【U.S. Stocks】Markets have temporarily found a bottom but

Hello, this is Reiman (@Lehman1980).

Global monetary easing and economic measures are starting to take shape for implementation,

but coronavirus infections are increasing explosively.

In the metropolitan areas and the Hanshin region, requests for movement restrictions are being issued.

President Trump signs $2 trillion economic stimulus bill amid the novel coronavirus

https://www.bbc.com/japanese/52074125

What will happen to retail stores and restaurants with weekend self-restraint requests?【Company responses】

https://www3.nhk.or.jp/news/html/20200327/k10012353221000.html

The S&P 500 index hit a intraday low of 2,191 points on March 23.

Finally hitting a bottom, it rebounded sharply from the next day, rising about 20% to 2,637 on March 26.

<S&P 500 index closing values>

https://jp.investing.com/indices/us-spx-500-historical-data

This is the SBI Securities account summary. (Closing value on March 27)

Current unrealized losses are as follows, and the accumulated profit and dividends total to a loss of$12,000.

Also, with the yen weakening to the 111 yen range against the dollar, I temporarily converted 35,000 USD back to yen.

Previously, I was converting dollars at about 108 yen on average, so I gained about 120,000 yen in foreign exchange gains.

In periods with ample purchasing power, this is modest but effective. (Tari-Tari CEOThank you as always)

Also, gains from foreign currency deposits and held funds due to foreign exchange transactions are considered miscellaneous income and subject to aggregate taxation, but

by selling USDMMF and receiving in yen in a ISA account (specific accounts can offset gains with other stocks and are taxed separately), please be aware.

Stocks for trading

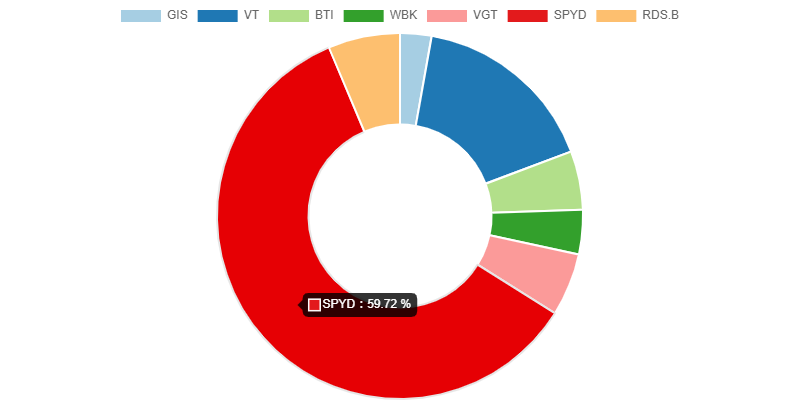

Sell: NGG, PFF (10⇒250⇒0), VGT, VT (120⇒10⇒50)

Buy: BTI, GIS, SPYD

I sold PFF for a temporary profit.

As we head toward a second bottom, I plan to buy again.

Current portfolio

Summary

The S&P 500 index finally rebounded significantly after breaking below 2,200, hitting a bottom.

VIX indexhas declined somewhat, but volatility remains high,

and it is still unclear when the market will settle.

The Fear & Greed index is also a well-known indicator that reflects investor sentiment.

https://money.cnn.com/data/fear-and-greed/

In this uncertain future, I will continue to select stocks and gradually increase purchases each week.