Winning Star is BT with a spread of 2 pips! Can be used with overseas accounts as well!?

Will Winning Star also be effective with overseas accounts!?

Please check because I back-tested with a spread of 2 pips.

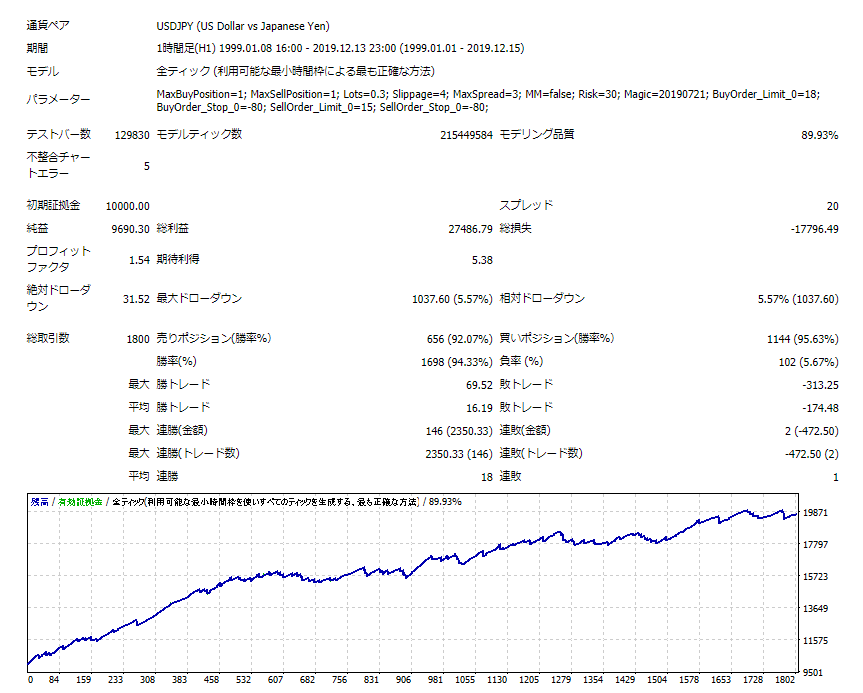

☆USDJPY Spread 2 pips 1999/1/1~2019/12/15☆

When back-testing with a 1-pip spread, the recovery factor is 20, but when back-testing with 2 pips (double), the recovery factor becomes 9.

However, the win rate is 94%, so if you want to use it for high-leverage trading, please give it a try.

There are overseas accounts with spreads around 1.5 pips for USD/JPY, so I also back-tested with 1.5 pips.

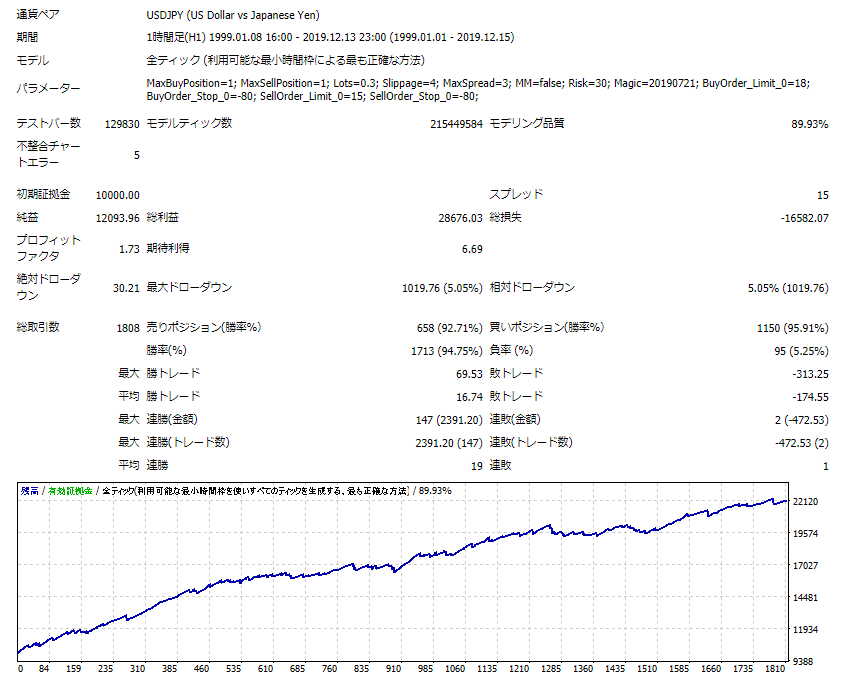

☆USDJPY Spread 1.5 pips 1999/1/1~2019/12/15☆

With 1.5 pips, the recovery factor became 11.

This seems fine, doesn’t it?

If you operate Winning Star on an overseas account, I recommend accounts with spreads up to 1.5 pips.

☆Winning Star Spread 1.5 pips Monthly Profit/Loss Table☆

Years in which you lose on an annual basis were 2008, 2013, and 2015.

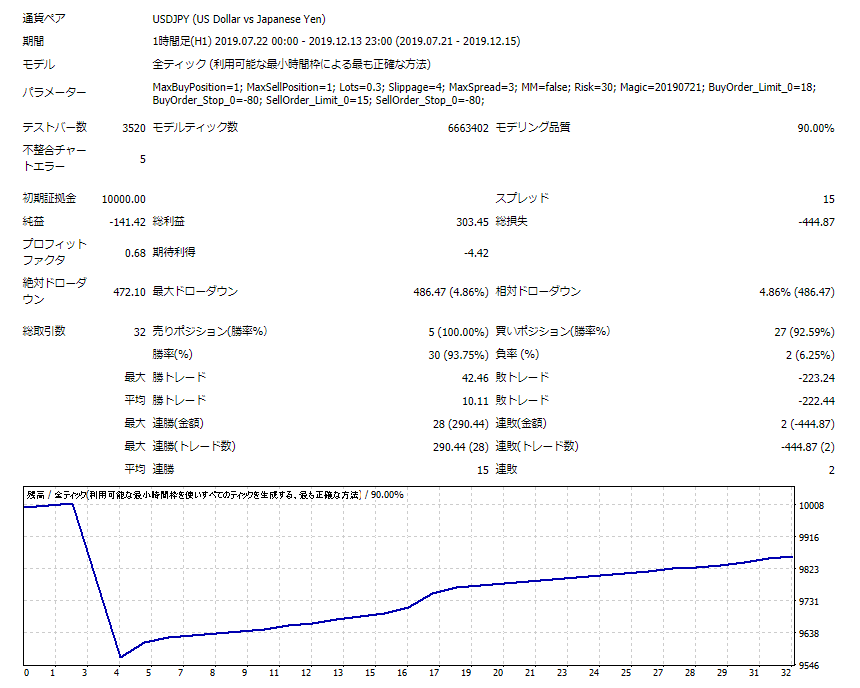

There was a fairly large drawdown in August this year, but since September it has been on a winning streak.

The back-test results with a 1.5-pip spread are presented as monthly profits and losses, so the August drawdown has not yet fully recovered.

Looking at it by month, August’s drawdown is the second largest in 20 years of backtesting.

From Go Go Jungle’s forward testing, it recovered in 2 months from August’s drawdown and achieved about twice the revenue of August’s drawdown, which is impressive, isn’t it!?

Compared to domestic accounts, overseas accounts often have lower spreads, making trades with high spreads disadvantageous for EAs.

However, overseas accounts also offer benefits such as deposit bonuses and the ability to apply large leverage, making capital efficiency favorable.

Therefore, I would like to continue introducing EAs that can operate without being disadvantaged by overseas spreads!

[Addendum]

> Since the back-test results with a 1.5-pip spread are presented as monthly profits and losses, this also means that the August drawdown has not yet recovered.

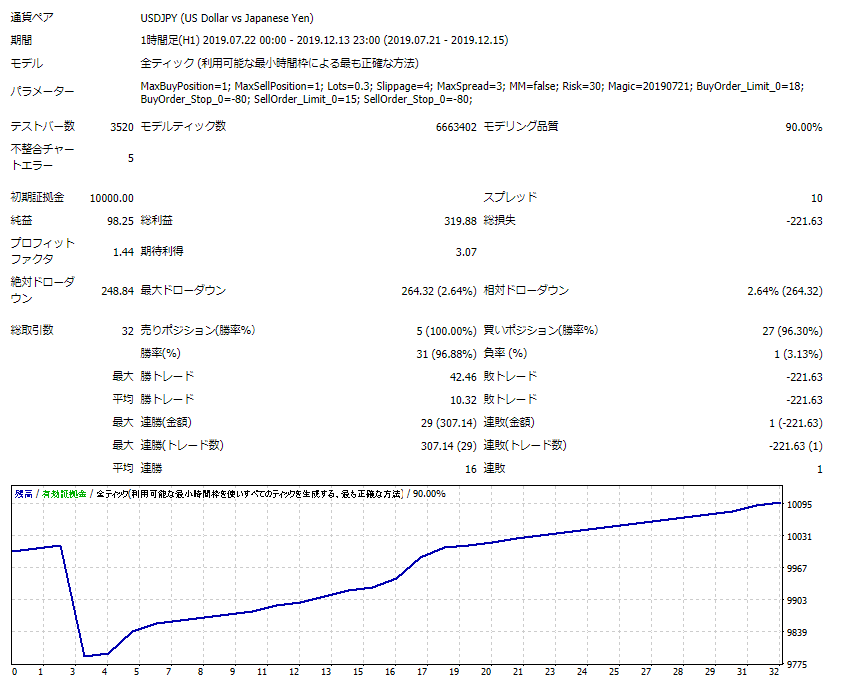

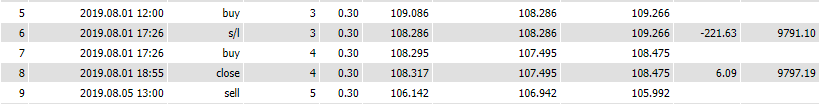

Because I was curious about back-testing with a 1.5-pip spread that had not yet recovered from August’s drawdown, I back-tested with 1 pip and 1.5 pips.

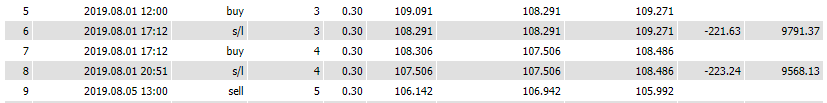

In August, the drawdown under 1 pip spread is SL once, but under 1.5 pips it is SL twice in the back-test results.

I think this is because the spread prevented the position from being closed.

☆USDJPY Spread 1.5 pips 2019/7/21~2019/12/15☆

☆USDJPY Spread 1 pip 2019/7/21~2019/12/15☆

EA performance depends on the spread, so please check via back-testing whether the EA you operate can handle a wide spread without problems.

Winning Star seems fine with a 20-year backtest up to 1.5 pips spread, but narrower spreads are more reassuring.

Among the EAs I am currently selling, the following look capable of operating on overseas accounts without being harmed by spreads.

https://www.gogojungle.co.jp/systemtrade/fx/16067

https://www.gogojungle.co.jp/systemtrade/fx/14946

https://www.gogojungle.co.jp/systemtrade/fx/14961

https://www.gogojungle.co.jp/systemtrade/fx/15467

https://www.gogojungle.co.jp/systemtrade/fx/14963

https://www.gogojungle.co.jp/systemtrade/fx/17100

https://www.gogojungle.co.jp/systemtrade/fx/18241

https://www.gogojungle.co.jp/systemtrade/fx/19584

https://www.gogojungle.co.jp/systemtrade/fx/19672

※There are EAs that have not been back-tested with high spreads, so you can still find them if you search more.

Since spreads vary by broker even for overseas accounts, be sure to check whether the EA you operate can profit under that broker’s spreads before using it.