[US Stocks] Has the market finally entered a correction phase?

Hello, I am Lehman (@Lehman1980).

The novel coronavirus outbreak has triggered a global stock market decline that continues worldwide.

The U.S. stock market had been hitting record highs up through the third week of February, but has finally begun to fall, hasn’t it?

From the peak of 3386 on February 19, it has fallen about 8%.

Five trading days of declines in a row, and it is likely entering a correction phase.

<S&P500 Index>

February 19: 3386

February 24: 3225

This is the SBI Securities account summary. (February 27 closing price)

We absorbed the declines, but when further declines were expected, we sold about 70% on the 24th and 25th.

Afterward, we bought back a little on the 26th.

Securities traded

Sell: ABBV30, BHP20, BTI60, PFF200, RDSB40, SPYD300, VGT30, VTI35,

Buy: CMCSA20, SPYD150, RDSB30, VTI10

Net over $30,000 sold.

Nevertheless, because we kept aiming for higher prices,unrealized gains and past realized gains/dividends have almost vanishedas a result.

Probably tonight will also decline, so practically it will be a negative.

Not only the already underwater RDSB and WBK,but every holding except ABBV is in negative territoryright now.

Weekly stock topics

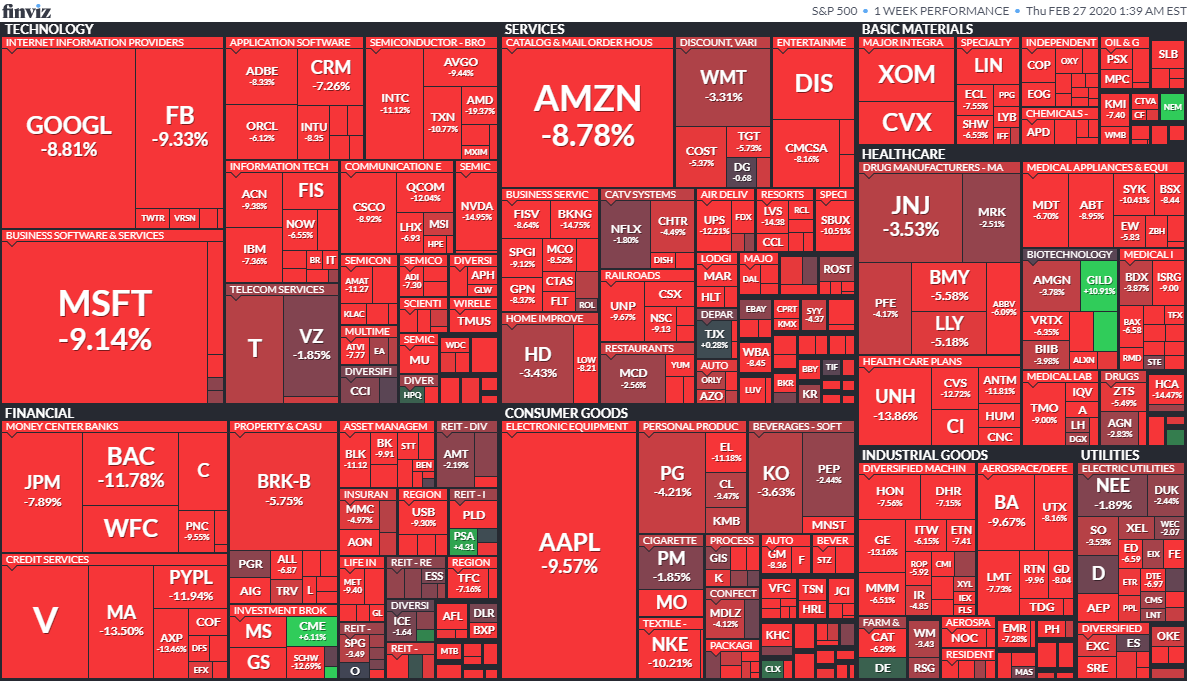

This is the heatmap of S&P 500 constituent stocks for the week (February 20 to February 26). (Source: FINVIZ)

Virtually all down, with only gold-related and some individual issue stocks showing gains.

Even relatively defensive names like T, VZ, KO, PG, PEP and utilities fell about 3%.

Thoughts on a correction market

When a correction is identified, reorganize and reduce holdings.

If a clear judgment cannot be made,it is better to hold as is without selling.

I focus on high-dividend stocks and a dividend reinvestment strategy,

but I believe that long enough declines should not be passively endured.

・Individual stocks: sell about 50–100% of each holding to lighten positions,excluding long-term investment targets.

・ETFs likewise, but willing to tolerate up to -10% on unrealized losses (excluding long-term targets).

・Repurchases should wait for market stabilization and be done gradually (increase small buybacks).

・When buying back, monitor price declines and potential yield improvements.

・Individual investors tend to have lower tolerance for pure losses than they think.

Trying to offset large losses with other gains is difficult in a correction market.

On the other hand, there is no need to realize profits every month, so

moderate stop-loss and position adjustments are effective. “Even resting is part of the market.”

Summary

Western countries may have viewed the novel coronavirus as a “problem of others.”

A famous American investor said about the coronavirus that

“Society is overly fearful. Meanwhile, the market is too optimistic.”

and it turned out that way.

Personally, I think the S&P 500 could fall to around 3,100–2,900.

Even if unrealized losses grow,once the real impact of the coronavirus on the economy becomes clearer,