economic indicators and forecast P/Es (price-earnings ratios) are currently almost meaningless.

It remains to be seen how institutional investors' massive money will move in the future.

Speculative individual investors should be careful with risk-taking at this time.