【US Stocks】Portfolio as of January 15

Hello, I’m Lehman (@Lehman1980).

With the year-end and New Year holidays, the portfolio status update has been a little sparse, but

please bear with me.

Since the start of the year, there have been tense developments in Iran and friendly-fire incidents involving private aircraft,

the stock market has moved somewhat, but the S&P 500 has not fallen for two consecutive days,

and compared to the end of last year, it has risen by 1.8% and remains solid.

https://www.bbc.com/japanese/features-and-analysis-51102318

US Stock Holdings

Account summary for SBI Securities. (January 14 close)

From December to New Year, I transferred dollars three times in 300,000 yen increments through Sumitomo Mitsui Banking Corporation Net Bank (average around the mid-108 yen range).

In addition to the below, there is about $7,700 in buying power. Since the last article,the cumulative profit and loss has increased by about $600.

Also, since June last year, cumulative P/L (including dividends and unrealized gains) is about $4,300.

Bought/Sold Stocks

Realized gains: BTI10, PFF100, RDSB10, MO30

Stock bought on a dip and sold immediately: BA

Stop-loss sale: WBK40

Additional buys: CMCSA40, GSK50, SPYD20, VGT10, VTI10

New buys: SMH5, VZ40

This time there are many buys and sells, so I’ll list them.

・Rebalance selling BTI & RDSB and full sale of MO. PFF partially liquidated.

・I attempted to buy BA, but due to the Iran crisis and potential for a crash, I sold it promptly.

・Rebalanced WBK and took partial losses.

・Looking for down days to buy more CMCSA, etc.

・New buys include previously introduced VZ and a tentative buy of the semiconductor ETF SMH.

BA (Boeing, Capital Goods Sector)

A well-known private aircraft (passenger and cargo) manufacturer. Competes closely with Europe’s Airbus for market share.

Stock price: $332.35 Estimated annual dividend: $8.24 Dividend yield: 2.47%

Payout ratio is a little under 40%. Since 2014, the dividend growth rate has been over 20% on average, making the future promising.

However, as a manufacturer, operating profit margin is around 10% and relatively low.

The impact of the B737 MAX crash is still strong, but I planned to hold it on a tentative basis,

and with the Iraq crisis (the downed aircraft was an older B737-800), it seemed to become a new factor, so

I sold it for now. I’d like to seize a new opportunity.

SMH (VanEck Vector Semiconductor ETF)

https://www.morningstar.co.jp/etf_foreign/overview.do?ISIN=MSF00000MVJB

An ETF of 25 semiconductor companies listed in the US market, including ADRs.

Top holdings: TSMC, INTC, TXN, MU, NVDA, QCOM

Stock price: $145.30 Estimated annual dividend: $1.64 Dividend yield: 1.12%

The first phase of the US-China trade deal is expected to be announced in the early hours of today in Japan time (late night January 15).

After that, the semiconductor sector is expected to benefit from economic recovery.

Since around 2016, this ETF has been on an uptrend, but it plunged at the end of 2018.

However, until the US presidential election in 2020 ends, there have been unconfirmed reports that tariffs will be postponed,

so I think this is also within the range for tentative buying.

This Week’s Stock Topics

This week’s heat map of S&P 500 constituents (January 7 to January 14). (Source: FINVIZ)

In the holdings, ABBV and VZ are slightly down.

Other than that, MVP, tech, and consumer staples are doing well.

Due to the drop after the oil price surge, the energy sector is down.

WFC, a large US bank, dropped about 6% after poor quarterly results.

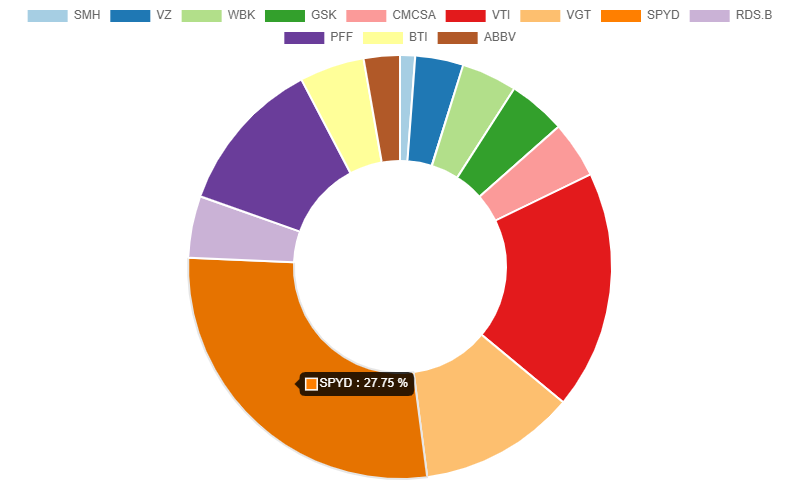

Current Portfolio

Summary

In the previous article, I admitted it was embarrassing to claim there was no short-term yen appreciation,

but during the year-end and New Year holidays the yen briefly strengthened to around 107,

and once the Iran situation settled, it reversed to yen depreciation, moving around 110 yen now.

For stocks that are already profitable, I will place long-term stop orders to secure gains,

and I plan to maintain the portfolio for the time being, aiming to realize profits on any sharp declines.