[US Stocks] Portfolio as of February 12

Hello, I’m Lehman (@Lehman1980).

The world’s attention has shifted to the new pneumonia (coronavirus issue),

but the US stock market has turned higher and is hitting record highs.

(Futures on the 13th are down, though...)

<S&P 500 Index>

January 31: 3225

February 7: 3327 (new intraday high on the 5th and 6th)

February 12: 3379 (new intraday highs for three consecutive days on the 10th, 11th, and 12th)

https://jp.investing.com/indices/us-spx-500-historical-data

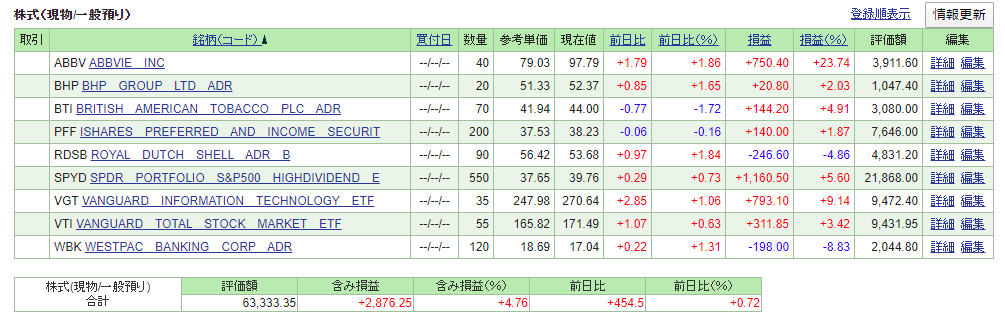

US Stock Holdings

This is the SBI Securities account summary. (as of the close on February 12)

Using the previously increased buying power, I am adding to my holdings.

Since the last article,the cumulative profit and loss has increased by about $1,300.

Trades

Take profit: VZ all

Cut loss: SMH all, CMCSA all

New buy: BHP 20

Added: SPYD 50, VGT 5, VTI 45, ABBV 20, BTI 40

・VZ: profit booked.

・CMCSA: since it had fallen after earnings, I sold it, but it soon reboundedand it would have been better not to sell.

・SMH: due to uncertainty about China’s outlook and the semiconductor market, I cut. Is VGT better?

・With the market turning risk-on,I added to my holdings.

BHP (BHP Billiton Australia): The world's largest mining company. Iron ore, coal, bauxite, silver, etc.

Dividend yield: 5.07%A substantial cut in 2016, followed by a recovery trend.

Because earnings are tied to commodity prices, price swings are relatively large. Currently fluctuating around $50–$55.

This week’s stock topics

Heat map of S&P 500 constituents for this week (Feb 6–Feb 12). (Source: FINVIZ)

It seems there are bright spots and dark spots for individual stocks.

Among held stocks, ABBV surged by +12% to become the sector’s top gainer.

VZ was lucky to be sold near the top.

Other notable gains included GOOG, AMZN, BA, PM, and many semiconductors.

On the other hand, financials, energy, and healthcare sectors generally underperformed.

Summary

The stock market seems to be proceeding bullishly, but the new coronavirus situation and the Iran issue in the Middle East remain unpredictable.

Oil prices went down further, but are oscillating around the $50 level, waiting for the next catalyst.

In the past two weeks, unrealized gains have grown substantially, so I hope to realize profits prudently while adjusting positions.

Until next time!