【US Stocks】From the bottom, half-way rebound + α

Hello, this is Leeman (@Lehman1980). It has been three weeks since the last update.

Markets have regained stability as financial easing and economic measures are implemented in various countries, and the rally has continued for this half month.

As for me, telework was suddenly implemented while the remote work environment was not yet prepared, but

somehow I still end up going to the office at least once a week.

Regarding new coronavirus treatment drugs, clinical trials are progressing, and some effects are being observed. (Vaccines will take more than a year.)

In Japan, first a state of emergency was declared in the major metropolitan areas,then the scope was expanded nationwide.Simultaneously, provisions to individuals went through twists and turns,

It is very disappointing that the Liberal Democratic Party (Soka Gakkai) pushed this through, and one could say it is a criticism of populism.and it was decided that a uniform 100,000 yen per person would be given.By the end of April, the bill is to be deliberated, so the earliest start of payments would be around late May.

Also, looking at the crude oil market, OPEC+ agreed to the largest ever production cuts, but the oil price had recovered somewhat on expectations of the agreement (from 19 USD to 25 USD),

but pessimism over demand decline rose, and it dramatically dropped again, reaching the 17 USD area for the first time since 2004 on the 17th.In the 21st century,it touched the low 17 USD range.

Summary of Developments in COVID-19 Treatments and Vaccines

https://answers.ten-navi.com/pharmanews/17853/

Abe expands the state of emergency nationwide; "minimize movement" before the holidays

https://www.bbc.com/japanese/52308525

100,000 yen, uniform payment... voluntary declaration system to be "in May"

https://www.yomiuri.co.jp/politics/20200417-OYT1T50080/

The reality of an "oil shock reversal" is finally becoming tangible

The S&P 500 index fell 1150 points (about 34%) from the February 19 peak of 3386 to the March 23 closing bottom of 2237.

It recovered to 2812 by April 14, a half-retracement of the decline, and has continued an upward trend since.

Whether profit-taking will push it toward 3300 depends on crude oil prices and the post-COVID-19 world.

Many are wary of a double bottom, and if a second wave of the mutated coronavirus emerges this autumn or later, it could head toward a second bottom.

<S&P 500 End-of-Day Figures>

April 17: 2874

https://jp.investing.com/indices/us-spx-500-historical-data

This is the SBI Securities account summary. (Close of April 18)

Current unrealized losses are as follows, and when accumulated with realized gains and dividends,$10,000 lossis recorded.

The unrealized profit/loss ratio has dropped significantly, briefly falling below 10%.

Also, I previously converted 350,000 dollars at 111 yen, but as the USD/JPY has returned to the 107 yen area, I converted 3 million dollars in five installments.

FX is moving significantly in a short period, too.

Stocks Bought and Sold

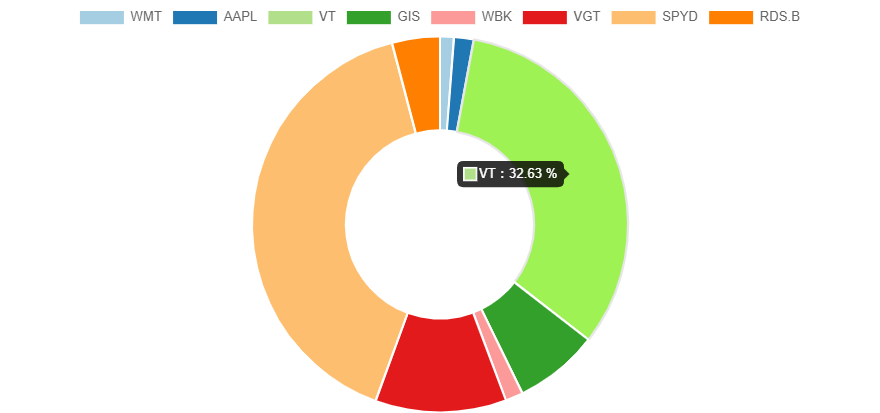

Sell: BTI all, WBK (80 → 50)

Buy: AAPL, GIS, SPYD, VGT, VT, WMT

Short-term trades: T, TLT

Because the portfolio was heavily weighted in high-dividend stocks, I am reorganizing around VT.

Overall losses are decreasing, and some previously falling stocks have turned positive due to dollar-cost averaging.

The two short-term trading assets are slightly in the green.

Also, since another sudden drop could occur at any time, I am buying a little each week with available funds in mind.

Portfolio Status

Summary

The S&P 500 index is in a subdued state after retracing half of the move from the bottom.

The Fear & Greed index has returned to the 40s. It was as bad as “1” at the worst point (;^_^A

https://money.cnn.com/data/fear-and-greed/

The market appears to have escaped the panic phase, but

the economic environment has not returned to normal, and the timing of concerns about prolongation is arising.

Going forward, I will continue to reduce losses while gradually reallocating my holdings.